As recently as March 2019, when Aurora Cannabis (ACB) was still a $10 stock, everybody who was anybody in marijuana investing wanted to know Aurora, which was still one of the most popular stocks on the Street.

Today, the stock is down more than 80% from that height, and selling for less than $2 a stub (American — it costs a bit more in Canadian dollars, or “C$”). And now, it seems Aurora has lost one of its few remaining fans on Wall Street, as Piper Sandler analyst Michael Lavery pulls even his half-hearted hold rating, downgrades to “underweight,” and assigns a new price target … of just $1. (To watch Lavery’s track record, click here)

What’s got the analyst playing this new, and sadder tune?

As Lavery explains, Aurora is still a big player in the Canadian cannabis market, with “industry leading production capacity” and a likely revenue growth rate of anywhere from 30% to 35% through 2021. Problem is, this rate that Lavery projects is only “about half of consensus,” which raises very real risks that in future earnings reports, Aurora will “miss” expectations — with dire results for its stock.

What could cause this to happen?

For one thing, Aurora depends heavily upon medical marijuana sales in Germany, where it sells its “highest priced and highest margin products.” But German regulators have halted sales of its products pending a review of the company’s “sterilization process.” The longer this sales halt continues, the greater the danger to Aurora’s “revenue and margin mix.”

Lavery worries further that the company’s cannabis derivatives business (vapes, edibles, and so on) poses a “risk to our top-line outlook” — which as already noted, is only half as bright as what other analysts are looking for. Vape sales in Alberta particularly, “one of the most popular derivative products are now postponed indefinitely,” and it’s not clear when they will begin.

Result: Already, Lavery has been forced to reduce his revenue projection for Aurora from C$340 million to C$335 million in fiscal 2020. But that’s not the worst of it. Looking ahead to fiscal 2021, he now worries that sales initially expected to approximate C$635 million could come in as low as C$440 million instead — a haircut of more than 30%.

Meanwhile, Aurora’s oft-mentioned cash crunch looms as an overarching concern. Despite recently raising $80 million in cash from dilutive stock sales, Lavery notes that Aurora will probably be cash flow-negative through at least fiscal Q3 2021. And to be clear, Lavery is speaking here of negative operating cash flow. Actual free cash flow will probably remain negative even longer, prolonging the company’s cash burn.

Unable to raise enough cash from its business operations, Lavery warns that Aurora will run a C$200 million cash deficit. Some way, somehow, the company is going to have to find a way to plug that gap.

Realistically, given lenders’ reluctance to throw good money after bad in this struggling industry, that probably means more stock sales — and more dilution of Aurora’s long-suffering shareholders.

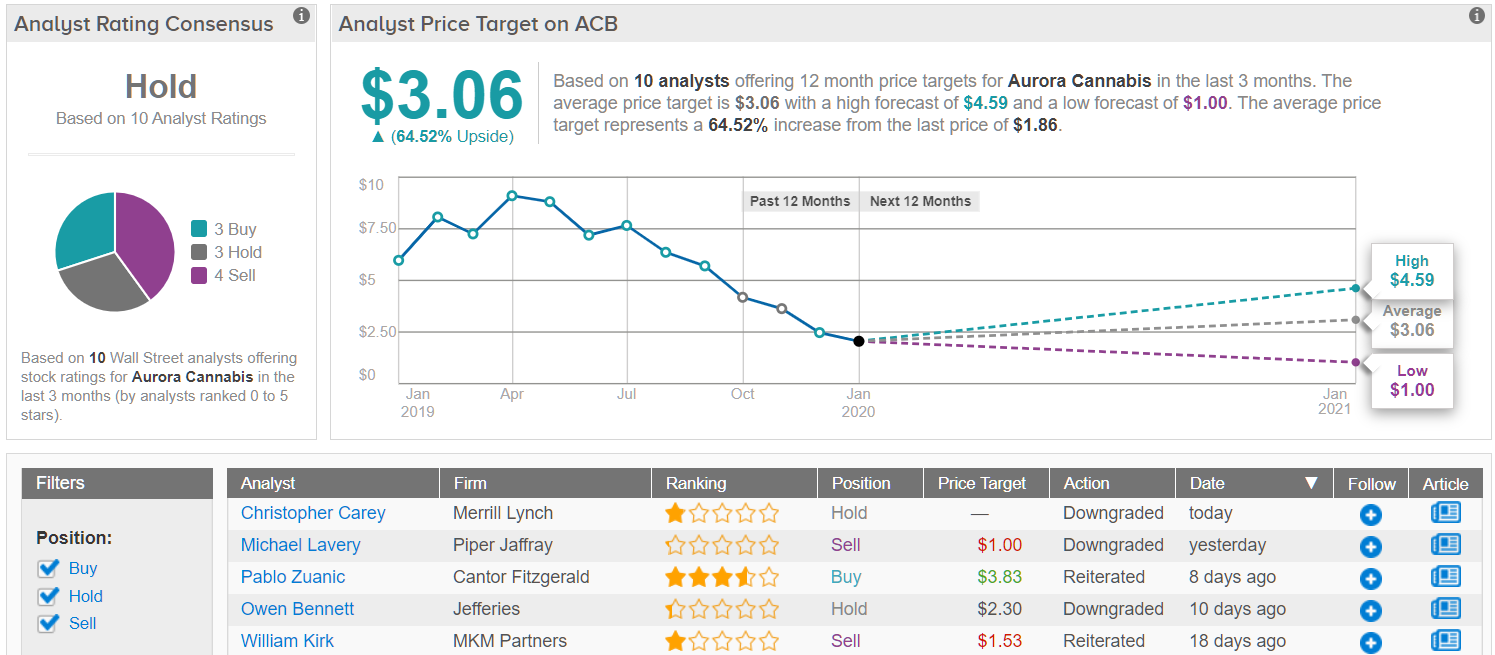

The majority of the Street sides with the Piper Sandler analyst’s cautious take on the cannabis player, as TipRanks analytics demonstrate ACB as a Hold. Out of 10 analysts polled in the last 3 months, 3 are bullish on Aurora stock, 3 remain sidelined, while 4 are bearish on the stock. With a return potential of 64%, the stock’s consensus target price stands at $3.06. (See Aurora stock analysis on TipRanks)