Investment banker BMO Capital Markets upgraded shares of Canadian cannabis company CannTrust (CTST) to “outperform” today, with an C$11 price target that promises about a 38.5% profit to new buyers — that’s the headline.

What’s interesting about this news, however, is something else entirely. Let’s review.

BMO’s Tamy Chen says she is upgrading CannTrust shares on an “observed the Phase 2 greenhouse ramping ahead of our prior expectations.” The analyst believes CannTrust is now at or near full-scale production capacity of 50,000 kilograms of marijuana per year, a rate of production which would put the company in third place for Canadian pot production, behind only Canopy Growth (CGC) and Aurora Cannabis (ACB). Based on this belief, Chen is upping her estimates for both fiscal 2019 and fiscal 2020 sales and earnings.

Chen now predicts that CannTrust’s sales will roughly triple to C$116 million this year, then grow a further 70% to C$197 million in 2020. The analyst still expects the company to lose money — C$0.03 — this year. But Chen believes earnings will turn positive in 2020 — a C$0.03 per share profit.

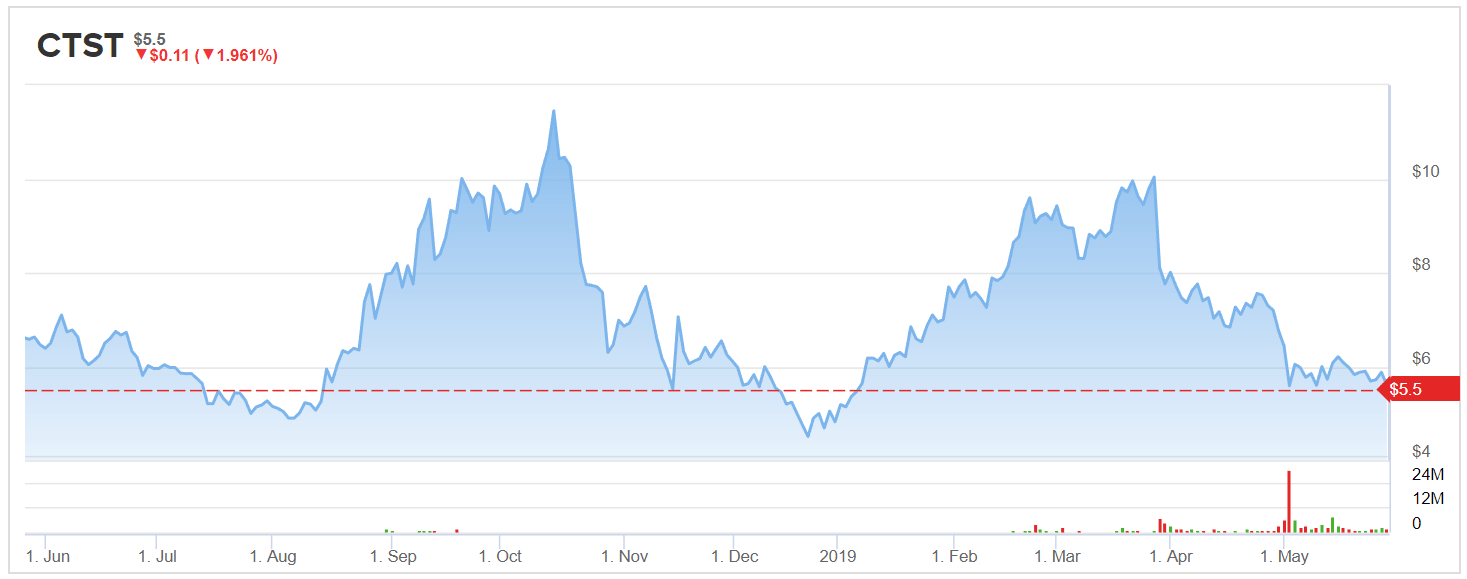

One reason Chen is so optimistic on CannTrust today is the fact that, based on these sales estimates and CannTrust’s recent C$8 share price (that’s about $5.60 in US Dollars), the stock is now selling for “a notable discount” to its peers: just 5-times fiscal 2020 sales. (Other Canadian cannabis companies sell for as much as 25 times FY 2020 sales).

Chen blames this discount on two things: First, CannTrust’s recent decision to float 41.8 million new shares of common stock at $5.50 per stub. This makes sense. Albeit selling these shares raised some $221 million in gross proceeds for CannTrust to use in expanding its business, it also diluted CannTrust’s existing shareholders significantly. For context, CannTrust had only 136.6 million shares outstanding at the end of last quarter — and it had as few as 29.3 million shares just five years ago. (Yes, you read that right. CannTrust just sold more shares in one day, than the entire company had five years ago).

But wait. We still haven’t reached the interesting part.

The most interesting part of Chen upgrade today is that she also blames CannTrust’s Q4 earnings report for the stock’s slide. On March 28, CannTrust reported a 132% increase in quarterly sales to $16.2 million, and a $0.26 per share loss for the quarter.

Now, maybe the fact that CannTrust lost money in Q4 shook investors’ confidence somewhat. But still, this is old news. Since that Q4 report came out, CannTrust has already reported earnings again — for Q1 2019 — on May 14. Yet, Chen seems to overlook the fact that in that report, CannTrust showed only a 115% increase in sales (i.e. a slowdown from Q4), alongside a $0.12-per-share quarterly profit (which while positive, showed no year-over-year improvement when compared to the $0.12 per share that CannTrust earned in Q1 2018).

The fact that sales growth slowed, and earnings improved not at all, in the most recent quarter might be more important to investors than something that happened two quarters ago.

Final point: As for what comes next, it’s worth noting that, as optimistic as Chen is about CannTrust’s future (a C$0.03 per share loss in 2019, followed by a C$0.03 profit in 2020), other analysts are forecasting C$0.05 in profits in 2019, and C$0.25 in 2020. In other words, even if Chen is right to raise her own estimates for CannTrust, this cannabis stock is set to miss consensus estimates for the next two years running.

To read more on the nitty gritty of what’s going on in the rising cannabis industry, click here.

Read more on CTST: