Legendary hedge fund guru George Soros has made some intriguing chip stock moves in the second quarter. He swapped out Micron (NASDAQ:MU) for rapidly-rising chip stock Advanced Micro Devices (NYSE:AMD) – despite Micron’s robust chorus of Street supporters. Not that Soros can’t afford to take a risk. The 88-year old Hungarian-American has a personal value of approximately $8 billion according to Forbes. And this is after donating a massive $18 billion to his philanthropic agency, Open Society Foundations.

You have to remind yourself that Soros started with nothing. He was born in Hungary and managed to escape Nazi persecution by fleeing to England on false papers. It was in London that he funded his philosophy studies at the London School of Economics (LSE) by working in not one, but two jobs, as a railway porter and waiter.

Surprisingly, he initially struggled to find a job in finance: “Well, I had a variety of jobs and I ended up selling fancy goods on the seaside, souvenir shops, and I thought, that’s really not what I was cut out to do. So, I wrote to every managing director in every merchant bank in London, got just one or two replies, and eventually that’s how I got a job in a merchant bank” he explained to the LA Times in 2006.

This led to a long and fruitful investing career, and ultimately Soros opening up the famous Soros Fund Management back in 1970. His most famous move: raking in $1 billion in just 24 hours on a bet against the British pound. Indeed, since its inception, the fund has generated $40 billion. With this in mind, let’s now take a closer look at two of the fund’s most recent moves:

No More Micron

Soros revealed a very bearish take on Micron- exiting the stock completely in the quarter. This boils down into the sale of 395,912 shares, worth $20,761,625.

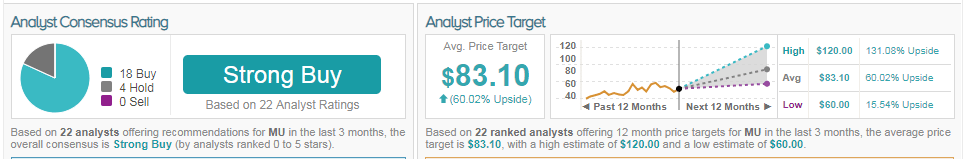

Interestingly, the Street is showing very bullish sentiment on MU right now. It has a Strong Buy analyst consensus with 18 buy ratings vs just 4 hold ratings. Plus this comes with an average analyst price target of $83.10- indicating robust upside potential of over 60%. (See MU’s price targets and analyst ratings on TipRanks.)

So why is Soros making such a contrarian move now? What is he seeing that the Street isn’t? And what should investors do in the face of such contradictory evidence on the stock’s potential? Notably Soros isn’t the only hedge fund manager selling up- in fact the stock has a Very Negative hedge fund sentiment on TipRanks. In the last quarter, hedge funds decreased MU holdings by no less than 7.7 million shares, with Andrew Law and Richard Driehaus also exiting the stock completely.

There are some bearish pointers that could illuminate the reasoning behind this MU sale. Let’s take a closer look now: First of all, Micron is currently trading at peak EBITDA margins. This is a worrying sign based on historical trends. We can see looking back that the stock tends to underperform roughly 12 months after margins peak. The reason for this is that the semiconductor business- despite what the stock’s supporters may argue to the contrary- is cyclical. When prices ride higher, manufacturers bring on new supply- and the increase in inventory will ultimately see prices adjust accordingly.

At the same time, a note from top Goldman Sachs analyst Mark Delaney makes some interesting observations. He has a Buy rating on the stock but with a more constrained price target of $68. “We believe NAND flash remains oversupplied, and we believe that the outlook for NAND pricing is incrementally weaker for 3Q18” writes Delaney. Note that this represents about a third of MU revenue. DRAM meanwhile makes up roughly the other two thirds and listen to what Delaney has to say about this: US hyperscale customers will likely moderate server DRAM procurement in 1H19.” He admits that this represents a ‘potential negative inflection’ given the success of DRAM in driving MU so far.

Indeed, it’s worth highlighting that on a forward EV/EBITDA basis, the stock trades at just 2.6x. This low valuation suggests investors are also nervous about the possibility of a downturn in the memory market. And even though the bulls argue that new demand catalysts like automotive and internet of things will mute these cyclical movements, others are convinced that it is still too early in the day for such catalysts to make a real difference (currently at under 10% of revenue).

But Hello AMD

In the second quarter, Soros took a bullish move on rising chip stock AMD. He snapped up a whopping 353,400 shares- boosting the fund’s AMD holding by 91%. The result: a total of 745,400 AMD shares valued at $11.174 million.

Clearly Soros believes the stock has further to run. This is despite shares already shooting up an eye-watering 159% since the 1Q18 earnings call. Luckily five-star Cowen & Co analyst Matt Ramsay believes these gains are justified. He has just ramped up his price target from $25 to $30- screaming ‘AMD at $25! (To watch Ramsay’s stock picks, click here)

Where do we go from here?’ For Ramsay, the answer is onwards and upwards. “Given we believe sustainable earnings power of $2.00 is achievable (and datacenter fundamentals could yield sustainable solid growth beyond that), we believe this valuation level is justified” says Ramsay of the stock’s record climb.

First of all, Intel’s delayed 10nm roadmap – originally targeted for 2016 launch in client and now pushed to 2H19 – opens opportunities for AMD across the business. This is because AMD products are now utilizing near equivalent 7nm TSMC silicon. As a result, “investors have given AMD much more credit for potential share gains for the EPYC server and Ryzen client roadmaps.”

In addition, the stock is also set to benefit from the increasing need for CPU diversification from customers. Due to recent processor security issues, enterprise and hyperscale customers will increasingly demand multi-sourcing. Ramsay believes “AMD will be pushing this narrative aggressively as they engage with customers.” As a result: “AMD’s EPYC lineup is increasingly well-positioned to benefit during 2019/20” concludes this top analyst.

However, he does caution that some near-term volatility is to be expected. “While our conviction regarding strong long-term fundamentals and EPS growth remains high, some stock volatility in September is likely after such a large move.” Plus he cautions investors to be realistic, and not to have premature server share gain expectations in terms of timing. It will take time for AMD to steadily win market share, advises Ramsay. He is modelling for mid-to-high single digits unit share in 2019 and 10%+ share by mid-2020. Longer-term investors can look forward to 12% server share delivering near $2B in new 60% margin revenue for AMD.

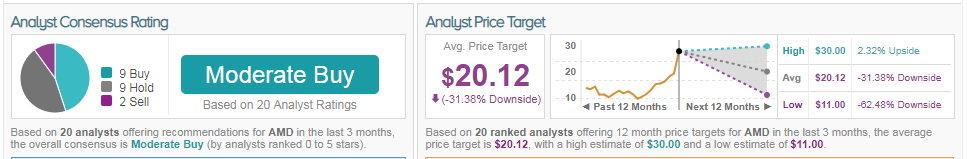

Net net, the Street is opting for a cautiously optimistic outlook on AMD with a Moderate Buy analyst consensus rating. This breaks down into 9 buy ratings vs 9 hold ratings, alongside two more bearish sell ratings. However, this comes with an average analyst price target of $20.12- indicating that prices could plunge over 28%. (See AMD’s price targets and analyst ratings on TipRanks.)