“We expect oil prices to remain volatile and unpredictable driven by speculation and competition for market share among OPEC and other large oil producers,” write Gheit and Amadeo. “We expect most, if not all, oil producing companies to face free cash flow deficits at $80/b WTI oil price and to be forced to cut spending and raise capital. We believe WTI oil price should be closer to $70/b, not $90 or $50, and the longer prices stay inflated the steeper the correction, and the longer the price remains low, the sharper the spike.”

At $80 WTI, most producers still burning cash

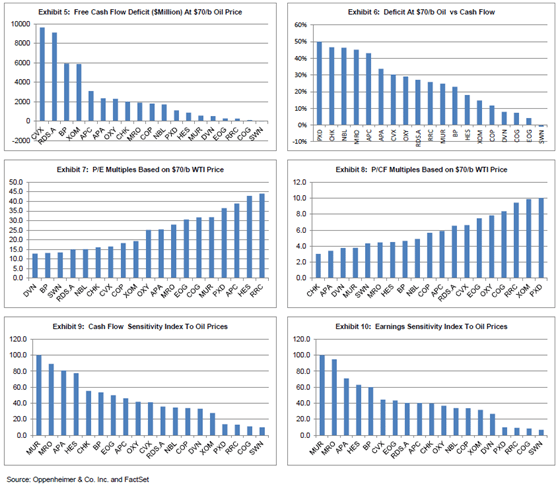

If oil stays around $70 WTI and no one changes their capex plans, Gheit and Amadeo expect the industry to have an overall PE multiple of 25x and P/CF of 6x, with Hess Corp. (NYSE:HES) being the most expensive (42.6 PE) and the situation gets worse as you look at lower average prices. But even a bounce back to $80 WTI (no one is even talking about what would happen at $100 per barrel anymore), the industry would start to be reasonably priced again with a PE multiple of 17.5x. At $60 per barrel, some companies’ earnings go negative and only Southwestern Energy Company and Devon Energy Corp (NYSE:DVN) still have low valuations.

Low oil prices could drive industry consolidation

Realistically, this means that low oil prices would have to start cutting capex, with some companies slashing it by as much as 30%. If low prices drag on, companies with higher production costs and more leverage will start to have serious financial problems, and this could lead to some industry consolidation. Exxon Mobil Corporation (NYSE:XOM) has the highest total capex in the industry, but the lowest relative to its market cap. The highest capex/market cap ratios are Chesapeake Energy Corporation (NYSE:CHK) Corp and Apache Corp at 46% and 38% respectively, compared to an industry average of 22%.

According to TipRanks.com, which measures analysts’ and bloggers’ success rate based on how their calls perform, analyst Fadel Gheit has a total average return of 7.4% and a 61.2% success rate. Gheit is ranked #647 out of 3440 analysts.