Over the past few months, Aurora Cannabis (ACB) has taken several steps to enact a U-turn for its ailing business. Along with a reverse stock split to ensure it remains listed on the New York Stock Exchange, it has closed some of its smaller facilities, as well as put the brakes on the construction of two new sites.

Another move has been to acquire Reliva, which has given it access to the U.S. CBD space. That acquisition brought with it Reliva’s CEO, Miguel Martin, who Aurora has just appointed as its new Chief Commercial Officer.

Weighing in on the appointment, Jeffries analyst Owen Bennett is not sure the right choice was made.

“While we don’t doubt Mr. Martin is very capable, and has past experience that is very relevant for this position, there could be some disappointment that the position did not go to someone more high profile,” the analyst said.

The past year has been a rough ride for the company that was once one of the most promising Canadian cannabis stocks. Along with a share price that has been slashed by 86%, there has been a mass exodus of top brass, including a co-founder and CEO, another co-founder and President, and a COO. However, the changing of the guard is in line with other cannabis companies’ attempts to gain credibility and trust among investors, after most companies in the fledgling industry have been unable, so far, to fulfill earlier promises.

As a result, Bennett argues, the type of management that takes hold of the reins “is critical for sentiment and the outlook of these businesses.”

Although Bennett likes Martin’s background in regulated industries such as cigarettes and vapes, the analyst believes most of Martin’s experience “appears to be heavily focused on gas stations and convenience stores.”

What Bennett thinks investors might have been hoping for is a different type of CCO. “Experience across a variety of different industries, and across multiple product categories and distribution channel, as well as experience at c-suite level of a major CPG company, may have been preferred,” the analyst said.

Bennett hopes the appointment of the new CEO, to which attention now shifts, will be more on point.

No change, then, to Bennett’s rating, which remains an Underperform (i.e. Sell). The price target stays as is, too, and at C$14 ($10.33) represents possible downside of 16%. (To watch Bennett’s track record, click here)

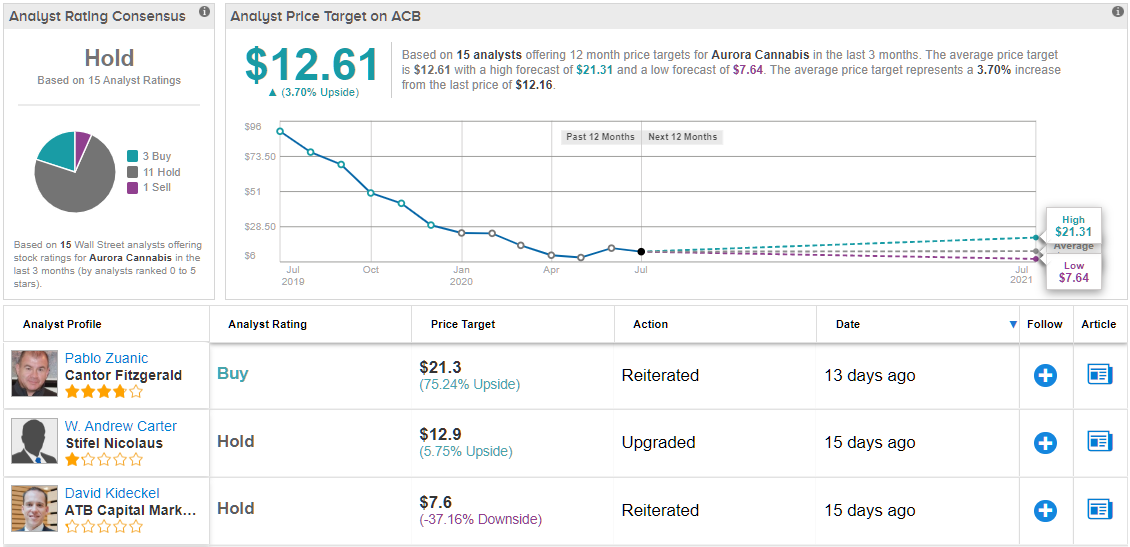

Among Bennett’s colleagues, Aurora has a Hold consensus rating, based on 3 Buys, 11 Holds and 1 Sell. At C$17.16 ($12.61), the average price target suggests shares have modest upside of 4% from current levels. (See Aurora stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.