Before the open today, Aphria (APHA) reported FQ3 results that showed substantial revenue growth, but the Canadian cannabis maker generated a massive quarterly loss. The results through February 28 provided some further insight into the adult-use recreational market in Canada, but the reckless spending by the major corporations continues a troubling pattern.

Troubling Loses

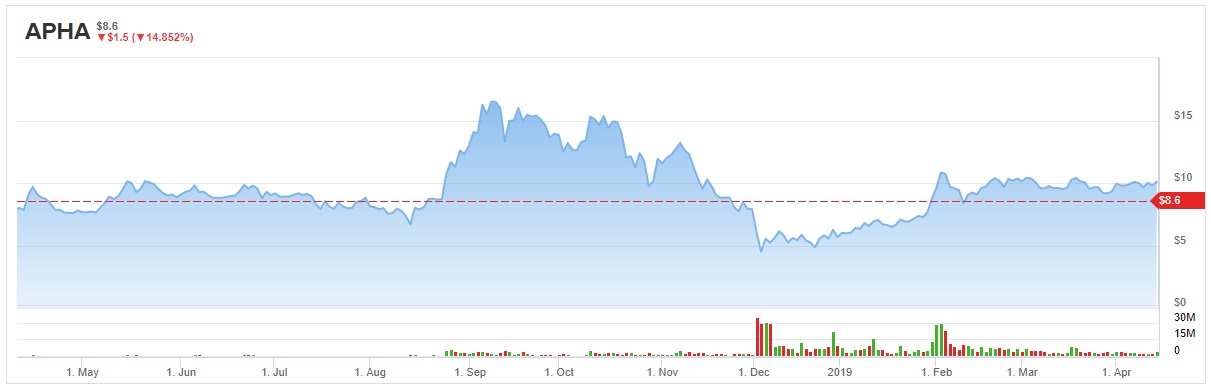

Aphria is down nearly 15% on the day to below $9 on results that missed analyst estimates by a wide margin. Analysts expected revenues closer to C$84 million and the company only generated revenues of C$74 million.

Investors must carefully view the 617% YoY revenue gain as the majority of the revenue increase came from distribution deals from the acquired CC Pharma. For this reason, gross margins plunged to only 18% as distribution revenues are only targeted in the 10% to 15% range.

The revenues from internally produced cannabis were a meager C$18 million. The prior quarter generated revenues of C$22 million with limited revenues from distribution.

A gross profit of only C$17 million with general and administration expenses of C$22 million places the company in a disappointing position considering the competitive nature of the cannabis market. This doesn’t even count sales and marketing and research and development expenses that add up as well.

The adjusted EBITDA loss reached C$14.4 million as the company again shifted from positive EBITDA last year to huge losses this year. The EBITDA loss even expanded from C$9.5 million loss in the prior quarter.

Questionable Growth

While the revenues told a misleading story, the kilograms equivalents sold should alarm investors. Aphria only sold 2,637 kg in the quarter compared to 3,409 kg in the prior quarter.

The average selling price increased to C$8.03 per gram from C$7.51 per gram, primarily driven by higher cannabis oil sales. The average price for adult-use cannabis fell to C$5.14 from C$6.32.

The company blamed the shift to smaller package sizes for the price hit, but the market in general has felt more pressure on wholesale prices. As more legal supply comes online and the cannabis market continues competing with illegal supplies, adult-use wholesale supplies are likely facing more pricing pressure. One only has to imagine the prices, if Aphria had additional supplies.

The pricing pressure concerns are a prime reason that larger losses are problematic in this current market climate. Investors have to wonder if companies like Aphria are correctly positioned for a competitive pricing environment with potentially blind expectations that current market prices multiplied by future supplies will automatically lead them to over C$1 billion in annual sales.

Aphria is one of the major players that lacks much in the way of production capacity currently. The company only recently got approval for 115,000 kilograms of production while the Aphria Diamond facility is needed to push the company towards annual capacity in excess of 250,000 kg.

Takeaway

The key investor takeaway is that Aphria has had too many questions about corporate governance to make an investment. The quarterly results aren’t that impressive with cannabis sales down as the company focus shifted to distribution.

Signing on Walter Robb, former co-CEO of Whole Foods Market, as a director is a first step in improving governance concerns, but the company needs to improve results before the investment story actually improves.

To read more on the nitty gritty of what’s going on in the rising cannabis industry, click here.

Disclosure: The author has no position in APHA stock.