As the ongoing fallout from the debacle surrounding CannTrust (CTST) continues to create increasing uncertainty concerning its future and even survival, it appears it could easily get worse, even after the company has lost over 50 percent of its value.

After discovering it had been ignoring the guideline put in place by Health Canada in regard to growing cannabis in unlicensed room at its facility in Pelham, the company has been subject to thorough review of its operations, which has led to the company being in a state of operational paralysis, and with the chance of it getting fined, losing its license, and predictably, now the recipient of class action lawsuits.

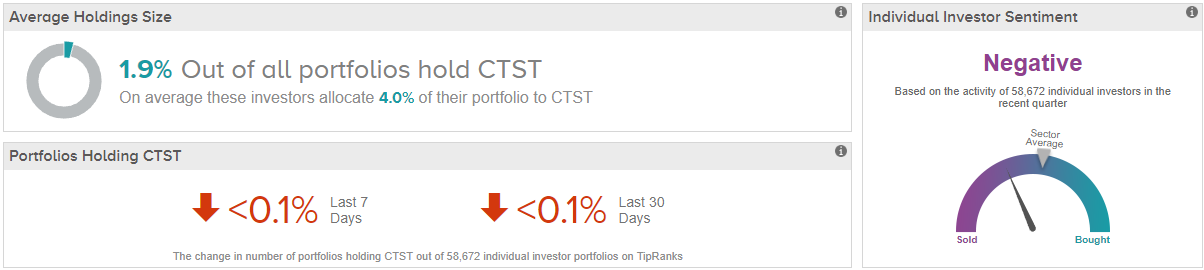

Unsurprisingly, investor sentiment is negative, with individual portfolios in the TipRanks database showing a pullback from CTST.

More comprehensive probe underway

Canadian securities regulators have opened up an in-depth probe into the practices of CannTrust to ensure it is compliant concerning the guidelines and parameters required of the company concerning the production of cannabis.

The investigation is being conducted by the Ontario Securities Commission in coordination with the Joint Serious Offences Team. They will do further research concerning there are more “serious violations of the law using the provisions of the Securities Act or the Criminal Code.”

The Joint Serious Offences Team said that for now it’s not going to release any more details of the investigation “in order to protect the integrity” of it.

What I see most devastating here is it’s going to keep the company in a state of limbo as to how investors view it, as there is no way of knowing how deeply the violations end up going, if there are more found.

Consequences and potential consequences

For now, the immediate impact on the company is its stoppage of sales and shipments until the investigation is over. While it’s stated as voluntary, the fact is if it did continue sales and shipments it could further damage the company if it did so if the cannabis sold was not compliant at different points of its supply chain.

Along with that, the company is subject to penalties of up to $1 million for each violation that is discovered. Not only that, but there is the very real possibility it could lose its cannabis licenses, which would effectively shut it down.

I think there, as the company stands today, it would probably not lose its licenses if there is nothing else uncovered. If there is more, all bets are off as to whether or not CannTrust will survive.

Another negative that is adding to uncertainty is the company stated it will probably miss the upcoming deadline for filing an interim financial report because of the ongoing investigation.

Finally, not only are millions in fines a high probability, along with the plummeting share price of the company, but some companies that acquired cannabis from CannTrust that were grown in its unlicensed facilities have filed a class-action lawsuit against CannTrust concerning securities fraud.

That the company is in disarray would be an understatement

Since the reports of growing in unlicensed rooms was reported in the media, CannTrust fired CEO Peter Aceto and got rid of co-founder and president Eric Paul.

At time it appears the executives had full knowledge of producing pot in the unlicensed rooms. While this is an attempt at damage control, it’s probably far too late for the company to salvage anything as a result of those actions.

That is one of the reasons reports have been circulating that the company is seeking to offer itself for sale as one of its options.

Conclusion

As this disaster has unfolded, it keeps getting worse, as uncertainty and total lack of visibility of how this is going to play out remains in place.

That means the company is now in paralysis until the investigation is completed, and further is known about fines and the viability of the class action lawsuits.

This also includes the fact the company isn’t selling any more product because it could cause further damage if some of that is found to be non-compliant as well. The result is little if any revenue, probable stiff fines, potential large payouts from the lawsuits, and in the worst-case scenario, the loss of its licenses.

I’ve seen some in the financial industry attempt to convince some that things aren’t as bad as they seem for CannTrust. But my conclusion is this isn’t a company anyone should take a position in with the idea it will be able to turn itself around.

How low the stock can go? Canaccord analyst Derek Dley has recently slashed his price target for CannTrust stock to C$2.50 (from C$5.00), which implies nearly 17% downside from current levels. (To watch Dley’s track record, click here)