Canadian cannabis producer HEXO Corp. (HEXO) has taken a pummeling in the market recently. In the last 6 months it has seen its share price drop from $7.81 to its current price of $2.19, with the last month alone being especially violent as the stock has shed more than 40% of its value.

It wasn’t long ago that the company was predicting substantial growth figures for F2020, but it has now withdrawn its rosy outlook of CA$400 million revenue. This follows the fourth quarter adjusted net loss of CA$43.73 million. Figures for the whole of 2019 are just as gloomy, revealing a net loss of CA$67.6 million.

So, what’s gone wrong? The Canadian cannabis industry has, as a whole, been experiencing problems lately – supply shortages, regulatory issues, delay on derivatives reaching the market – have all played their part, but the problems with Hexo appear to be more specific.

The recent resignation of newly appointed Chief Financial Officer, Michael Monahan, was a sign of trouble. Although the resignation appears to be unrelated to the recent report, CEO Sebastien St-Louis presented Monahan’s appointment as a bit of a coup, and now must contend with putting out another fire.

Another sign indicating all might not be well was the recent announcement of job cuts – 200 of them – among those senior management positions. This has raised the question whether Hexo has a cash flow problem and for how long it can stomach the losses before caving in. This follows a recent $70 million cash injection from private investors, including from the pockets of founder and CEO St-Louis. Maybe this indicates a vote of confidence in the company’s ability to tun things around. Time will tell.

In a report following the recent earnings report, BMO’s Tamy Chen noted, “HEXO believes its cash balance ($134mm including the $70mm financing) will be sufficient for the next 12 months and expects to achieve positive EBITDA in calendar 2020 if total store count reaches 700 in Canada, from ~500 currently”, adding, “Based on our revised model, which includes this restatement, HEXO could make it through F2020 but would need $90mm of funding in F2021 […] Until there is better visibility into HEXO’s ability to “rightsize” its operations to reaccelerate revenue growth and improve margins, we remain on the sidelines.”

Chen reiterated a Market Perform rating on HEXO stock along with a C$3.00 price target, which implies a slight upside from current levels. (To watch Chen’s track record, click here)

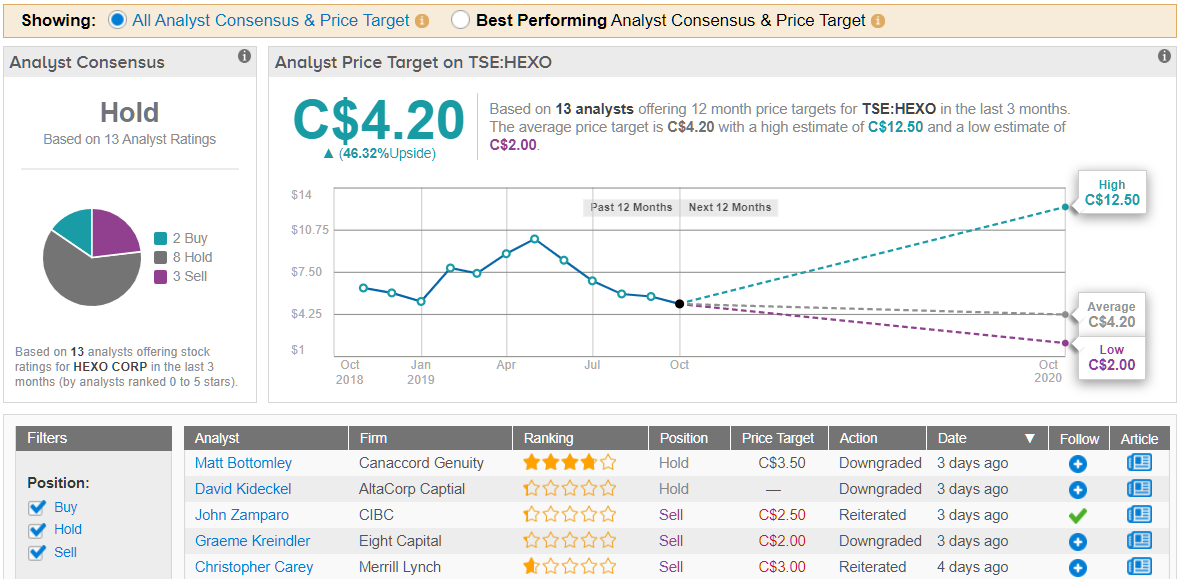

Chen is not alone in playing it safe on the embattled cannabis producer, as TipRanks analytics exhibit HEXO as a Hold. Out of 13 analysts polled in the last 3 months, 2 are bullish on HEXO stock, 8 remain sidelined, and 3 are bearish. Yet, consider that the 12-month average price target of C$4.20 reflects healthy upside potential of nearly 46% from where the stock is currently trading; in other words, optimism circulates among analyst sentiment even amid apprehension. (See HEXO stock analysis on TipRanks)