Cronos Group (CRON) has been up to a lot of things recently and part of that has been to do with the US CBD market.

Indeed, last week the company announced that it would enter the US CBD market in a deal to acquire the CBD businesses of Redwood holdings LLC including the high-end brand Lord Jones.

Jeffries Analyst Ryan Tomkins commends the company for putting its cash pile to work diving into the worlds largest CBD market. The analyst also likes the fact that the company is acquiring a high-end brand, which makes success a lot more likely as opposed to starting its own brand and going through the brand-building process. Tomkins argues that many LP’s can gain access to the CBD and Hemp markets in the U.S., but the fact that Cronos has acquired an already established brand gives the company an advantage when launching new products because it will be able to leverage the brand and its distribution network.

However, Tomkins still believes there’s reason for caution when it comes to Cronos as the stock trades at a premium vs similar cannabis companies in the sector. As a result, the analyst reiterates an Underperform rating on CRON with C$15.00 price target, which implies nearly 20% downside from current levels. (To watch Tomkins’ track record, click here)

Tomkins believes investors are seeking security in Cronos’s large cash pile as well as the partnership they have with Altria Group including their brands and distribution network. The analyst stresses that this business model has not been proven although it could quite possibly be in the future, and, as such, he thinks “valuation is too rich at these levels.”

Long story short, the recent acquisition by Cronos is well noted as a positive when it comes to the company but this analyst wishes to see proven results before he becomes more upbeat on the company.

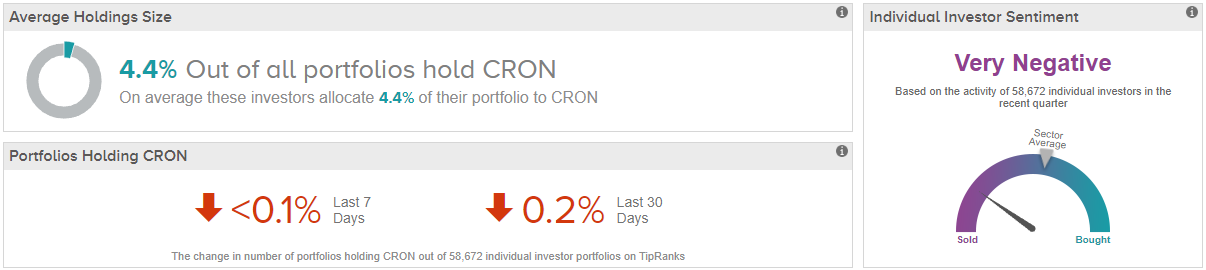

Investor sentiment is also quite negative, with individual portfolios in the TipRanks database showing a pullback from CRON.

Ultimately, the word on the Street points to a sidelined majority on CRON. In the last three months, Cronos stock has landed one ‘buy’ rating vs. two ‘hold’ and one ‘sell’ ratings. (See CRON’s price targets and analyst ratings on TipRanks)