It is a rough time to be 53-year-old John Burbank, founder of Passport Capital and the man who once knew the dice to play in the mortgage crisis- a man who once reaped a full gravy train amid the global financial crisis. Yet, this was 2006, where by 2007 Burbank’s hedge fund firm earned 220%. Present-day, Passport’s assets are a far cry from the golden days of roughly $5 billion in assets. It is no wonder that Burbank is making big moves in Advanced Micro Devices, Inc. (NASDAQ:AMD) and Alibaba Group Holding Ltd (NYSE:BABA) as he struggles to rebound from a crisis he did not anticipate this time around.

By 2016, losses turned to double-digits, with even more losses mounting last year. Once April 2017 hit, assets slipped to $2.4 billion- and then fell off the cliff down to $900 million, as investors began to withdraw assets. The San Francisco-based multi-strategy firm in its 18 years has seen its Long-Short strategy fund stricken from the table after 2016 proved massively rock- and now, the flagship Passport Global Fund has come to an end as well.

Though Burbank boasts over a decade long record of investing in global equity markets, his heyday 11 years ago of scoring triple-digit returns is in the rearview mirror. Don’t count out Burbank- he is still the genius that took the daring gamble to short the subprime mortgage crisis and perhaps has some rally in him yet. Even Burbank acknowledges his returns in the last two years are simply “unacceptable.”

Let’s take a closer look in Burbank’s sharp quarterly retreats in two of the tech sector’s biggest giants:

Advanced Micro Devices Gets Zapped

Following a crumbled flagship Passport Global Fund, John Burbank is busy trying to pick up the pieces, with his Special Opportunities Fund and the Saudi share class the last funds left kicking. Burbank needs to be careful about his bets these days, and based on his recent fourth quarter play, Advanced Micro Devices is no longer a compelling risk. Burbank has sold off his entire stake in the chip giant- all 617,341 shares worth a whopping $6,346,265.

Yet, Burbank’s bearish move is not the only one against AMD these days: Susquehanna analyst Christopher Rolland just joined the bears now that ryptocurrency mining company Bitmain has officially developed an application-specific integrated circuit (ASIC) for Ethereum mining.

As such, the analyst has a Negative rating on AMD stock with a price target of $7.50, which implies a 24% downside from current levels. (To watch Rolland’s track record, click here)

What does the proliferation of Ethereum mining ASICs spell out for AMD’s future revenue? By Rolland’s estimation, the Bitcoin mining giant could hit at roughly 20% of the chip giant’s total revenue. In fact, Rolland muses greater than 20% of AMD’s total sales could be at stake if “aftermarket sales abound.”

Be wary, AMD investors, Rolland warns, all too aware that Ethereum-related graphics processing unit (GPU) sales spell out big bucks for the company. True, Rolland could be jumping the gun too soon on this downgrade- it is a “likely early” call ahead of “needed GPU channel replenishment.” Yet, the fear of tumbling PC graphics cards demand is no small risk, considering Ethereum mining just got “its ASIC.”

Here’s why Rolland stepped down to the sidelines and joined the bears on AMD: “The commercialization of this ASIC, coupled with: 1) continued pressure on Ethereum coin prices ($530 today, down from a peak of $1,385 in January); 2) a potential move from PoW to PoS (perhaps in 2019); 3) additional Chinese chip makers developing Ethereum ASICs; and 4) the potential for increased secondary market GPU sales, potentially cannibalizing future GPU sales, compels us to downgrade.”

Yet, the AMD team has come out swinging, arguing that it is not as dependent upon crypto as analysts like Rolland might think: “Yesterday a report was published on AMD which hypothesized very high revenue for Ethereum-related GPU sales. As a reminder, on our Q4’17 earnings conference call we stated that the percentage of annual revenue related to Blockchain was approximately mid-single digit percentage in 2017. We had significant growth in the GPU business outside of Blockchain in Q4’17 as we ramped our Radeon Vega products, our GPU compute products, and our Apple business. We also spoke about strength across the rest of our business with AMD Ryzen and AMD EPYC product momentum. We have very compelling long-term drivers for the company including PCs, servers and graphics and our Q1 2018 financial guidance reflects that.”

There is a bigger picture here, the AMD team defends, and to dismiss its other growth levers is to underestimate this chip giant: “We appreciate the time and attention that investors continue to pay to Blockchain and cryptocurrency, but would also like to keep it in perspective with the multiple other growth opportunities ahead for AMD.”

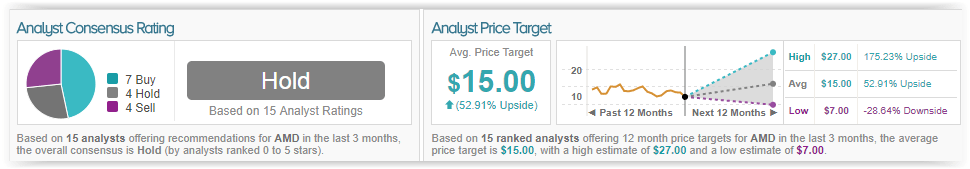

Ultimately, TipRanks shows a cautious Wall Street leaning towards the bulls on AMD’s market opportunity. Out of 15 analysts polled in the last 3 months, 7 are bullish on the chip giant, 4 remain sidelined, while 4 are bearish on the stock. With a healthy return potential of almost 53%, the stock’s consensus price target stands tall at $15.00, indicating optimists are mixed into those not ready to take the bet on AMD just yet.

Kicking Out All $31 Million in Alibaba

Amid Burbank’s hedge fund struggles, the guru who once called the housing market collapse and lived to count the dollars after has opted to outright axe his Alibaba holding of 180,452 shares worth $31,115,338.

Yet, was it too soon to walk out of this e-commerce giant? The Wall Street Journal is churning exciting stock listing news: Alibaba is angling for a listing in China.

Should this offering come to light, and Chinese securities laws become amended to make it possible for foreign firms to list, investors may see the offering as early as the summer.

The BABA team told CNBC, “Since our IPO in the US, we have stated that if regulations allow, we would consider a listing in China.” Keep in mind, BABA founder Jack Ma had indicated at the start of the year the intent to “seriously consider” a Hong Kong listing.

Could mainland China traders participate in the Wall Street name of the game? The Wall Street Journal says the Chinese e-commerce king is musing how this could be possible for investors.

Worthy of note, BABA went public four years ago in New York in a historic monster $25 billion offering. This followed Hong Kong’s refusal to take Alibaba’s governance structure.

Chairman of the China Securities Regulatory Commission Liu Shiyu asserts, “We will not waver from reforms (to make China’s capital markets) more market-based, law-based and international.” Reuters had stirred up buzz late last month that China’s securities regulator had been approaching offering a group of China’s biggest tech players a shortcut to be able to domestically list shares.

If BABA does list in China, this would be a “positive for the stock,” cheers top analyst Youssef Squali at SunTrust.

Therefore, one of the best performing analysts on the Street reiterates a Buy rating on BABA stock with a $225 price target, which implies a close to 24% upside from current levels.

“Historically, companies incorporated overseas (in Aliababa’s case the Cayman Islands) were prohibited by law to sell shares to local Chinese investors. It appears that Alibaba’s robust share performance since its IPO in NY, its market cap at $~500B, its global franchise and the missed investment opportunity for local investors are leading regulators to look into altering the rules. If this change takes effect, it may encourage BABA to consider a dual listing on a Chinese exchange, and ensure that future Chinese tech IPOs (Ant Financial for one) choose a dual listing. While the exact method of BABA’s potential local listing is still unknown, the WSJ indicates that Chinese banks would create depository receipts, which is consistent with our view that BABA is not likely to list locally by selling new shares. This is in part because of its cash rich balance sheet, and in part to avoid any unnecessary dilution from new share issuance,” asserts Squali.

Youssef Squali has a very good TipRanks score with a 70% success rate and a high ranking of #51 out of 4,759 analysts. Squali garners 19.5% in his annual returns. Notably, investors who follow Squali’s recommendation on BABA will earn an average of 24.9% in profits on the stock. Squali has an impressive track record on the Street.

Though Burbank has backed out, Wall Street consensus does not seem to agree here. Alibaba has landed among one of Wall Street’s favorite stock picks, according to TipRanks analytics. All 17 analysts polled in the last 3 months unanimously rate a Buy on the Chinese e-commerce king. The 12-month average price target of $235.59 marks a strong return potential of nearly 32% from where the stock is currently trading.