Shares of CannTrust (CTST) have been crushed since July, when a whistleblower revealed to Health Canada that the company was growing cannabis at an unlicensed facility in Pelham, Ontario. Not long afterwards it was discovered that management, at that time, knew about the issue and sought to cover it up.

Market research firm Leger, based in Montreal, said that in early 2019 CannTrust was considered the third-most-reputable cannabis in Canada. Since the revelation of the scandal, it has plunged to 19th.

Not only has this been devastating to CannTrust, but it gave the cannabis sector, in general, a black eye, with some leaders furious over the negative impact it has had on the industry.

Update on CannTrust’s status

On August 15, 2019, CannTrust said in its filing that the value of the inventory being affected by the decisions of Health Canada came to approximately $51 million.

That accounted for about 53 percent of the overall inventory of the company at that time. Concerning its bio assets, it accounted for about 30 percent of the total at hand, as of the end of June.

Also as of the end of June, the company had $250 million in cash and cash equivalents.

The application for a management cease trade order was approved by the Ontario Securities Commission, per that filing.

Most recently the company noted that there have no material changes in the information released in the August 15 filing.

Until Health Canada brings the matter to conclusion, the fate of CannTrust remains up in the air. It’s doubtful if it’ll be able to recover from the failure, although a mild response from Health Canada may give it a chance to recover its reputation, although it would take some time to do that, if it is given the opportunity.

While that uncertainty is going on, its competitors continue to scale, putting the company is a very weak position. A major hurdle would be if other companies will trust CannTrust to deliver approved of cannabis again; it’s going to be hard to win back individual and corporate customers if it survives.

For now, the company remains under investigation by not only regulators, but by the police as well. It also has stopped all recreational and medical cannabis sales.

Lessons for the cannabis industry

According to Leger Vice President Dave Scholz, there are things cannabis companies can to to mitigate the unethical failures of their rivals on their reputations.

The most important thing to do, according to Scholz, is to build a strong brand that differentiates from peers. Companies that don’t stand out from their peers will experience more of a negative impact than companies that have built up a good brand and reputation. Cannabis companies with weak brands will be painted with a similar reputations as companies that are faltering.

Companies that manage to stand out in the industry will not be hit as hard as those that haven’t, concluded Scholz.

He said this about recovering a reputation:

“The reputation recovery that’s gone well is for organizations that have already built out a level of trust among their customers and key stakeholders and created relationships with broad stakeholders.”

For investors, when looking at various cannabis companies to take or increase a position in, their brand differentiation and reputations are important to the long term viability of the company and its potential performance.

Also important is for companies to never attempt to hide something that could have a short- or long-term impact on its performance, especially if it’s related to compliance, as in the case of CannTrust. I’m not talking about proprietary secrets and competitive advantages that would be unwise and irresponsible to reveal.

Finally, watching how companies respond to various challenges is a key to seeing if they are prepared for most contingencies that may arise. If they do well with those, it’s highly probable they’ll be able to deal with any issue that could do some damage to its reputation.

Again, the best preventative is to have a solid brand and reputation in the first place, and build on that if any surprise crises comes about.

Conclusion

The major issue for CannTrust is, while it did have a good reputation among Canadian companies before it was discovered it had been producing cannabis at unapproved facilities, its response to the revelation was horrible. Not long after the discovery, it was also found that some in management had willfully covered up the situation.

That removed almost any chance of reputation recovery because that would have been the foundation to build upon. Hiding the non-compliance made the situation much worse than it had to be.

The key thing to take away from this in my opinion is for investors to closely watch how management responds to various challenging questions in its earnings reports, and the level of accuracy in its comments and its press releases.

This will give at least some clues as to whether or not they’re adequately prepared to face a reputation hit, and if the companies have a propensity to overly embellish things. In the relatively nascent cannabis sector, this is especially important.

As for CannTrust, I would continue to stay away from this stock until regulators give their response to the ethical violations the company engaged in.

The Consensus Verdict

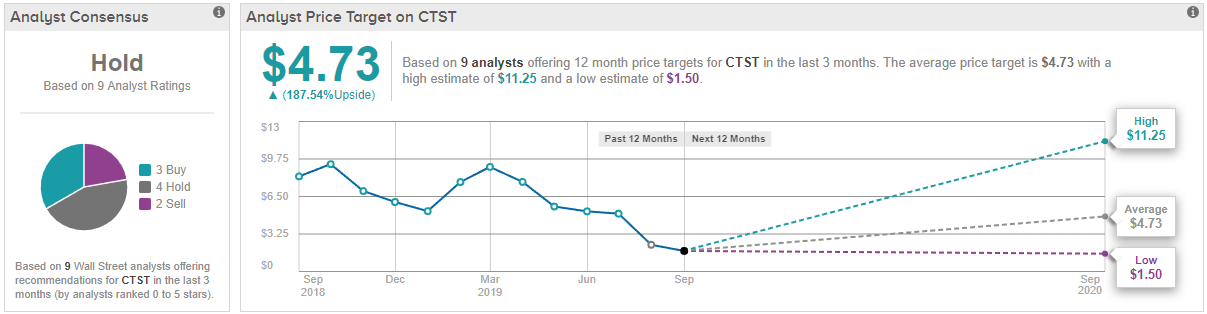

Wall Street believes it’s smart to play it safe when it comes to CannTrust, as TipRanks analytics reveal CTST as a Hold. Out of 9 analysts polled in the last 3 months, 3 are bullish on the stock, 4 remain sidelined, and 2 are bearish. However, the 12-month average price target stands at $4.73, marking a about 188% upside from where the stock is currently trading. (See CTST’s price targets and analyst ratings on TipRanks)