The most recent earnings report from Aphria (APHA) was underwhelming, as it continues to experience heavy losses. While its earnings were up, they still failed to meet already mild expectations.

It’s no secret cannabis companies based in Canada are going to continue to experience weak growth over the next couple of quarters. Even so, in the case of Aphria, if it is able to successfully execute in several segments, it could surprise to the upside throughout calendar 2020.

Recreational pot

A potentially major catalyst for Aphria will be if it can continue to increase market share in Ontario, which is by far the largest market in Canada. It has managed to boost its share of recreational pot from 6 percent in fiscal 2018, to an impressive 14 percent as of this writing.

For most Canadian companies, the commitment by Ontario authorities to increase the number of retail cannabis stores on a monthly basis should provide a resultant increase in revenue. If it manages to follow through on its promises, and Aphria can at least maintain its share, and possibly increase it, it will be a nice catalyst for the company.

It needs to be understood that it’s going to take time because of the gradual opening of new stores in the province. There should be at least 20 stores a month opened, starting at latest in April 2020.

Its Riff and Good Supply brands are two of the more recognized recreational brands in Canada, and should continue to do well as legal demand for pot increases.

Derivatives

Derivatives could play a big part in the potential surprise performance of Aphria in 2020. The first thing to note is if the company does retain or grow recreational share, it should generate significantly more revenue because of higher prices. It also should result in wider margins and a decline in losses.

Other potential surprises could come from a successful launch of infused beverages, and if Alberta and Quebec decide to remove existing bans on vapes. Of the two, I’m not as convinced about the market demand for infused beverages yet, and of course the bans must be removed for it to make a difference.

These two aspects of derivatives need to be closely watched, but for now, they can’t be counted on.

GMP certification

The company announced it has received GMP certification from EU, which will allow it to start shipping medical cannabis products to the trading bloc. The company stated it expects to start shipments to the EU by the latter part of May 2020.

With Germany being the largest market in the EU, it’s the most important. Expectations are that within a few years it could have as many as 1 million medical cannabis patients in the country. Combined with other EU markets, it represents a significant opportunity to sustainably increase revenue and earnings.

Germany is also important because it has among the highest prices for medical cannabis, and also has insurance pay for between 60 and 70 percent of usage. That’s expected to improve in the years ahead.

Consensus Verdict

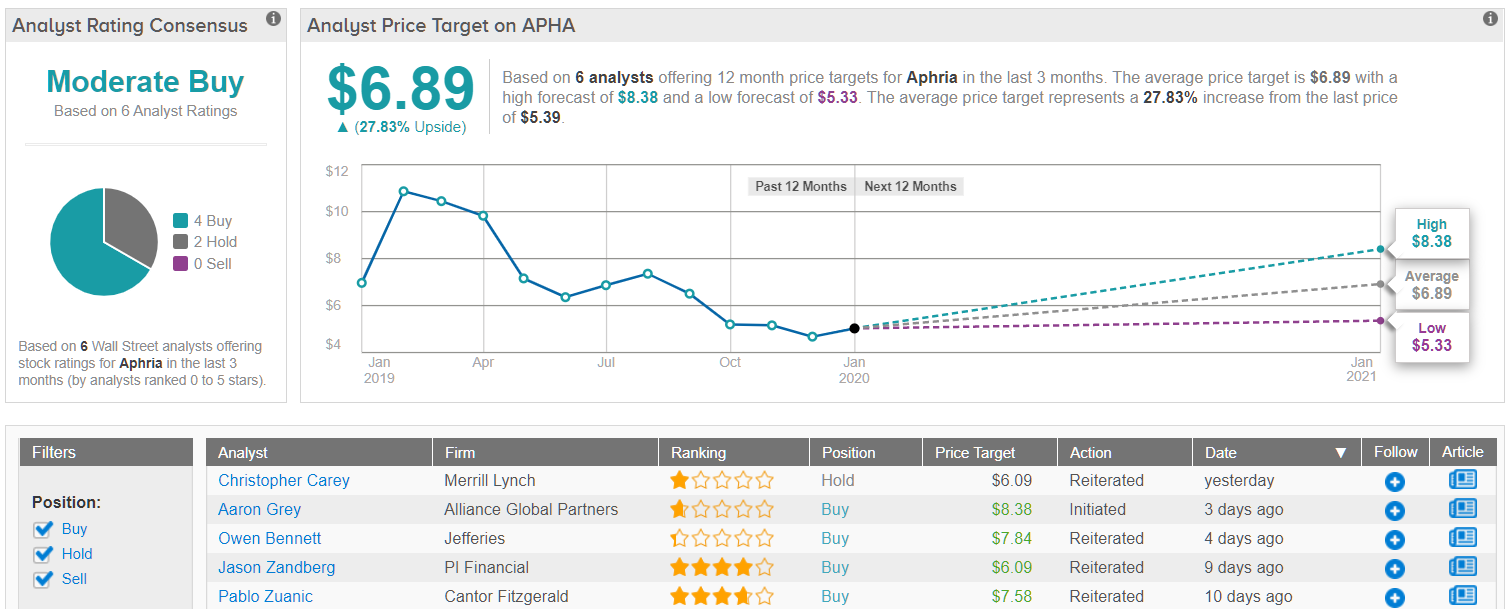

Wall Street anchor a bullish perspective on the cannabis player, as TipRanks analytics showcase APHA as a Buy. Based on 6 analysts polled in the last 3 months, 4 are bullish on Aphria stock, while 2 remain sidelined. The 12-month average price target stands tall at $6.89, marking a nearly 30% upside from where the stock is currently trading. (See Aphria stock analysis on TipRanks)

Conclusion

Although there are a lot of things that have to go right for Aphria for it to surprise to the upside in 2020, if it is able to successfully execute in Ontario, successfully introduce some derivative products in Canada, and catch some breaks in Alberta and Quebec, it is going to generate good returns for shareholders.

At the least, what I want to see is how it continues to perform in Ontario specifically, as that presents the strongest short-term opportunity in Canada for Aphria and its competitors.

The combination of recreational dry pot sales, along with a boost from higher-priced and wider margin derivatives, has the best chance of the company exceeding expectations.

I don’t expect this to happen in the first calendar half, but in the second half, if Ontario follows through on its promises, and it gets a decent boost from medical cannabis sales in the EU, it has a good chance of turning market sentiment in its favor.

At this time it’s hard to be too optimistic with Aphria because there are some things outside of its control. That said, those things, for the most part, will be resolved going forward, and as they improve, and if Aphria can execute as they improve it should start to enjoy solid growth and provide a visible path to sustainability.

To find good ideas for cannabis stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.