With a net worth of about $1 billion, Robert Citrone is at the helm of Discovery Capital Management (DMC), a hedge fund with a portfolio value of nearly $1.7 billion. Before launching DCM, Citrone worked as a portfolio manager at Tiger Management and is known as a “Tiger Cub.” Citrone is a graduate of the Darden School of Business at the University of Virginia and holds minority ownership of the Pittsburgh Steelers.

The plurality of the fund’s investments goes to technology companies, followed by basic materials and consumer goods companies; the fund’s largest holding is in satellite services provider Intelsat, which commands more than 10% of the fund’s value.

The past few years have not been great for Citrone. While he was included in Forbes’ Top 25 hedge fund managers in 2014, he dropped off the list in 2015 and has not been included since. Furthermore, while his net worth hovers near $1 billion, Forbes reports he dropped of their Billionaires list in 2018. Among the reasons for dropping off both lists were a rocky few years in DCM’s performance; the fund has risen at less than 1% annually over the past three years. Worse yet, the past twelve months have been one to forget for DCM, as the fund declined 20% after significant losses from investments including Advanced Micro Devices (AMD) and Micron (MU). Just recently, Citrone dumped about half his position in AMD and sold all shares of Micron. Let’s take a closer look.

Citrone Dumps AMD

Investors are fleeing AMD in droves. While the stock had tripled between January and September, share prices have plummeted more than 50% since it reached a 52-week high. Citrone and DCM sold nearly half its share in the semiconductor company – 3.5 million shares – valued at more than $110 million, as worries over slowing demand for CPUs and semi-custom have sent the stock into a free fall.

AMD has long-term potential for sure. But investors are most worried about the short-term challenges ahead. For example, trade tensions and other geopolitical events are playing a negative role as the company relies heavily on strong US-China relations. Falling semiconductor prices is also playing a part in poor investor sentiment, as slowing demand and high supply is pushing average selling prices down, which contributes to lower revenue.

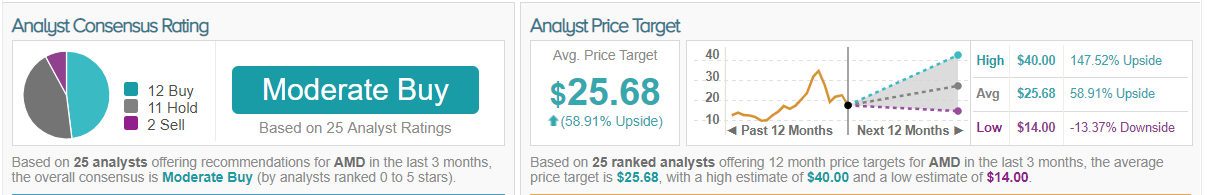

While investors have shied away from the stock over the past few months, Wall Street analysts are still moderately optimistic. TipRanks analysis of 24 analyst ratings show a consensus Moderate Buy, with a 54% upside. Of the 25 analysts polled, 12 recommend Buy, 11 say Hold and two recommend Sell. (See AMD’s price targets and analyst ratings on TipRanks)

Another Chip Bites the Dust

AMD isn’t the only chip stock feeling the heat from Citrone and DCM. The manager and fund recently dumped their entire stake in Micron, more than 680 thousand shares worth $30.9 million. The company recently reported worse-than-expected quarterly results and issued guidance that poor results will probably continue. The stock is down nearly 15% since earnings were released last week and more than 30% overall this year.

Similar to that of AMD, Micron’s business is extremely cyclical. When things are good, they’re really good. But the industry recently hit a speed bump, as strong demand earlier this year has waned while supply has actually increased. Slower demand and higher supplies results in lower selling prices and revenue, which was evident in Micron’s recent quarterly update when results were at the low-end of estimates. Moving forward, investors are wary of slowing worldwide economic growth amid rising interest rates and tariffs which slow international trade. This is expected to contribute to continued lower demand for semiconductors.

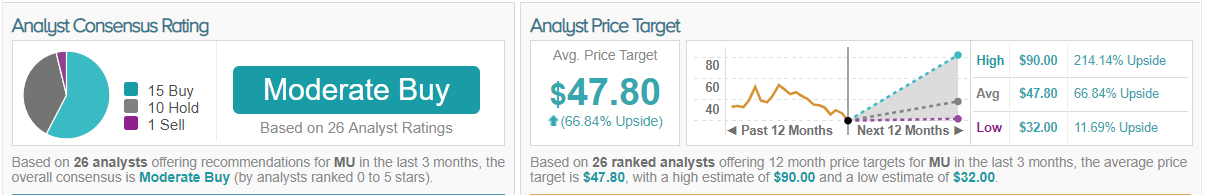

While analysts are concerned about short-term challenges in the components market, most are bullish over Micron’s long-term potential. TipRanks analysis of 26 analyst ratings on Micron shows a consensus Moderate Buy rating and an average price target with a 65% upside to current levels. Of the 26 analysts, 15 analysts recommend Buy, ten recommend Hold and one recommends Sell. (See Micron’s price targets and analyst ratings on TipRanks)