Supreme Cannabis (SPRWF) has been under pressure lately, as it missed on revenue and earnings in its last quarter. That followed a revenue miss in the prior quarter, although the company was able to beat on earnings by $0.01.

The question going forward is how the company will compete against its much larger peers that have been widening the production capacity gap between them and Supreme Cannabis, and how it’s going to grow over the long term with its primary market being the Canadian recreational pot segment.

I think that’s why it’s been getting punished lately, even though it has enjoyed consistent revenue growth from the first fiscal quarter of 2018 through the latest reporting period, climbing from $1.22 million to $7.40 million.

The revenue miss in the last reporting period was especially hard on the company because it fell short by $1.08 million, a large number for a small company like Supreme.

Recreational pot exposure

Supreme Cannabis has supply agreements in place with eight of Canada’s 10 provinces. It has had an annual run rate of slightly above 26,000 kilograms, and it has recently received approval to increase growing space to the point it can produce approximately 50,000 kilograms annually at full capacity.

The one thing the company has going for it is its premium cannabis flower products, which allows it to charge a higher price and widen margins. Supreme does produce a quality product that has attracted company’s like Tilray, which have to acquire product from others to meet its own supply demands.

Obviously, the challenge for Supreme Cannabis is what it’ll do once it reaches the ceiling on its production capacity, which isn’t going to take long to reach. Where does it go from there.

For now it should continue to grow revenue from the recreational pot market, but with the system in Canada on the way to being fixed, and multiple companies that are either producing an annual run rate of over 100,000 kilograms, or are close to doing it, it’s hard to see the company finding ways to grow, especially because of the constraints from its low production levels.

It’s not likely to have much if anything left once it meets its recreational pot obligations.

To boost revenues, earnings and margins, a deal was made with cannabis extractor Medipharm Labs to produce high-end cannabis oils. That could help it in the near term, but it’s still going to struggle to break through the limitations of the ceiling associated with relatively low production capacity; there is only so much the company can do with what it has to work with.

Another issue is it’s only a matter of time before the recreational pot market demand is met. For now, smaller companies like Supreme Cannabis are benefiting from low supply and issues on the retail side of the business, but it shouldn’t be long before those are fixed and more than adequate supply can meet all Canadian recreational pot demand.

Again, once that happens, which I don’t think is that far away, there is nowhere else the company has to go with its product, even if it is able to boost capacity to the levels it believes it can. It has some time to grow for a couple of quarters, maybe a little longer, but it must find markets outside of Canada to give it a chance of remaining competitive and grow over the longer term.

Because of its small size, the chance of it winning long-term supply deals is close to zero. With its one growing facility called 7ACRES, it could help it to manage its costs very well, possibly generating fairly decent operating margins. But what it may gain in that area could be lost to larger competitors that can compete on scale, driving down margins that way.

Other markets

Supreme Cannabis entered into a partnership with Khalifa Kush Enterprises, to “release a line of premium cannabis products.” Initially the company will produce and sell KKE branded products in Canada, and may possibly attempt to expand to some international markets.

Its partnership with Medigrow Lesotho, located in the Kingdom of Lesotho, which is a jurisdiction surrounded on all sides by South Africa, has a little more promise. It has a population of close to 2 million.

The Kingdom of Lesotho isn’t where the potential lies, but in South Africa first, and possibly other markets in the region. Europe would be the ultimate market it look to serve, specifically with CBD oil. Supreme Cannabis has an international distribution agreement in place with Medigrow.

Medigrow is building out a cultivation facility that will comply with EU GMP standards, along with an industrial-grade oil extractor.

If the company is able to leverage this partnership to the point of generating meaningful revenue in a few markets, it could provide an answer to its reliance on Canadian recreational pot.

I’m not very optimistic about that happening, but if it can survive long enough on the basis of Canadian recreational pot sales, it has a chance to potentially expand slowly into other markets.

Conclusion

When all is said and done, the only future I see for Supreme Cannabis is to position itself to be a solid acquisition target for larger competitors to boost their production capacity.

The company will be unlikely to survive on its own, and the best way to increase shareholder value would be to build itself into a nice add-on supplier that would make a difference in the performance of a larger competitor.

Its premium products would be attractive to a potential suitor, and it trades at a low valuation, which means it could possibly be acquired at a decent price.

I see the company being especially attractive to competitors with an international presence, which need more product to meet their domestic and international recreational and medical pot demand.

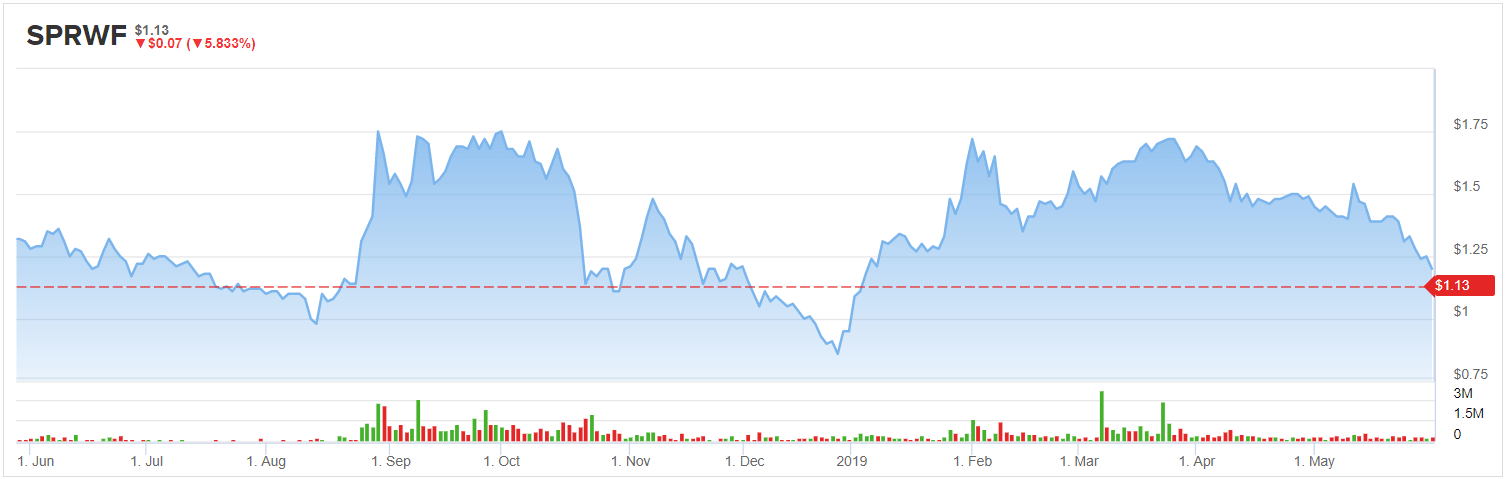

All that said, I think there is at least one more big upward push in its share price left. Even so, it’s not a stock I would hold, but one that I would trade for a short period of time.

To read more on the nitty gritty of what’s going on in the rising cannabis industry, click here.

Disclosure: No position.