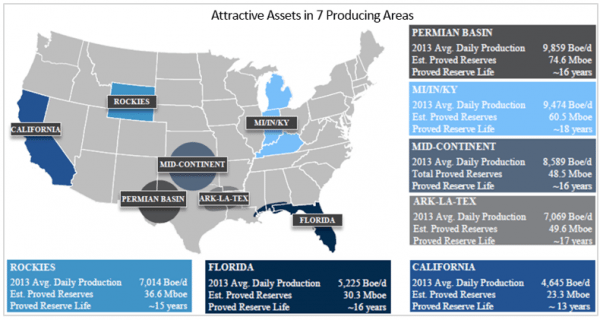

BreitBurn Energy Partners (NASDAQ:BBEP) is an upstream Oil & Gas company operated as a master limited partnership (MLP). They buy mature crude oil and natural gas producing properties with slow decline rates. The fields generally have long production histories, some dating back to the 1800s, from 7 different areas throughout the United States with a total reserve life of 16-17 years.

The strategy is to harvest the long life stable production from the acquisitions or grow organically as the assets are often characterized with low risk exploitation and development opportunities. The properties are then managed operationally and through commodity price and interest rate derivatives to generate stable cash flows and make distributions to unitholders.

The majority of production growth comes from new acquisitions. In November, 2014 BBEP announced (source) the QR Energy LP (NYSE:QRE) acquisition making BEEP the second largest upstream MLP. This follows an October 2014, $123 million acquisition of Midland Basin acreage in the Permian Basin, and $1.2 billion in acquisitions during 2013 primarily in the Oklahoma Panhandle and Permian Basin. The portfolio of oil & gas reserves and production including QRE consist of 323.4 million barrel oil equivalents of estimated proved reserves, 82% Proved Developed comprised of 58% oil, 8% natural gas liquids (NYSE:NGLS), and 34% natural gas.

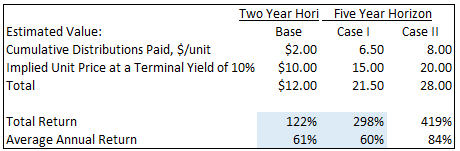

BreitBurn Energy Partners Valuation Summary:

Crude oil’s rapid decline and the U.S. dollar’s strength is causing some to forecast crude oil to stay or continue lower due to excess supply and weak demand. In our view there has been no fundamental underlying change in supply and demand over the longer term. In short we think the market’s reaction is overdone for the entire sector.

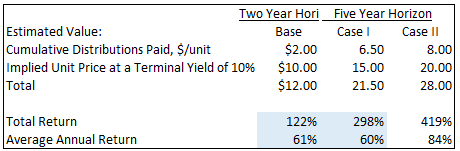

Three valuation cases are estimated for BBEP. In the Base Case the unit price increases to about $10/unit over a two year period while we collect $2.00 in distributions for a total return of 120% or about 60% per year. The Base Case valuation is estimated from the volumes used in the company’s recent 2015 guidance and are believed to be conservative. That is because higher realized prices should increase volumes, which in turn improve operating efficiencies, improve hedging opportunities, and enable additional organic growth.

To estimate this additional potential, Case I and II assume distributions would increase in response the benefits of volume improvements over a longer five year period; to $1.50 or $2.00 per year. In Case II the distribution is returned to the $2.00/unit distribution level before the recent reduction and in Case I the distribution gets only half way there to $1.50/unit over the five years. The potential returns for Cases I & II are compelling but less well defined:

Background:

Oil stocks took a beating over the past six months as oil prices fell to the lowest levels since the financial crisis. Softening worldwide demand for oil in Europe and China, increasing supplies from North America and Iraq and no volume relief from the OPEC cartel has contributed to an oversupply of crude oil estimated at about one million barrels per day. West Texas Intermediate (WTI) futures were testing new lows in the mid $40’s/bbl. down nearly 60% percent from the summer high of almost $108/bbl. The decline in crude oil prices was not anticipated and are reminiscent of the 2008 financial crisis and recession. Investors are fleeing the sector.

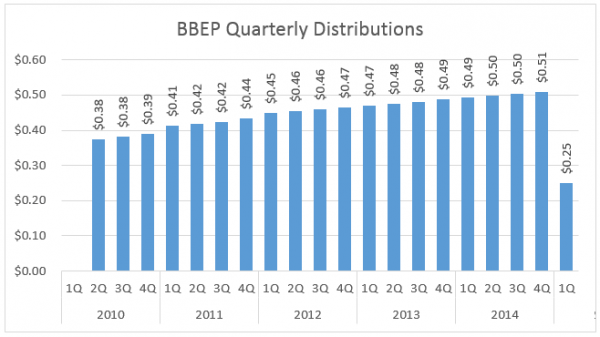

So here we are in 2015 and BreitBurn Energy’s unit price has dropped almost 75% to about $5.00/unit from the low $20/unit range. Income investors justifiably feared the BreitBurn distribution would be cut or suspended as it was during the financial crises. The company subsequently announced (source) the monthly paid distribution would be reduced from $2.08 per year to $1.00 per year and the 2015 capital budget reduced to $200 million. These measures will provide more financial flexibility during this weak commodity price market and for the debt service associated with the QRE acquisition.

Déjà vu? In early 2009 during the financial crises BBEP’s unit price dropped from the $25-30 range to as low as $6 because oil went from a high of $140/bbl. to $40/bbl. and gas from $13/MSCF to $4/MSCF. BBEP suspended their distribution payments for about 5 quarters starting in 2009, a prudent but unpopular move with their income oriented investors. The stock got crushed but BBEP survived because of a strong hedge book, cost cutting, and capital conservation measures. The distributions were resumed in the 2Q 2010 and the stock returned to the low 20’s over time.

Crude Oil Assumptions:

In short we think the market’s reaction is overdone; the energy industry fundamentals have not changed, and the OPEC cartel led by Saudi Arabia’s decision not to intervene, is in our view a change for the better in that it will allow market fundamentals, not politics in the cartel, to prevail.

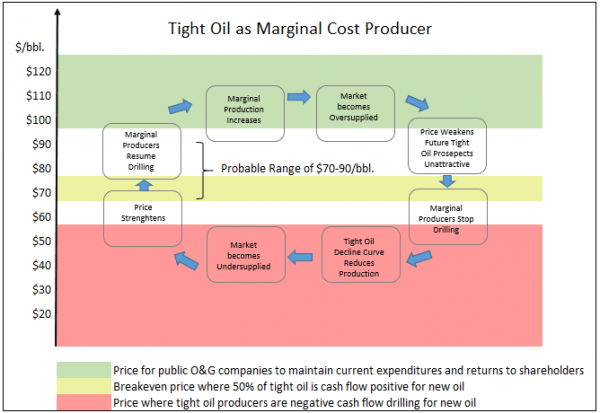

The price of a commodity, in this case crude oil, is unlikely to fall below the cost incurred for that last barrel produced to meet demand. With OPEC’s new nonintervention position, crude oil prices will increasingly be determined by the marginal cost of developing new oil in the free market rather than control of supply by the cartel.

North America tight oil (shale oil) producers are now the marginal cost suppliers. The relatively wide range of costs within this group enables incremental supply responses within the potential 10-12 million barrel per day supply source.

North American tight oil added six million b/d of crude oil and condensate over the past few years to a world market where other crude oil supply increases were just about sufficient to help offset demand growth and the natural 4-5% per year decline in conventional crude oil sources.

Tight oil producers have relatively quick response times (months vs. years) because new drilling programs can be initiate within months to add supply; and the 65-90% first three year decline rates subtract from supply once drilling stops. This enables supply and demand adjustment to occur faster than previously with the slower decline rates of larger conventional reserves and the multiyear projects typically needed to bring new conventional sources of crude oil online.

The advent of tight oil as the marginal cost of supply, characterized with the relatively short development cycles and high decline rates enables Saudi Arabia, the world’s lowest cost producer to take advantage of its low cost position and cede the role of swing producer to the marginal cost tight oil producers. The higher costs of these new crude oil supplies, primarily from North America’s tight oil but also Canada’s oil sands and Russia coupled with dysfunction in the OPEC cartel has led Saudi Arabia to adopt their nonintervention strategy. They recognize the market share loss to them through intervention is no longer necessary over the longer term and has publicly said so in not so many words.

As marginal cost producers, and by default, swing producers the tight oil producers are the ones that must adjust to supply and demand imbalances. At today’s crude oil price levels their breakeven price for new oil is not being met. Drilling will decline and the fast decline rates will reduce production until prices return to more sustainable levels. Tight oil producers will continually be forced to respond quickly to crude oil price signals, if not willingly, forcibly as their lenders and investors will demand.

Below is a graphic representation of how the market forces may unfold while tight oil remains the marginal crude oil supply and Saudi Arabia’s no longer intervenes. Keep in mind these prices are based on information available today and there is no attempt to estimate the over reactions that can occur in commodity markets. Nevertheless, fundamentals will prevail overtime.

Notional Pricing Model with Tight Oil as the Marginal Cost Crude Oil Supply:

Implications for Investing:

The time required to “adjust” crude oil supplies and the subsequent price of crude oil has shorten considerably. It is likely a recovery to the probable range of $70-90/bbl., will be sooner than many anticipate because the shorter reaction time, perhaps as soon as 6 to 18 months.

Oil and gas companies are capital intensive and have little control over prices. However, when prices fall below the marginal cost of production, marginal producers are forced to react to preserve capital. In the meantime the industry becomes distressed temporarily and Mr. Market offers us the opportunity to buy solid businesses at attractive prices.

Investment Thesis:

BreitBurn’s QRE acquisition during this tumultuous period may not have been the best timing. The transaction was completed issuing approximately 72 million BreitBurn common units and borrowing another $1.5 billion under a credit line. The transaction valued at about $3.0 billion raised BreitBurn’s credit agreement borrowings to $2.1 billion, approaching the approved credit limit of $2.5 billion. So, with crude oil prices down 60% and a load of new debt, what’s there to like?

Potentially a lot: As investors we have a history of overreacting to oil price signals. The underlying premise of this investment is that crude oil prices will not remain below $50/bbl. very long and BreitBurn Energy’s business model differentiates it in ways that offers significant upside for the longer term investor.

BreitBurn a Conventional Producer:

First, BreitBurn Energy’s 75% price decline is comparable to that of some tight oil producers facing 65-90% production decline rates in the first three years and uneconomic drilling prospects at these prices. BBEP is not a tight oil producer, they buy mature crude oil and natural gas producing properties with slower conventional production decline rates. They are diversified, producing from 7 different areas throughout the United States with a total reserve life of approximately 16-17 years. Management estimates maintenance capex, that is the capital expenditure rate required to maintain current production levels, is about $200 million.

Source: BBEP at Wells Fargo 2014 Energy Symposium

Strong Dividend Payments:

As a master limited partnership BBEP manages the oil, natural gas liquids (NGL) and gas properties to generate cash flow for distributions to unitholders. Even after the recent distribution reduction, primarily as a precautionary move to assure financial flexibility, the market perhaps anticipates another as the unit price fell further and the distribution yield is currently about 20%.

Strong Hedge Book:

BBEP revenues and net income are sensitive to oil and natural gas prices. Commodity hedging has been an important part of their strategy to reduce volatility and achieve more predictable cash flow by reducing exposure to adverse fluctuations in the prices of oil and natural gas.

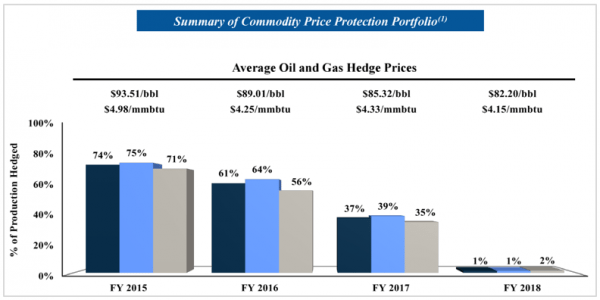

Source: BBEP Summary of Commodity Price Protection Portfolio

The current derivative arrangements cover 75% of 2015 oil and gas production: hedged at $93.51/bbl. oil and $4.98/million BTUs of natural gas. The above graph shows 2016 and 2017 with 64% and 39% of total production hedged respectively at prices significantly about the current market prices.

Credit Line:

According to the Form 8-K filed with the SEC (source) BBEP entered into a new credit agreement with Wells Fargo Bank and a syndicate of lenders on November 19, 2014, in connection with the QRE acquisition. It provides an aggregate maximum credit of $5 billion maturing in November 1919. The initial total lender commitment, as of November 2014, was $2.5 billion of which BBEP total borrowings are $2.1 billion primarily associated with the QRE acquisition. These borrowings are subject to a borrowing base, which is scheduled to be redetermined approximately every six months with the next borrowing base redetermination scheduled for April 2015.

The credit agreement contains customary covenants, including restrictions on additional indebtedness; investments, and it requires the interest coverage ratio to be greater than 2.5 to 1.0. Management believes the credit agreement is less restrictive than the previous agreement, provides greater operating flexibility, and reflects in part the larger size of the operations when compared to the prior agreement according to the filing.

Financial Flexibility:

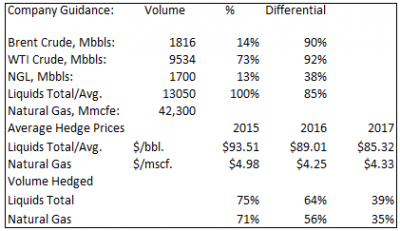

Let’s look at BBEP’s financial position and measure their ability to weather this storm. On January 2, 2015 BBEP announced (source) distributions and provided guidance for the full year 2015 as follows:

Estimates can also be made for future years using this guidance, the reported hedge book for 2016 and 2017 and assuming all else equal (production and expenses remains at the 2015 guidance level). The crude oil assumptions are applied to create a range of unhedged prices.

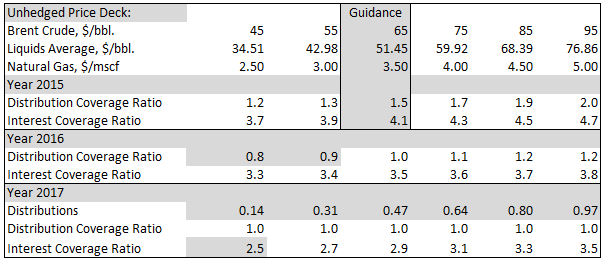

Using managements guidance for 2015 that assumed unhedged prices of: $65/bbl. Brent Crude, $60/bbl. WTI, natural gas at $3.50/mscf and the hedged volumes the following is estimated for the unhedged price range shown below:

Year 2015:

In 2015, even at today’s below guidance crude oil prices, both the dividend and credit agreement coverage ratios are adequate.

Year 2116:

In 2016, even at today’s below guidance crude oil prices, the interest coverage ratio is adequate however at Brent prices below $55/bbl. the dividend may be reduced further.

Year 2117:

In 2017 adjusting for the even lower production currently hedged and all else equal:

- In the lowest price case the interest coverage ratio is still met ranging from 2.5X at $45/bbl. and up to 3.8X at $95/bbl.

- If all distributable cash flow is paid out as a distributions the range would be $0.14/year at $45/bbl. to $0.97/year at $95/bbl.

The year 2017 is a sensitivity that assumes no opportunity for operation or hedging improvement over the next three years. The key message is the interest coverage ratio is adequate even in this pessimistic view.

Valuation:

North American tight oil requires a price range of $70-90/bbl. to breakeven and drill for new oil to offset the 65-90% first three year production decline rate. Interestingly, it appears Saudi Arabia may agree by virtue of their decision not to intervene even though this stance is at a high initial cost to them.

Three valuation cases are estimated for BBEP. In the Base Case the unit price increases over a two year period to about $10/unit while we collect $2.00 in distributions for a total return of 120% or about 60% per year. The Base Case is estimated from the volumes used in the company’s 2015 guidance and are believed to be conservative. That is because higher realized prices should increase volumes, which in turn improve operating efficiencies, improve hedging opportunities, and enable additional organic growth.

To estimate this additional potential, Case I and II assume distributions could increase in response to capturing the benefits of volume improvements over a longer five year period; to $1.50 or $2.00 per year. Case II assumes the distribution is returned to the $2.00/unit distribution level before the recent reduction and Case I assumes the distribution gets only half way there to $1.50/unit over the five years. The potential returns for Cases I & II are compelling but less well defined:

The value of BreitBurn Energy will be realized on the total return from both income and growth. Management’s guidance for 2015 is explicit and as the second largest MLP upstream player with a good track record of delivering returns to unitholders we think these are reasonable valuations. BBEP has a long history of delivering better than expected returns through operational performance, capital allocation discipline and their excellent hedging program to lock in better than average returns.

BBEP should be considered for investment because:

- Crude oil will likely be significantly higher within 12 to 18 months even while recognizing the EIA forecast of additional surplus through the early half of 2015.

- North America tight oil producers are the marginal cost suppliers. Within the group there is a wide range of costs that enables incremental supply responses to occur quickly within this 10-12 million barrel per day supply source.

- Tight oil new drilling programs can be initiated within months to add supply; and the 60-90% first three year decline rates subtract from supplies relatively quickly once drilling stops.

- Crude oil prices will likely recover to a range of $70-90/bbl., sooner than many anticipate, and as early as 6 to 18 months in our view.

- BreitBurn is not a tight oil producer, their fields generally have long production histories, from 7 different areas throughout the United States with a total reserve life of approximately 16-17 years.

- The existing hedge program can be demonstrated to generate sufficient cash flow to service the debt for the QRE acquisition and pay the recently reduced distribution.

- The new credit agreement was negotiated during the collapse of crude oil prices where presumably both lender and borrower assessed the environment and both will remain interested in a successful outcome.

- The industrywide sell off may offer many other opportunities in the energy sector and in a sense is less risky than a company specific issue. Single company issues may make value recovery difficult but entire industries rarely are impaired forever.

- Over the next two years our base case value estimate shows a 120% total return or a 60% annual return over the next two years.

- The current monthly paid distribution is about 20% per year and could be locked in on the investment costs for many years to come.

Risks:

- If energy prices stay low there is significant risk for to the distribution payment. However the adage; “the best cure for low crude oil prices is low crude oil prices” referring to the cyclical nature of the business has held true over many cycles and we believe it will again.

- The credit agreement is subject to a borrowing base redetermination scheduled every six months, and the next redetermination is in April 2015. Management disclosed in their view that the agreement provides for additional flexibility. BBEP is well above the disclosed 2.5X required interest coverage ratio.

- BBEP’s Debt/EBITDA (Earnings before Interest Tax Depreciation and Amortization) ratio estimated at 5.2X after the QRE acquisition is high. This leverage may presents a risk to future distribution payment levels; this somewhat offset by the recent distribution reduction but high leverage increases risk.

- Leverage works two ways. The price level of BBEP suggests that investors remain concerned about crude oil prices and the leverage used for the QRE acquisition. As this leverage likely contributed to the decline in BBEP’s unit price, equity holders stand to benefit to the upside should the thesis play out.

- It is likely that the BBEP unit price will respond negatively to a rising interest rate cycle although the estimated returns at these distressed prices could help insulate the company from the interest rate risk.

- The overall health of the global economy is a determining factor in performance as energy consumption tracks overall economic activity levels. An increase in energy consumption should lead to an increase in crude oil consumption and prices but a decrease due to economic health should lead to a decrease in crude oil consumption and prices were it to occur.

The crude oil oversupply is in part due to the North American Oil & Gas Renaissance. The key assumption is this is temporarily depressing crude oil prices in the face of positive longer term industry fundamentals. BreitBurn’s business strategy and oil & gas properties, with a life of 16-17 years, is protected with a strong hedge book in our view to weather the current downturn.

Shareholder friendly management; proven performance in the financial crises; and stable cash flows should provide sufficient protection until prices improve, likely within a 2 year time frame offering a significant opportunity. This investment is not for the faint at heart but selling at 1.4X 2015 year cash flow, and at paying a 20% dividend with a strong hedge book; it may be worth the risk.