The market wasn’t very happy with the FQ2 results from HEXO (HEXO), but the Canadian cannabis company is making some definite headway on becoming a legitimate force in the global cannabis sector. As HEXO slowly regains its footings from the sector collapse and company specific problems, investors can finally start looking toward the long-term potential of the Molson Coors (TAP) partnership.

FQ2 Results

Somehow, some financial websites listed HEXO as missing FQ2 estimates despite the company providing an update placing revenues at C$17.0 million. The company hit this number exactly on target and importantly cut EBITDA losses in half to C$10.3 million. Gone are the days of HEXO producing massive losses after the two prior quarters combined for EBITDA losses of nearly C$50.0 million.

The company cutting losses from operations is a big step for their progression as a legitimate cannabis enterprise. The next issue is to solve the cash burn.

The major reason for delaying the filing of the quarterly reports was the calculation around the C$250 million impairment charges and another C$16 million in inventory charges. The numbers were in the range of forecasts between C$265 million to C$280 million so these charges didn’t move the stock.

The big issue is with cash flows and the disconnect with the company producing 22,305 kg of cannabis while only selling 6,579 kg. The gross overproduction has real impacts on cash flows despite the improving operations based on actual products sold.

Cash Burn

According to calculations, HEXO burned C$51 million of cash from operations during the quarter, up from C$34 million in the prior quarter. The huge cash burn of C$80 million was despite an improvement in the capex spending with a C$16 million dip in the sequential quarte to C$29 million.

Even the reduced level of capex spending still has HEXO spending nearly double on facilities as the level of net revenues of only C$17 million. The other issue is the company producing nearly 4x the amount of cannabis sold on a quarterly basis.

The company plans to shutter the Niagara Facility for good, but HEXO has to reduce quarterly cannabis cultivation to levels commensurate with sales. As an example, inventory levels ended the January quarter with a balance of C$94 million, up from C$85 million in FQ1 despite the C$16 million write down. The inventory levels are at levels that will cover product sales for up to a year.

While the big write downs are sometimes ignored in businesses with a focus on current operations, the Canadian cannabis industry still hasn’t been able to match cultivation levels with cannabis sales levels to avoid dumping assets. The big step for the upcoming FQ3 report will be HEXO turning the improvements in operations on the income statement into an improving balance sheet with a substantial cut in cash burn as inventory turns into cash.

Takeaway

The key investor takeaway is that HEXO got beaten down again following the reporting of the FQ2 report after the initial delay. The company is slowly making positive steps and started this quarter with C$81 million in cash, but management suggests the need to raise more capital this fiscal year. If the company can turn the inventory into cash and reduce the capital requirements, the stock is a solid buy below $1 as the Molson Coors partnership starts to produce cannabis beverages.

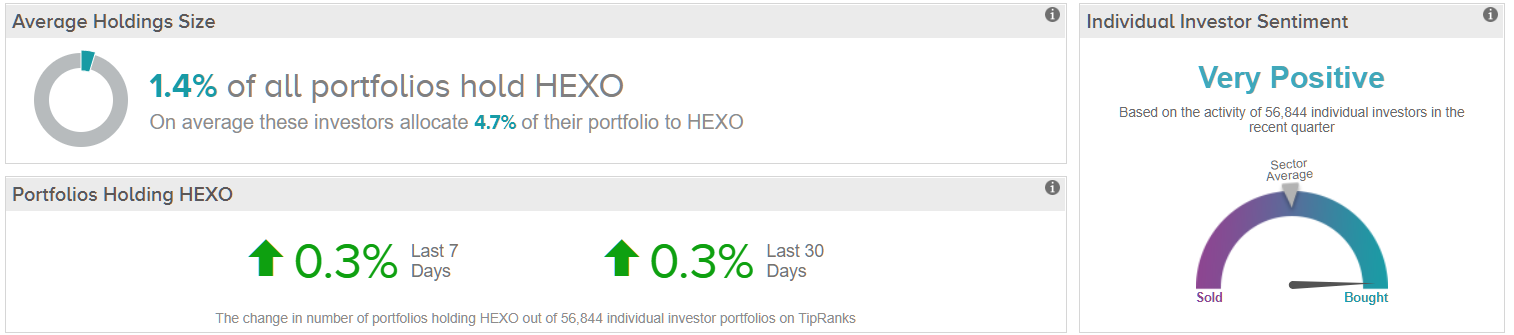

Despite the recent sell-off, HEXO boasts “very positive” sentiment from TipRanks investors – a readout of individual investor portfolios tracked by TipRanks on its Smart Portfolio platform.

Disclosure: No position.