Jefferies analysts name NVIDIA Corporation (NASDAQ:NVDA) and Chevron Corporation (NYSE:CVX) as their top picks in semi-conductors and integrated oil industries. The analysts anticipate a successful investor day for NVIDIA and future success of Chevron despite a tough economic environment for oil stocks.

NVIDIA Corporation

Jefferies analyst Mark Lipacis highlights NVDA as his one of his top stock picks prior to the company’s Investor Day, scheduled for April 5, 2016. The analyst notes that one year after its last investor day, the company “has executed on its growth strategy in PC Gaming, HPC & Cloud and Automotive, while returning $800m to shareholders in the form of dividends and buybacks.” Going into the meeting, the analyst predicts an “upbeat” tone on Gaming, Data Center, and Self Driving Cars.

Liapis points to an increase of 800 bps in product GM’s for the company in the past 5 years, believing the “change is secular” and represents “reflection of NVDA’s transformation to a supplier of platforms with higher software content, from a supplier of chips.” The analyst predicts additional GM growth in 2016 in its PC gaming, HPC/Cloud, and high ASP-high margin VR GPUs. The analyst mentions that in September, the company chose to focus on growth for its PC Gaming, Autos, Cloud, and Virtual Reality markets through “software and platform solutions.” He elaborates, “This change in strategy means that 1) NVDA has decoupled from the PC market and 2) NVDA is no longer a direct competitor to INTC in its primary businesses.”

The analyst concluded, “We expect improved investor sentiment after NVDA’s Investor Day (5-Apr-16), as the company highlights innovations and leadership in its 4 focus markets: PC Gaming, VR, Auto and HPC/Cloud. For CY16, we expect continued GM expansion and higher capital return YoY. NVDA continues to look like a call option on 4 secular trends.”

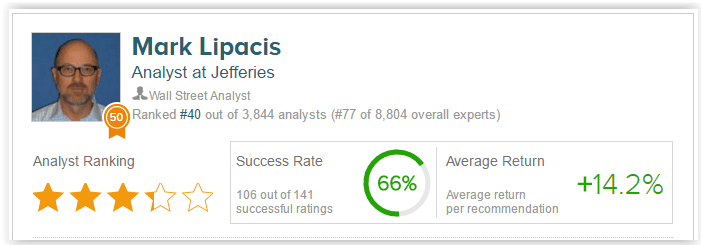

Lipacis reiterates a Buy rating on the stock and increases his price target to $42 to $40.

According to TipRanks, Mark Lipacis is ranked #40 out of 3,844 analysts on TipRanks. He has a 75% success rate recommending stocks with an average return of 14.2% per recommendation. Among Lipacis, out of 16 analysts who have rated the company in the past 3 months, 6 gave a Buy rating, 1 gave a Sell rating and 9 remain on the sidelines. The average 12-month price target for the stock is 433.54, marking a 6% downside from current levels.

Chevron Corporation

Jefferies analyst Jason Gammel chose Chevron as his top stock pick in the integrated oil sector. The analyst predicts that the company’s free cash flow “should improve significantly through 2018” due to “lower capital spending, production growth and margin expansion.” He believes this will help the company “fund its dividend with free cash flow” despite Brent oil prices priced at a low $50 a barrel. The analyst also cites that “major capital projects are near completion and should underpin a production CAGR of 5% from 2015-2018.” He believes these projects could generate favorable cash margins for the company. He elaborates, “With the finish line in sight it is incumbent on the company to deliver these projects in order for the stock to outperform.”

The analyst also comments on the company’s “rock solid” balance sheet, which it has effectively used to “navigate the low oil price environment at a time of high capital spending.” Gammel notes “manageable” leverage and believes the company’s net debt/capitalization will not exceed 19% by the end of 2016. He assures, “Even within the context of the current low oil price environment the company’s liquidity and financial flexibility are robust.”

The analyst also points to a relatively stable stock price despite the difficult sector. He believes that after the company completes its projects, “leading production growth and a pristine balance sheet,” will enable the stock to trade at a 10% + premium relative to its peers. He concludes, “The company is positioned to generate the highest organic production growth amongst its peers, and it has the most dramatic cash cycle inflection in the sector.”

Gammel reiterates a Buy rating on the stock with a $110 price target.

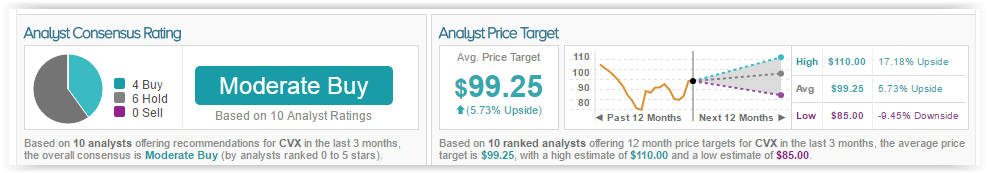

According to TipRanks, Gammel has a 50% success rate recommending stocks with an average return of 2.6% per recommendation. Out of the 10 analysts who have rated the stock in the past 3 months, 4 gave a Buy rating while 6 remain on the sidelines. The average 12-month price target for the stock is $99.25, marking a 5% upside from current levels.