Steve Cohen is the founder of Point72 Asset Management, a family office that manages more than $12 billion. Cohen founded S.A.C. Capital Advisors in 1992, but the hedge fund shut down in 2016 after the firm pleaded guilty to insider trading charges. Point72 spun off from S.A.C. in 2016 and had only managed Cohen’s personal fortune and that of select employees until 2018, when the fund’s SEC-imposed restriction on outside capital was lifted.

Cohen began his Wall Street career at Gruntal & Co. in 1978, where he quickly rose became a star trader at the company. In 1992, Cohen launched S.A.C., which eventually would become among the largest and most successful hedge funds in the world. In 2018, Forbes ranked Cohen 8th in its annual Highest-Earning Hedge Fund Managers list, earning $700 million.

Point72 has significant investments in a wide-array of sectors and industries, including services, technology, utilities and consumer goods. In the most recent quarter, Point72 sold 95% of its holdings in Advanced Micro Devices (AMD), but initiated a new position in Qualcomm (QCOM). Let’s take a closer look:

Bye Bye AMD

AMD being the S&P 500’s best performing stock of 2018 wasn’t enough to keep Cohen an investor. While the stock closed up 68% for the year, it plummeted more than 40% from its September 52-week high. Cohen sold more than 2.9 million shares of AMD in the most recent quarter, or about 95% of his total his holdings in the company.

Investors are most worried about AMD in the short-term. The company is facing challenges stemming from geopolitical uncertainty, including the ongoing US-China trade war, as well as US domestic uncertainty. AMD relies heavily on strong US-China relations, including for manufacturing and selling to the Chinese market. Falling semiconductor prices have also played a role in the sell-off, as low demand/high supply has pushed average selling price down.

Over the long-term, however, Wall Street is optimistic about AMD. The company is expected to launch its new 7-nanometer (nm) processing chip this year, which will position itself to look very good against Intel, which is still having production problems on its 10-nm chip. On Intel, AMD is clawing away at its CPU market share, which is also piquing investor excitement. AMD also recently partnered with Amazon Web Services (the largest cloud computing platform), which has investors bullish on its server segment.

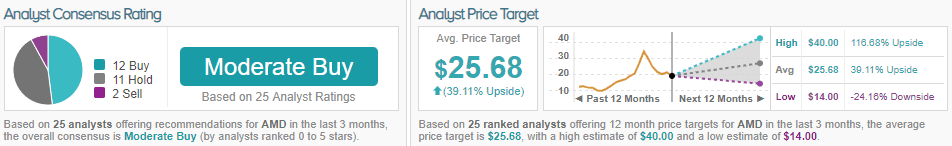

Overall, even as billionaire Cohen has sold most of his position in AMD, the investment community is bullish on the stock. TipRanks analysis of 25 analyst ratings on the stock shows a consensus Moderate Buy rating, with 12 analysts recommending Buy, 11 Hold and 2 Sell. The average price target is $25.68, representing a 39% upside. (See AMD’s price targets and analyst ratings on TipRanks)

Buy Buy QCOM

While Cohen has sold nearly his entire stake in one company, he has initiated a new position in another. The billionaire bought nearly 5 million shares of Qualcomm, for more than $357 million in the most recent quarter. While its stock lost 12% of its value in 2018, many investors are actually still bullish on the company, after scoring a few big wins in the courtroom over the past few months.

Qualcomm and Apple had been embroiled in a legal battle of patents and licensing fees in German and Chinese courts, after Qualcomm accused Apple of patent infringement. While Apple had paid Qualcomm for the use of its patents in the past, the company stopped doing so which forced Qualcomm to take legal action. Two recent verdicts have come on the side of Qualcomm, essentially saying that Apple had, indeed, violated Qualcomm patents. Some analysts, including Romit Shah of Nomura, says this puts Qualcomm in a good position to reach an agreement with Apple that will restore licensing fees to the company, which could result in up to $2.4 billion in additional annual revenue for the company.

Though this is a major piece to the puzzle, other analysts are bullish on Qualcomm for other reasons. Michael Walkley of Canaccord Genuity says the company can “build off its strong share for its Snapdragon 700 and 800 series to drive ASP and margin expansion,” which would be another source of revenue growth.

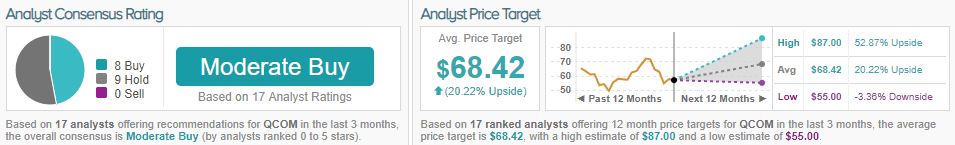

Overall, Wall Street is optimistic about Qualcomm’s future. TipRanks analysis of 17 analyst ratings on the company shows that 8 analysts recommend Buy, while 9 recommend Hold. The average price target is $68.42, representing a 20% upside to its current price. (See Qualcomm’s price targets and analyst ratings on TipRanks)