After a difficult few months for the cannabis sector, Aurora Cannabis (ACB) had an opportunity to turn around the sector stocks with a strong earnings report. The report was an utter failure with the company unable to even match preliminary results provided a month after the quarter closed. The stock will likely trade weak until the company can redeem itself with better numbers down the road.

FQ4 Numbers

As my preview summarized, Aurora Cannabis has already released preliminary FQ4 results. Those key metrics weren’t expected to be a focus with this report, but the company actually missed their guidance in a shocking move.

For the June quarter, Aurora Cannabis reported these actual numbers in comparison to the preliminary numbers released on August 6:

- Revenue – C$98.9 versus forecast of C$100 to C$107 million

- EBTIDA – -C$11.7 million versus tracking toward positive EBITDA

- Production – 29,034 kg versus up to 30,000 kg

Possibly the most meaningful number was gross margins growing only 3 percentage points sequentially to 58%. The company actually sold 17,793 kg in the quarter, up from only 9,160 kg in the prior quarter.

Revenues were up 52% sequentially from the prior quarter so one can immediately see a hiccup occurred during the quarter with the kg sold nearly doubling. The issue was the average net selling price down to C$5.32 per gram.

The company used far more of the inventory available for sale in the quarter leaving only ~11,000 kg not sold. This means that far more of the inventory supply reported by Health Canada is attributed to competitors and not from Aurora Cannabis.

Aggressive pricing from Canopy Growth and others could impact the targets of Aurora Cannabis going forward.

What Happened?

The biggest issue is that Aurora Cannabis had to ramp up wholesale revenues where the average net selling price per gram is only C$3.61 per gram. With medical cannabis selling at C$8.51 per gram, the difference between which channel sells the additional production makes a substantial difference to the bottom line.

For the June quarter, wholesale revenues surged over 800% to C$20.1 million. Medical cannabis grew a minimal C$2.7 million sequentially with important EU dried cannabis sales at only C$4.5 million in the quarter.

The end result was the average net selling price dipping to C$5.32 per gram, down from C$6.40 per gram. My previous estimates had the company needing 70% gross margins to reach EBITDA breakeven on 15,000 kg sold during the quarter.

The company didn’t come anywhere close to these targets. Investors are left wondering what happened to the global medical cannabis thesis when bulk wholesale revenues now swamp EU medical cannabis sales.

Investors should expect analysts to reign in current projections for September revenues toping C$120 and up to C$140 million in the December quarter. The focus will soon shift to the Cannabis 2.0 ramp at the start of next year. Based on the flop of the recreational cannabis rollout, investors should focus as much on the costs that might prevent Aurora Cannabis from eliminating the EBITDA losses.

Takeaway

The key investor takeaway is that Aurora Cannabis reported a highly disappointing quarter. The company has even more capacity already online with quarterly production up at over 37,500 kg now questioning if pricing doesn’t head even lower.

The stock has a market valuation approaching $6.5 billion again as the stock still trades near $6. With analysts likely cutting revenue estimates, Aurora Cannabis doesn’t deserve to trade above 10x FY20 sales estimates of $500 million.

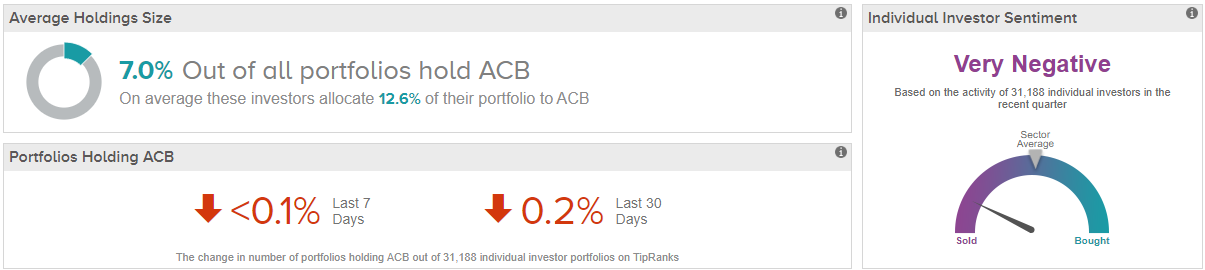

Unsurprisingly, investor sentiment is very negative, with individual portfolios in the TipRanks database showing a net pullback from ACB.

Disclosure: No position.