Down more than 52% over the past 52 weeks, could Canadian marijuana giant Aurora Cannabis (ACB) go to… zero?

One analyst thinks so. On Monday, analyst and firm founder Gordon Johnson of GLJ Research announced he was initiating coverage of Aurora Cannabis stock with a “sell” rating. Arguing that “ACB’s equity holds no value,” he predicted Aurora Cannabis stock will become utterly worthless by the end of 2021, and so proceeded to assign a two-year price target of $0. (To watch Johnson’s track record, click here)

Whether you’re talking American dollars or Canadian dollars, either way, that’s a pretty bold claim. After all, up until recently (i.e. before it lost half its market cap in a matter of months), Aurora Cannabis was the second most valuable (by market cap) cannabis company in the world.

So how does Johnson back up this bold claim?

He does it with numbers. Lots, and lots of numbers — mostly relating to arcane subjects such as rising debt (“ACB recently added $160mn to its existing $200mn credit facility w/ BMO”) and restrictive covenants on that debt, which Aurora may be at risk of violating (“this debt carries a number of restrictive covenants that go into effect 9/30/20, namely a total debt/EBITDA covenant of <4.0”).

But the long and the short of it comes down to this: Aurora Cannabis is a company loaded down with debt, that its bankers will eventually want to have repaid. Over the last two years, total corporate debt at the company has exploded from just $64 million to $796 million. Now admittedly, debt can and often is “rolled over” by taking out new loans to pay off the old. However, in Aurora’s case, lenders have told the company it needs to be making enough money, by the end of Q3 2020, that its debt will be no more than four times its earnings before interest, taxes, depreciation, and amortization (EBITDA). Problem is, Aurora currently has negative EBITDA and, unless it starts earning some money pretty soon, it will be in violation of its debt agreements, and its bankers can call in its loan.

Could Aurora just borrow some money from somewhere else? Perhaps. But as Johnson points out, “Canadian banks recently decided not to lend to The Green Organic Dutchman” when it was in similar straits — and they may decide to cut Aurora off as well.

Well, if that happens, could Aurora perhaps issue and sell some shares to raise the cash it needs? Again, perhaps.

In fact, Aurora has been issuing and selling quite a lot of shares. From 9/30/16 to 9/30/19 ACB’s shares outstanding have advanced from 183.6 million to 1.023 billion. The company has literally quintupled its share float, diluting its existing shareholders in the process. But the farther its share price falls, the less money it gets for issuing new shares.

And again, that share price has already fallen 52%.

So while it’s true that “the company plans to continue this dilution via incremental equity issuance,” it’s getting less and less money for the shares it sells, even as it dilutes its early backers with each new share issued.

Of course, there’s always the chance that Aurora Cannabis will be able to do what it should have been doing in the first place — earning profits instead of financing itself with borrowings and share sales. But here again, Johnson raises an objection: In 2020, there’s going to be about 3 million kilograms of cannabis produced in Canada, to satisfy a demand for… 1.06 million kilograms. That’s a recipe for oversupply, falling prices, and falling profits (or more precisely, continued losses at Aurora).

And that, in a nutshell, is why Johnson thinks Aurora Cannabis stock is worthless — and headed for $0 a share.

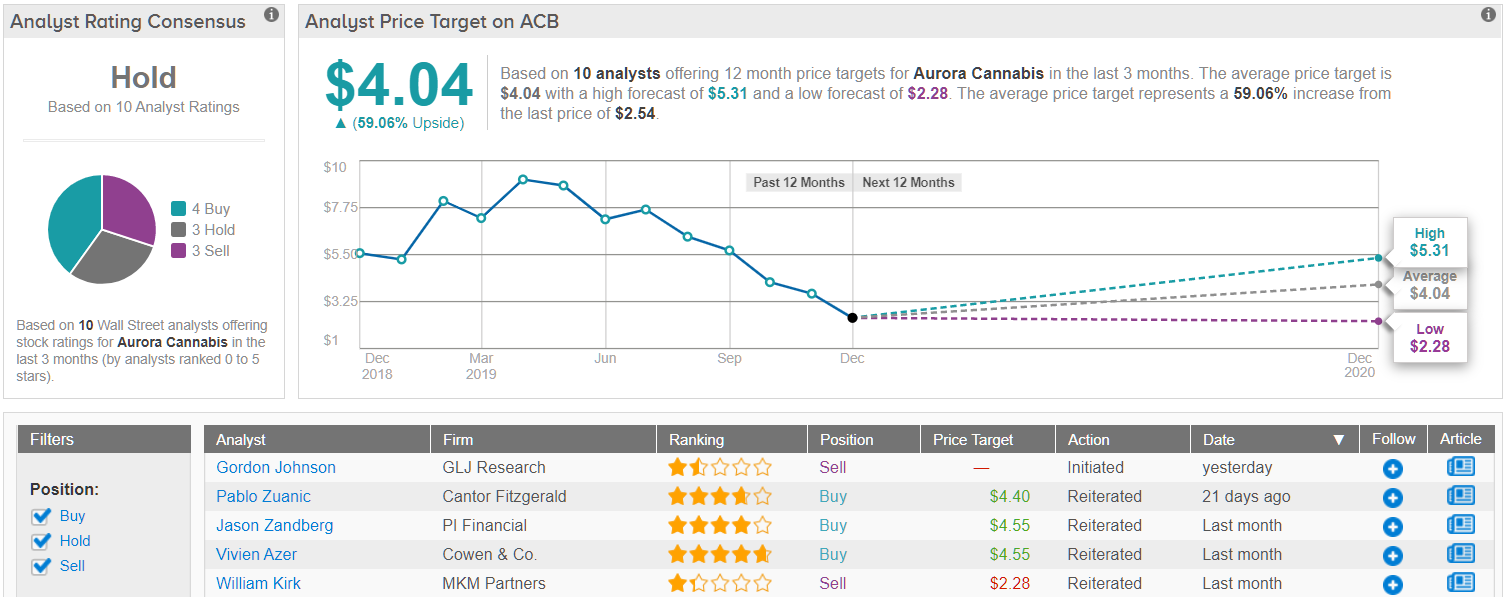

All in all, the market’s current view on Aurora stock is a mixed bag, indicating uncertainty as to its prospects. The stock has a Hold analyst consensus rating with 4 recent “buy” ratings. This is versus 3 “hold” and 3 “sell” ratings. However, the $4.04 price target suggests an upside potential of nearly 60% from the current share price. (See Aurora stock analysis on TipRanks)