By all accounts, Aphria (APHA) reported a better than expected FQ4 quarter for the period ending May 31. The Canadian cannabis company was under substantial pressure due to claims of financial shenanigans, so any positive news was bound to send the stock soaring. The quarterly details suggest the company didn’t produce the major blockbuster quarter originally thought by the stock rallying 30%.

Distribution Business

Aphria reported that FQ4 revenues surged 75% sequentially and nearly 1,000% from the previous year period. The key to the story is that the majority of the boost came from the purchase of the cannabis distribution business via CC Pharma.

The distribution business is very low margin with a quarterly gross profit of only 12.4% in the last quarter. This portion of the business surged over C$44 million from FQ3 to reach C$99 million. In total, the low margin distribution business accounts for 77% of the quarterly revenues.

The important cannabis sector of the company did generate near 100% sequential growth to reach quarterly revenues of C$29 million. This division generates gross margins of 53%. In total, the company only generated gross profits of C$27 million despite quarterly revenues that surged C$55 million to C$129 million.

These numbers highlight how Aphria changed the view of the company due to running distribution revenues through the business. A better way to view the company is one that only sold 1,417 kg for medical cannabis and total cannabis of 4,645 kg in the quarter.

Business Prospects

Despite the near C$100 million quarterly distribution business, the company only generated an adjusted EBITDA profit of C$4 million. The business appears to add little value.

The cannabis business generated adjusted EBITDA of nearly C$2 million and improved the number by over C$14 million sequentially. Investors almost need to completely eliminate the distribution revenues in the analysis of the company.

Looking at the outlook, Aphria guided to these FY20 numbers:

- Revenues C$650 million to C$700 million.

- Distribution revenues at slightly above 50% of total revenues.

- Adjusted EBITDA of ~C$89 million to C$95 million.

Based on this outlook, Aphria is forecasting non-distribution revenues in the C$300+ million range. The best metric is the C$90 million EBITDA target or the equivalent of $70 million when converted to U.S. dollars.

The stock has a market valuation approaching $1.7 billion after this rally. The stock now trades at about 24x the adjusted EBITDA target for the next year. As the next year progresses, the market is going to start focusing on more bottom-line measures over pure top line growth as all cannabis stocks aren’t equal.

Aphria plans to ramp production capacity up to 255,000 kgs in the current fiscal year. The company will be one of the largest producers in the Canadian cannabis market as 2020 closes.

Takeaway

The key investor takeaway is that Aphira produced a quarter that likely changes the perception of the company, but not the industry. The headline numbers were more impressive than the details and the company has likely taken market share away from other Canadian cannabis players. The stock likely rallies more on these results due to valuation, but the quarter wasn’t a blockbuster one.

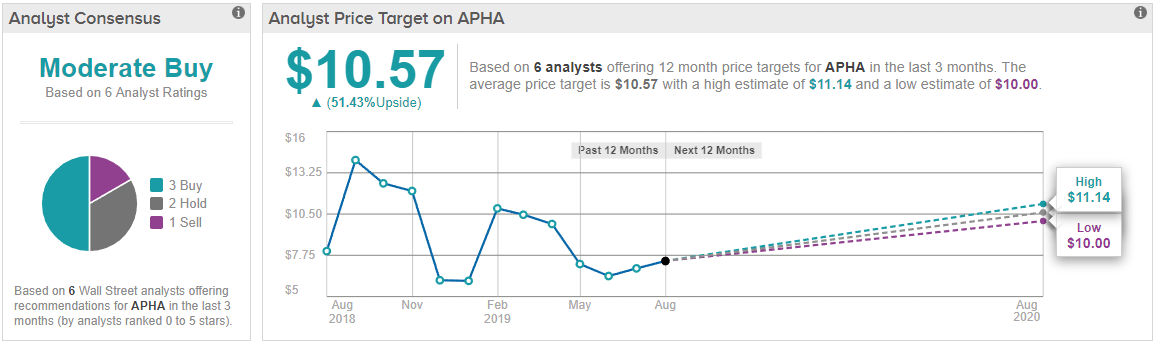

Wall Street is not convinced just yet on this Canadian cannabis maker, but cautious optimism is circling, as TipRanks analytics demonstrate APHA as a Moderate Buy. Based on 6 analysts polled in the last 3 months, 3 rate a Buy rating on Aphira stock while 2 maintain Hold, and one recommends Sell. The 12-month average price target stands at $10.57, marking about 50% upside from where the stock is currently trading. (See APHA’s price targets and analyst ratings on TipRanks)