After peaking in March, it’s been pretty much downhill for Cronos Group (CRON) stock, and yesterday was no exception.

While the stock initially jumped Thursday on the news of revenues surging 202% over last year, it eventually closed the day nearly 4% lower. The reason? The actual numbers are still quite low, and it took a while for the market to realize that.

My previous article highlighted the problem with the stock where a $5 billion market cap is mismatched with a revenue base hardly topping $10 million. The stock likely treads water for a considerable amount of time.

Blah Q2 Results

Cronos officially reported revenues of $10.2 million while a couple of large competitors released numbers above C$100 million. The Altria Group (MO) investment and a global R&D center in Israel are still the highlights of the business, not the actual operations.

The quarterly details just aren’t that impressive. Cronos only sold 1,584 kilograms in the last quarter. The net price per gram dipped to $6.44, down from $7.03 last Q2.

Cannabis oil sales only grew slightly to reach 20% of total sales during the quarter. The company has no distinguishable value from the hundreds of other cannabis stocks in North America outside of the Altria Group investment. One has to even wonder, if Altria would even choose Cronos nowadays.

Another big issue is that the Canadian cannabis company produced an adjusted EBITDA loss of $17.7 million. The EBITDA loss grew by $15 million over last Q2 while revenues were only up $6 million.

The company saw costs per gram sold actually rise 12% over last Q2 to $3.01. The gross margins were still a solid 53%, but the company needs to product at much lower costs as prices decline and competitors have massive scale. While the global cannabis market remains in ramp up mode, Cronos Group sits far behind the market leaders.

These types of sales levels don’t correspond very well with a market cap anywhere above $2 billion, if not down at $1 billion. As the cash balance disappears so will the stock valuation that now sits up at $5 billion.

All About The Cash

Cronos Group ended Q2 with a cash balance of $2.3 billion. The company plans to spend $225 million on the recent deal for Redwood Holdings so the available balance should sit close to $2.0 billion as the current quarter ends.

The large cash balance has the positive of providing substantial interest income to offset the current large losses. Cronos earned over $12 million in interest during Q2 to nearly offset all of the large EBITDA losses.

What Cronos Group does with this cash balance is key to the investment thesis. The Redwood Holdings details are crucial to understand whether the company plans to spend the cash hoard on inflated private market valuations or wait for distressed assets such as CannTrust (CTST). A few more deals in the $300 million range would quickly deplete the cash balance into the low $1 billion range placing the stock valuation back purely on the limited sales and profit picture of the company.

Takeaway

The key investor takeaway is that Cronos Group remains a highly valued cannabis stock with very little actual substance. Until the company wisely invests the cash balance, the stock isn’t investable at one of the richest market valuations in the cannabis sector.

The downside risk is that the company wastes the cash on unwise acquisitions that take years to pay off. In this scenario, Cronos Group could head significantly lower.

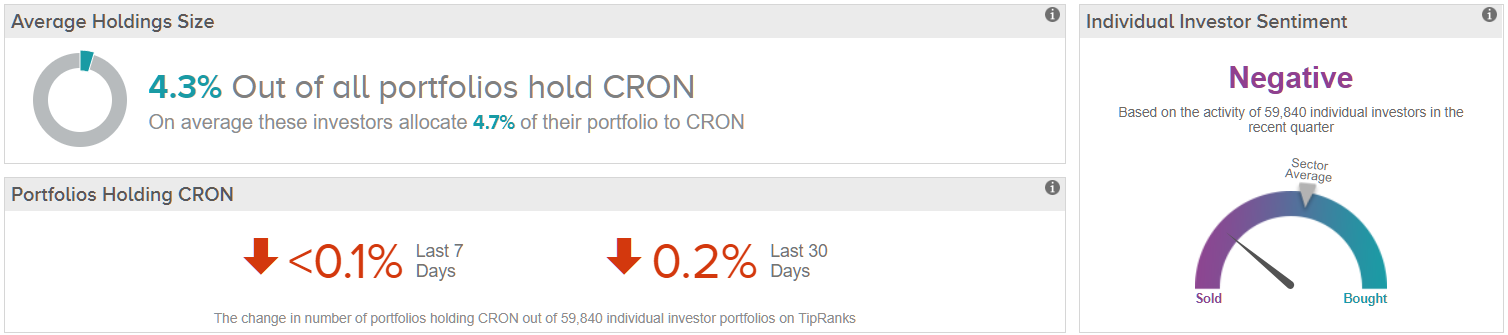

Unsurprisingly, investor sentiment is negative, with individual portfolios in the TipRanks database showing a net pullback from CRON.