As the Canadian cannabis market faces an over supply due to a lack of legal retail stores, companies are facing growing pains that could lead to liquidity problems in the sector. The best companies in the sector could be the ones with the strongest balance sheets to take advantage of sector weakness and thrive when the market eventually takes off in 2020 as Cannabis 2.0 products hit store shelves.

The Canadian cannabis sector has already seen a few stocks blow up due to regulatory and sales issues. CannTrust (CTST) was teetering on the verge of going out of the business, but progress on regulatory compliance could have the company back in business. HEXO (HEXO) missed sales targets and slashed 2020 guidance requiring the company to raise C$70 million of 8.0% unsecured convertible debt. At the same time, Zenabis Global (ZBISF) has pulled back on capacity expansion in order to conserve cash.

All of these stocks trade down substantially from all-time highs. The questionable balance sheets and business prospects make the stocks risky even at the low.

A main issue in Canada remains the size of the black market due to the government holding back on licenses for retail stores. Seaport Global sees the market needing 1,055 stores for maximum sales and profit generation and Canada is only on pace for 675 stores in 2021. Both Ontario and Quebec are adding retail stores, but both provinces will remain far under stored entering 2020.

While the above stocks are facing liquidity concerns due to various issues in the cannabis sector or specific company problems, we’ve delved into these three cannabis companies poised to thrive in an environment where the sector has to cut back on wild expansion due to a lack of positive cash flows and cash:

Canopy Growth (CGC)

A big player in the global cannabis sector is Canopy Growth due in large part to the investment from Constellation Brands (STZ). The large consumer beverages company invested C$5.0 billion in Canopy Growth back in 2018 providing the large cash balance to thrive in a sector where companies are finding it a difficult time to obtain cash for further expansion.

The main concern with Canopy Growth is that the company has already spent a large portion of the Constellation Brans investment only months into claiming the cash. At the end of June, the cash balance was down C$1.4 billion to C$3.1 billion. The company spent aggressively acquiring the right to Acreage Holdings (ACRGF) and buying The Works and C3 during the prior period.

A smaller concern is the cash burn from operations. Canopy Growth has an alarming quarterly EBITDA loss of C$92.0 million while spending a substantial C$211.8 million on capital spending. The company has the cash to continue investing in global cannabis expansion, but investors will want to see Canopy Growth cut these quarterly losses substantially in the next couple of quarters or the cash balance won’t last very long.

The stock has a mark value of $7.5 billion so a large part of the investment here is the rather large cash position of $2.4 billion. Canopy Growth has an enterprise value of $5.1 billion, but the cash burn will quickly increase this number over the next few quarters.

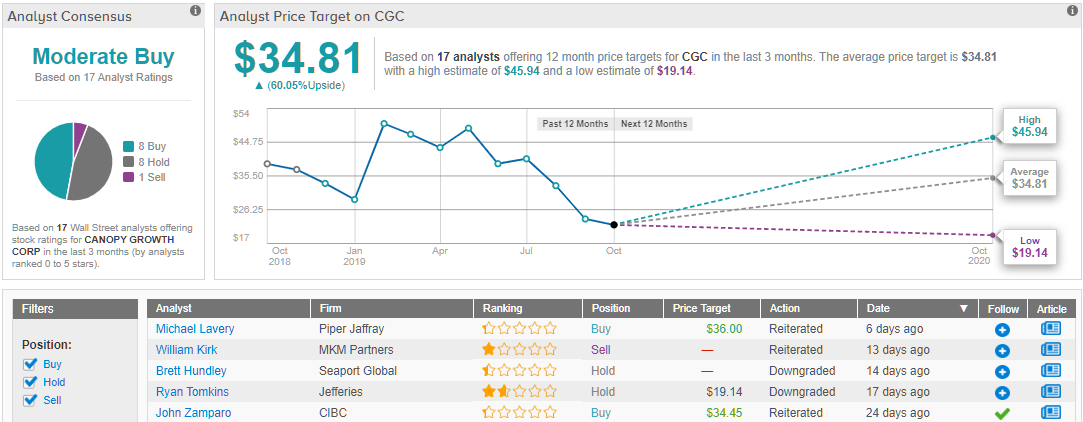

Overall, CGC has had 8 bullish analysts in its corner over the last three months, 8 analysts playing it safe on the sidelines, and one who sees a bearish scenario in play. Importantly, the 12-month average price target of $34.81 showcases 60% in upside potential for the stock. (See Canopy stock analysis on TipRanks)

Cronos Group (CRON)

The wild card in the group is Cronos Group. The stock only has a $3.0 billion market value while the company has a strong balance sheet due to a $1.8 billion investment by Altria Group (MO).

The company still has the cash on the balance sheet and will spend $225 million on the acquisition of Redwood for their hemp-derived CBD products during Q3. What makes the stock a major wild card is the near void of an actual business to this point.

For Q2, Cronos only generated C$10.2 million in quarterly revenues while producing a massive C$17.8 million EBITDA loss. In the quarter, the cannabis company only sold 1,584 kg with a high cost per gram sold of C$3.01. The company has some of the highest costs in the Canadian cannabis sector with the lowest production.

Analysts are only targeting 2020 revenues of $150 million making the current enterprise value of nearly $1.2 billion actually appear expensive. The company needs to use the cash wisely during this sector downturn to really make the stock appealing.

If Cronos Group can buy some liquidity strapped business on the cheap, the stock will have the major catalyst for a rally. Otherwise, the stock is positioned correctly below $10 despite the large cash balance.

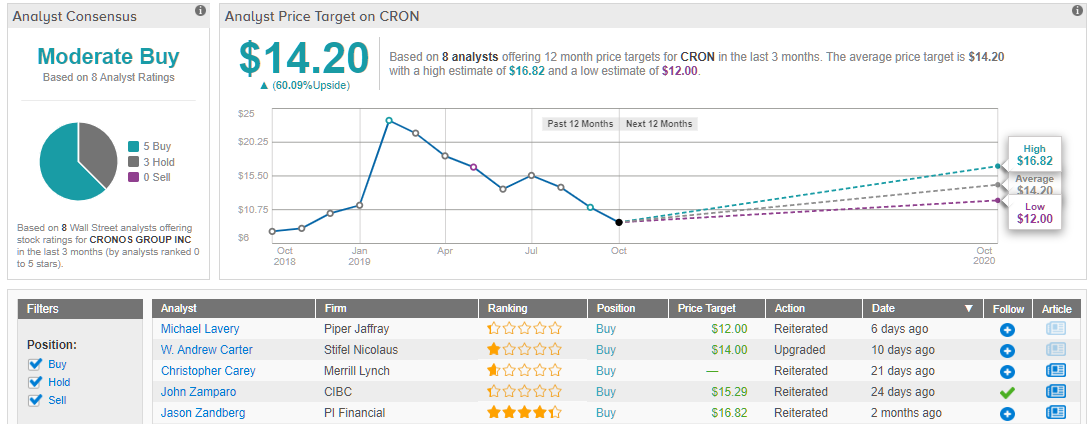

Overall, the word hovering around this cannabis player points to the bulls, as TipRanks analytics exhibit CRON as a Buy. Out of 8 analysts polled in the last 3 months, 5 are bullish on CRON stock while 3 remain sidelined. The 12-month average price target stands at $14.20, marking about 60% upside from where the stock is currently trading. (See Cronos stock analysis on TipRanks)

Aphria (APHA)

The conservative play in the group is Aphria. The Canadian cannabis company is already EBITDA positive, but the company has a relative smaller cash position in comparison to the other two companies on the list.

Aphria has similar global aspirations, but the company hasn’t wildly spent on operations beyond revenue generation. For FQ1, the company generated C$126.1x million in quarterly revenues and produced a C$1.0 million EBITDA profit.

The rather large C$464.3 million cash position and potential sale of an Australian asset provides the balance sheet of envy amongst most in the cannabis sector. The combination with forecasts for a C$90 million EBITDA profit for FY20 really sets Aphria in the unique position to generate positive cash flows while having a sizable cash balance.

The company is on path to increase annual production capacity to 255,000 kgs after only selling 5,969 kg in the last quarter. Aphria separates itself as not having large EBITDA losses heading into major capacity growth.

At $5.50, the stock is appealing while so many others in the cannabis sector struggle.

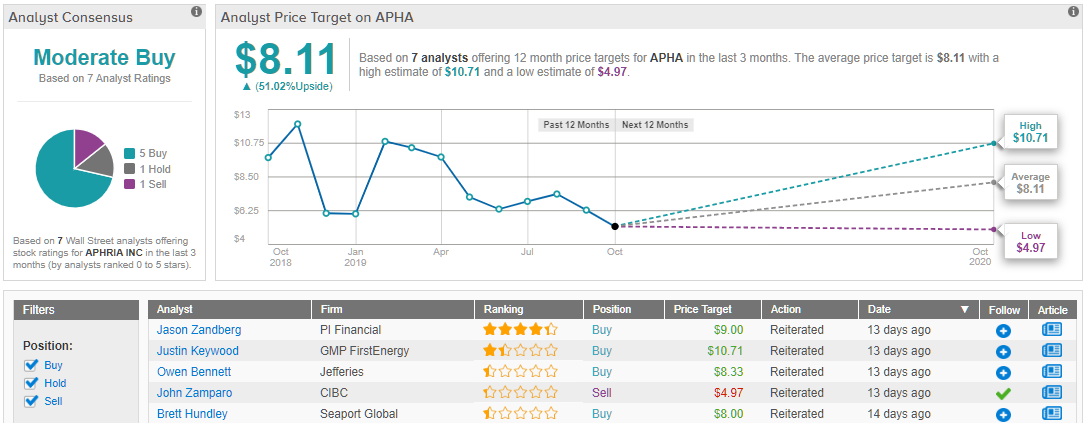

Wall Street tends to agree, considering TipRanks analytics reveal APHA as a Buy. Out of 7 analysts polled in the last 3 months, 5 are bullish on Aphria stock while one remains sidelined, and one is bearish. With a return potential of nearly 50%, the stock’s consensus target price stands at $8.11. (See Aphria stock analysis on TipRanks)

To find other good ideas for cannabis stocks trading at fair value or better, visit TipRanks’ Best Stocks to Buy, a newly launched feature that unites all of TipRanks’ equity insights.