Canadian-born portfolio manager and professional lacrosse player turned hedge fund guru, Oliver Marti has had his feet in equity research and investing for over a quarter of a century. Kickstarting his career at Morgan Stanley, the financial guru has been running his Columbus Circle Investors hedge fund since 1975. As of the end of 2017, CCI was managing $5.5 billion in assets. Marti has notably built his firm on a reputation of sustained performance track records on back of bottom-up growth-oriented equity managing. In the fourth-quarter, the guru ran for the hills on Micron Technology, Inc. (NASDAQ:MU) and Advanced Micro Devices, Inc. (NASDAQ:AMD). Did Marti observe warning shifts in fundamentals and expectations for these chip giants?

Let’s explore:

Micron Gets Hacked in Half

Micron is looking significantly less enticing to Marti, as the hedge fund trader sold off a massive 52% of his stake in the chip giant in the fourth quarter, or 1,250,258 shares. Now, Marti holds a position in the company of just over a million: 1,155,259 shares worth $47,504,000. How does the guru’s opinion measure up against experts of the Street?

After all, Micron has a bear fresh on its heels, after a top performing analyst on Wall Street came out with new coverage swinging against the chip giant.

Top analyst Timothy Arcuri at UBS spots downside ahead for Micron, even as he recognizes strides to “become a dramatically better company.” In the latest years, the company has been able to bridge the tech divide with its rivals, Arcuri notes, giving kudos to the chip giant’s ability to engage in a structurally stronger market. The analyst gives credit here to supply and demand shifts for the long-term here.

Yet, Arcuri still has a Sell rating on MU stock with a $35 price target, which implies a 29% downside from current levels.

“All of that said,” Arcuri explains, “we just saw peak EPS guidance and think MU is ~2Qs away from a cycle of potentially significant estimate cuts primarily due to a near-term wave of DRAM supply; in 20+yrs of history, the stock has not worked during such periods. After estimates come down, we do see the potential for MU to re-rate higher out the other side to reflect these structural inflections, but we think fighting these cuts through 2H:18 and 2019 (we are ~40% below Street for CY2019E) is going to be a losing battle.”

Ultimately, the record stands against Micron’s success when it comes to estimate downturns, as Arcuri concludes his bearish case: “MU is a structurally improved company in a structurally better market, albeit still cyclical and on the cusp of a cycle of estimate cuts starting later this year. While we argue the stock deserves to be rerated higher, 20+yrs of history shows that MU does not work when estimates are coming down. Net, given our view of cross cycle EPS and EBITDA, we feel that MU could be a core holding on a structural re-rating, but investors may get a better opportunity as we see downside to $31.”

Timothy Arcuri has a very good score with a 70% success rate and a high ranking of #24 out of 4,758 analysts. Arcuri garners 26.6% in his yearly returns. Investors following this top analyst’s recommendation will earn an average of 71.3% in profits on MU stock.

Yet, are these bears the sole traders running for the hills when it comes to majority consensus sentiment? Rosenblatt analyst Hans Mosesmann disagrees, batting for the bulls on the giant.

Mosesmann offers a rebuttal against Arcuri’s negative call, and notably rates a Buy on MU with an $85 price target, which implies a close to 72% upside from current levels. (To watch Mosesmann’s track record, click here)

“MU shares were under pressure yesterday on a competitor’s call of a conventional DRAM end of cycle driven by ~170K wpm incremental capacity in 2018 and 2019 (implying mid-single digit increases in wafer capacity for both years). Let’s start with our view that DRAM bit supply growth of ~20% for 2018 hasn’t changed based on our industry discussions, and we estimate also at this level for 2019,” asserts Mosesmann.

In a nutshell, this bull believes the writing on the wall does not spell out enough wafer supply boosts to knock Micron out of its bullish full steam ahead: “Mid-single digit wafer additions per year very likely only replacing lost throughput. We believe it would take high-single or even double digit yearly increases in wafer supply to alter the equation to oversupply for the next couple of years. Using historical DRAM cycles during the golden age of Moore’s Law (ignoring bits/wafers), is not practical in determining an imminent DRAM down-cycle going forward in our opinion.”

This chip giant is a semiconductor darling on Wall Street, considering positive TipRanks analytics. Out of 22 analysts polled in the last 3 months, 18 are bullish on MU stock, 3 remain sidelined, while 1 is bearish on the stock. With a return potential of nearly 54%, the stock’s consensus target price stands at $73.67.

Striking Advanced Micro Devices Out

Advanced Micro Devices got the full bearish stop from Marti, who opted to run out on all 467,436 shares worth $5,833,242 in his stake. Was this total exit from the company just in time? The fourth quarter move hit well before last week’s potential investor nightmare: a new rival that comes in the shape of a new Ethereum ASIC-based Antminer E3. China-based Bitcoin mining giant Bitmain is gunning for AMD’s crypto momentum, and as such, Wall Street turned skittish. The stock plunged about 20% in value once the confirmation of rivalry ran loose.

In a new bullish corner, Stifel analyst Kevin Cassidy just joined the confident camp on the Street betting on the chip giant’s prospects, praising a one-two punch of “margin expansion and valuation.”

What happened last week is a clear case of wildfire fears getting the best of investors and an “oversold” stock set into motion, argues Cassidy, who has a Buy rating on AMD stock with a $13 price target, which implies a 32% upside from current levels. (To watch Cassidy’s track record, click here)

Cassidy makes a bullish defense despite surging cryptocurrency apprehensions of what the new competition in Ethereum mining will mean for GPU sales: “We believe that pent-up demand, as reflected by inflated retail costs for GPU cards, and the need to restock inventory channels due to limited supply are likely to continue to boost GPU shipments, despite the potential for softer cryptocurrency demand. AMD estimates that crypto-currency based revenue accounted for a mid-single digit percentage of total FY2017 revenue.”

In fact, AMD is staring at an opportunity to boost its EPY server processor revenue in the second half of the year, by Cassidy’s perspective. The analyst angles for AMD’s server market share to leap to approximately 4% in 2018. Though the company’s gross margin reached 34.2% in 2017, by the end of this year, the analyst wagers it can spiral past 50%.

Bottom line, the analyst switched over the bulls for three fundamental points: “1) Valuation. We believe the market has oversold the AMD shares based on alternative crypto-currency mining solutions coming to market. 2) We suggest investors own AMD shares ahead of the company’s Epyc server CPU revenue ramp in 2H18. 3) AMD now has a full line-up of PC CPUs. We are increasing our estimates based on AMD’s solid execution in launching new products and the GM expansion driven by these new products.”

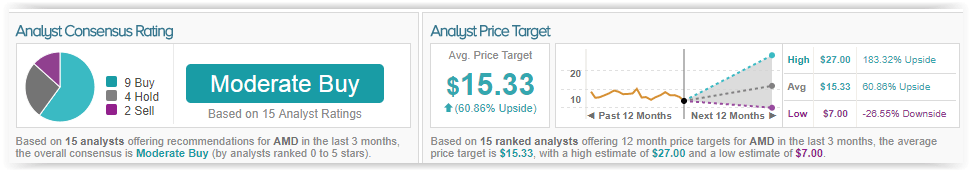

Bigger picture points to Cassidy’s stance over Marti’s, as TipRanks indicates analysts are quite optimistic on AMD’s market opportunity at play. Based on 15 analysts polled in the last 3 months, 9 rate a Buy on the chip giant, 4 maintain a Hold, while 2 issue a Sell on the stock.