Ahead of Aphria’s (APHA) second quarter fiscal 2019 earnings, which are set to be released on Friday, January 11, cannabis research team Cornerstone Investments (CI) makes its forecasts for what we can expect. (To watch CI’s track record, click here)

It will be interesting to review the numbers, after the Canadian cannabis company had a wild ride throughout 2018. Scandal after scandal defamed the company, especially as the year came to a close. In early December, a short report with photos and documents attached to it suggested Aphria had paid less money than management reported to investors for new assets abroad. Farms and office spaces were pictured to have not under-utilized and some of the people listed as workers at these locations denied being involved with the company or to have even ever spoken with leadership. Why? The writer of the report suggested it was to benefit insiders. In days after, the stock dropped and some questions if a hostile bid from Green Growth Brands was staged in order to drive the stock price higher.

CI predicts revenue will come in at $40 million based on management’s guidance, however the team warns that if the company releases disappointing results, it will be tough for it to come back. That said, there are some factors that investors should keep in mind when they look at the earnings.

“There are two key things that investors need to understand heading into Aphria’s first quarter including legalization. First of all, the upcoming quarter represents the three months between September to November 2018, which means that it will only capture 1.5 months of sales from legalization. Investors should adjust their expectations accordingly to account for the fractional quarter. Secondly, investors should expect volume to increase substantially while average selling price to decrease by a large percentage as well. Management disclosed last quarter that the company received initial orders of over 5,000 kg which might serve as a good proxy for its initial revenue during the first month of legalization,” the blogger explains.

“We believe Aphria’s Canadian assets hold significant value and it holds one of the best market positions in the Canadian market. Investors will also be looking for an update on the LATAM short report rebuttal and potential changes to management and corporate governance,” CI concludes.

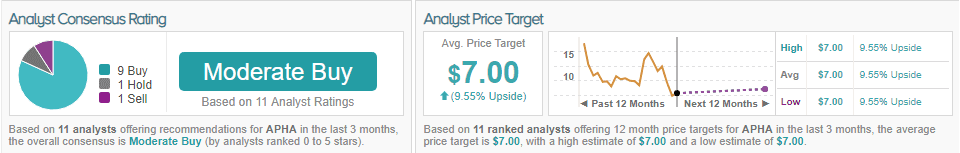

There’s a lot at stake for this company and we are just days away from seeing the outcome. For now, analysts are still mostly bullish. TipRanks analytics show out of 11, 9 are bullish, 1 sidelined and 1 bearish. The consensus price target of $7.00 shows a potential upside of 9%. (See APHA’s price targets and analyst ratings on TipRanks)