At the age of 51, billionaire Cliff Asness commands a hedge fund firm that has absolutely rocketed in assets- one of the quickest-growing in the world. With a net worth of roughly $3 billion to his name, Asness co-founded AQR Capital Management two decades ago on back of Wall Street’s favorite sorcery: quant trading. According to the latest SEC filing, Asness’ hedge fund firm opted to take a step back in Micron Technology, Inc. (NASDAQ:MU), but dial up the fire under Advanced Micro Devices, Inc. (NASDAQ:AMD).

Since the late ’90s, times have spun forward, where quant mania has left investors captivated. It is no wonder why, when quantitative hedge fund (where AQR signifies Applied Quantitative Research) was one of the elite firms on the Street to turn over a few billionaires; a true profits-making behemoth. Asness’ co-founders David Kabiller and John Liew both boast $1 billion in their net worth, with each of these three gurus climbing onto Forbes’ list of billionaires. Not every hedge fund manager survived the 2007 quant crash and the financial collapse the following year to close out 2010 with an impressive $33 billion in assets. Asness lives to tell the tale each time in face of losses and does not simply live to tell the tale- he absolutely thrives.

Present-day, the notable active researcher has earned a golden reputation for being a financial expert. In fact, Asness has been awarded the James R. Vertin Award from the CFA Institute to commend his lifetime commitment and drive for research. Asness has even been granted the Graham and Dodd Award from the Financial Analysts Journal for the best paper of the year- twice. Additionally, the billionaire earned an award for the greatest perspectives piece- the Graham and Dodd Excellence Award. When he is not winning accolades left and right, Asness has been making his Nobel Prize-winning professor from the University of Chicago Eugene Fama proud, proving a thesis that over time, the market can be outclassed by leveraging a stock pick’s fundamental value and momentum.

Let’s dive in to see why from where Asness is standing fortune does not favor MU, but shines bright on AMD potential:

Micron Gets a Trim

The quant genius sold off from his firm’s position in red hot chip stock giant Micron, dumping 402,515 shares in the first quarter. That said, the play marks a slight 3% chop at the end of the day, considering Asness still holds a jumbo 19,065,144 shares in MU worth $994,056,000.

Joe Wittine of Longbow is less confident than Asness, who even with a backtrack still looks like a Micron bull, anticipating the Street’s near-term “voting machine” will size up the semiconductor leader instead of the traditional “weighing machine.”

“While DRAM fundamentals are excellent and valuation is at trough as the cycle peaks (6x FY19 EPS, 7x FY19 FCF), we expect the normalization in the DRAM cycle to create some drag on in investor sentiment,” writes the analyst, assuming coverage on Micron with a Neutral rating without suggesting a price target. (To watch Wittine’s track record, click here)

“We see parallels between today’s DRAM setup and the mid-2017 peak of the NAND cycle, which have kept the shares of WDC (for example) range bound since, and could repeat for DRAM/MU until investors become comfortable with the down cycle’s trajectory,” continues Wittine, who nonetheless spots room to become positive on MU’s prospects.

Wittine argues his contingencies needed to be in play to become bullish on the chip giant: “We could become more constructive on the shares with either a valuation pullback toward $50/share to improve the risk/reward profile further, or an unexpected improvement in industry fundamentals.”

Deutsche Bank analyst Sidney Ho offers a confident spin on the company, especially following a strong analyst day- one that exhibited a fresh $10 billion share repurchase program that has the analyst boosting his target expectations.

In reaction to a stronger third fiscal quarter guide and the share repurchase program, the analyst reiterates a Buy rating on MU stock while lifting the price target from $68 to $72, which implies a 17% upside from current levels. (To watch Ho’s track record, click here)

Though Ho approached Micron’s analyst day already bullish on the stock, he pinpoints the following key insights as reasons to get all the more upbeat on MU’s prospects: “(1) DRAM technology roadmap that includes three more generations of products, (2) 4th-gen 3D NAND will use charge trap technology, (3) MU is shipping the industry’s first QLC 3D NAND SSD, and (4) the $10b share repurchase program.”

Industry dynamics are shifting, and Ho is taking note of a road paved for more stability in the market. The analyst explains, “MU laid out a compelling case why the memory market has structurally improved. On the demand side, the data-centric economy is increasing the value of memory and storage, and a diverse set of demand drivers (data center, automotive, mobile and IoT) is leading to significant growth opportunities for memory content. On the supply side, technology node migrations are becoming more expensive due to higher capital intensity and lower bit gains per transition. New wafer additions are needed to satisfy demand growth of ~20% per year for DRAM and ~40% per year for NAND. We believe this trend will lead to more rational capex behaviors by memory suppliers, providing stability to the market.”

Meanwhile, amid a positive supply/demand backdrop, the analyst believes MU has had its priorities set on tech roadmap execution and stellar execution. MU projects it has earned roughly $6 billion of structural operating improvements from fiscal 2016 and looks to earn a further approximate $3 billion by fiscal 2021. Around 75% of these gains stem from on-track cost reduction via tech transitions, with the last roughly 25% boiled down to operational improvements (such as supply chain management) coupled with product mix. In a nutshell, Ho believes these factors bolster his expectations that the company’s operating margins are structurally stepping up.

This chip giant has succeeded in narrowing its window for rivalry over the last few years. Ho highlights a tech player who asserts its DRAM technology is fresh on industry frontrunner Samsung’s heels, simply 15% behind, with 64L 3D NAND technology presently 15% stronger. When pointing out its technology roadmap, MU maintained its 1y-nm DRAM as well as 96L 3D NAND are tracking well.

Ho stands enthused with MU, having aligned with the Street’s expectations for third fiscal quarter revenue expectations of $7.48 billion. Well, this chip giant blew Street-wide expectations out of the water when jumping up its revenue outlook from $7.2 to $7.6 billion up to $7.7 to $7.8 billion. MU also turned up the notch on its EPS guide, with Ho and the Street calling for $2.85 and the chip giant hiking its outlook from a range of $2.76 to $2.90 up to $3.12 to $3.16. Consider this a sign of a “healthy” market atmosphere coupled with quicker recovery from the stumble experienced in one of its DRAM fabs, notes the analyst. Ho maintains his conviction for fiscal 2019 capital expenses to circle $10 billion, which would imply a roughly 33% slice of sales. The chip giant intends to pay down a further $4.7 billion of long-term debt in the back half of this fiscal year, which could sink total debt down to $4 to $5 billion by the close of fiscal 2018.

Lastly, Ho cheers a $10 billion share repurchase program that was bigger than his expectations, where the company intends to return a minimum of half of annual free cash flow to shareholders kickstarting in fiscal 2019. On back of the stronger financial guide for the third fiscal quarter and share repurchases, the analyst is boosting his EPS expectations for the third fiscal quarter of 2018 from $2.85 to $3.14, for the calendar year of 2018 from $11.25 to $12.00, and for the calendar year of 2019 from $10.75 to $12.00.

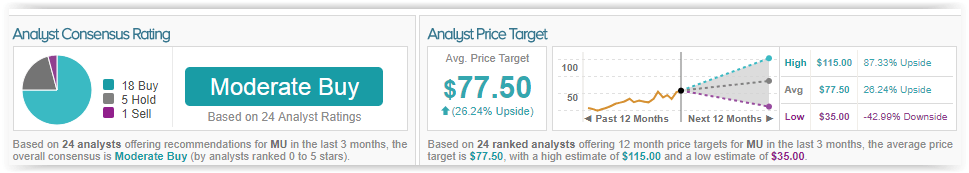

TipRanks suggests healthy positive sentiment circulates this chip giant on Wall Street. Out of 24 analysts polled in the last 3 months, 18 are bullish on MU stock, 5 remain sidelined, while 1 is bearish on the stock. With a return potential of 26%, the stock’s consensus target price stands at $77.50.

Ramping Up Advanced Micro Devices

In the latest quarter, AQR boosted its stake in Advanced Micro Devices to the tune of 135%- or another 147,701 shares in the semiconductor player. Now, Asness’ hedge fund titan owns 257,905 shares worth $2,592,000 in the stock.

On back of the Computex conference held in Taiwan, Rosenblatt’s Hans Mosesmann echoes the guru’s optimism on the chip giant, cheering AMD’s standout presentation and roadmap update- one roaring mostly about “momentum.” This is particularly remarkable juxtaposed to “more modest updates” from arch semiconductor nemeses Intel and Nvidia.

As such, the analyst reiterates a Buy rating on AMD stock with a $27 price target, which implies a 77% upside from current levels. (To watch Mosesmann’s track record, click here)

Though the conference was not a show for servers, the chip giant nonetheless put its 7nm-based server in the spotlight: the EPYC Zen2 CPU, at the company’s labs presently and “looking ‘really’ good.” The AMD team intends to sample this soon, expecting production to take wing next year. Mosesmann pays attention that this indicates the company is putting key focus on 7nm for server CPUs first and foremost while maximizing Intel’s 10nm process node delay. In other words, the analyst points out, “AMD could have both an architectural and process node advantage for 2019. Inconceivable.”

Specifically, the semiconductor leader set loose Threadripper Gen2 at 32-cores taking advantage of 12nm process technology and benefiting from a “cost effective multi-die packaging” strategy. The analyst underscores AMD’s disclosure as well as its demo of 7m Radeon Instinct GPU in compute-oriented workloads. While this is certainly racing “months” before Nvidia’s evolution to 7nm, the lead in the race could be as rapid-fire as even “quarters” quicker. It is especially surprising to see AMD best its rivalry in Intel and Nvidia “at their game” when eyeing the process node playing field.

Moreover, AMD unveiled an army of notebooks from each one of the other big players, flaunting its position as the most accelerated CPU for Ultrathin form factors, enhancing its robust integrated graphics IP. Glancing down the line, Mosesmann calls for notebook penetration to either fulfill or trounce that of desktops in today’s cycle.

Bottom line, between Computex and the latest fresh reveals from Cisco, HPE, as well as Tencent in their goals for EPYC server CPU deployment, the analyst sees “proof points that the current Zen/Zen2 CPU cycle is set to match if not exceed the 2006 peak in x86 CPU share of ~25%.” The company’s GPU and its game plan to make the most of its CPU and GPU platform solutions suggests to Mosesmann that this chip giant could turn out to be a “more relevant player” than Wall Street is ready to admit.

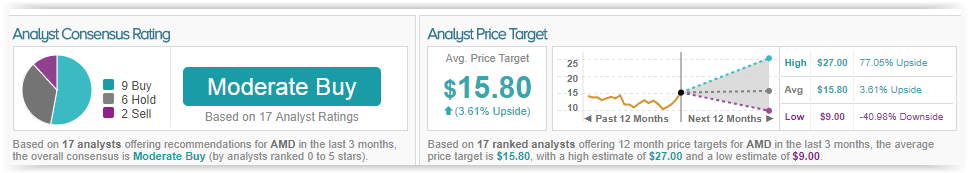

TipRanks indicates a cautiously optimistic analyst consensus surveying AMD’s market opportunity. Out of 17 analysts polled in the last 3 months, 9 are bullish on AMD stock, 6 remain sidelined, while 2 are bearish on the stock. With a return potential of nearly 4%, the stock’s consensus target price stands at $15.80.