Aurora Cannabis, Canopy Growth and Cronos Group have driven much of the attention in the cannabis sector for some time, as Canopy and Cronos were known for receiving huge cash infusions from Constellation Brands and Altria, while Aurora was noted for resisting the same, looking to carve its own destiny without giving up control to larger suitors.

Canopy and Cronos have been coming under increasing fire from Constellation Brands and Altria because of disappointing short-term performances, as shareholders at the larger companies press management concerning write-offs as a result of weak numbers generated by Canopy and Cronos.

In this article we’ll look at the cash infusions into Canopy and Cronos, and whether or not Aurora has made the right decision in rejecting a large investment in order to maintain control of the direction and future of the company.

Canopy Growth (CGC), Cronos Group (CRON) and the Investments

For some time Canopy and Cronos enjoyed primary media coverage because of Constellation Brands and Altria investing billions in them. Canopy received $4 billion from Constellation Brands, and Cronos $1.8 billion from Altria.

In the case of Constellation Brands, it was apparent from the beginning that its purpose was to gain control of Canopy. That was evidenced by the company being allowed to appoint to members to the board, and having influence in appointing two more. And if they didn’t get control that way, they had warrants that when and if exercised, would bring its position in Canopy to over 50 percent.

As for Cronos, hitching its future to Altria has resulted in similar outcomes, with mounting pressure for something to be done to improve the performance of the company; which is another way of saying put in new leadership.

The problem is shareholders in Constellation Brands and Altria, once the deals were made, had far too optimistic expectations for the short term, and not only that, it has weighed on the performances of both companies. Management, at both companies, should have been much or adamant and clear concerning these being long-term investments that would take time to boost the top and bottom lines.

The fact that Jody Begley, senior vice president of tobacco products for Altria Group, was recently appointed to the Board of Directors of Cronos, suggests it could be a prelude for changing management.

With the sell-off in the cannabis sector, the larger companies are under pressure to change things by shareholders, and they’ll do what is needed to placate them in order to not be seen as having made a bad decision that was detrimental to shareholders.

The point is that while the market celebrated the cash infusion from these large companies as confirmation of the legitimacy of the cannabis industry, the reality is it has disrupted Canopy, will likely do the same with Cronos.

When all is said in done, both companies gave up control, and even with the capital at their disposal, have done little to justify the investment.

Even today some analysts, pundits and commentators still view the cash held by Canopy and Cronos as a competitive advantage, even though it’s done nothing to improve the performances of the companies in the short term, and hasn’t added much to their long-term prognosis either.

Aurora Cannabis (ACB) Going It Alone

When taking into consideration the huge investments Canopy and Cronos received, and it having little impact on the performances of the companies, it reinforces to me that Aurora made the right decision in going it alone. By going it alone I mean that it refuses to give up control of the company in order to get a significant investment from a large company.

While Canopy and Cronos may have more of a cash cushion at this time, my view is just sitting on a lot of cash in order to protect themselves from cash burn isn’t a good strategy. The capital should be deployed in companies and projects that give them long-term growth prospects. Not only is that not happening, both companies will probably end up changing management in order to mitigate shareholders’ concerns in regard to their suitors.

I understand that most investors in Canopy point to the potential acquisition of Acreage Holdings a good deployment of capital. The obvious problem there is the deal may never be consummated, as it’s dependent upon the U.S. legalizing cannabis at the federal level; something I’m not convinced will ever happen. And even if it does, it’s not going to happen for a long time. What type of company will Acreage Holdings be at the time of an acquisition? What will the condition of the cannabis industry be at that time? Will its competitors have taken a lot of market share from them when the deal closes?

The time it could take for this to happen, assuming it ever does, leaves far too many questions on the table to justify any positive or optimistic conclusion. If it happens sooner than later, and Acreage Holdings continues to do well, then yes, it’ll be a great deployment of capital. If not, it’ll be a huge disaster for Canopy.

With Aurora, as it relates to resisting giving up control, the question is this: can its management to a better job or running the company without the interference, or possible takeover, from a larger company. My conclusion is that it already has, and can continue to do so.

For Aurora, the major thing to consider is the capabilities of its management team. If you believe they’re a top-notch team, as I do, than it’s not a struggle to embrace the decision for them to use other means of growth than giving up control.

Price Targets

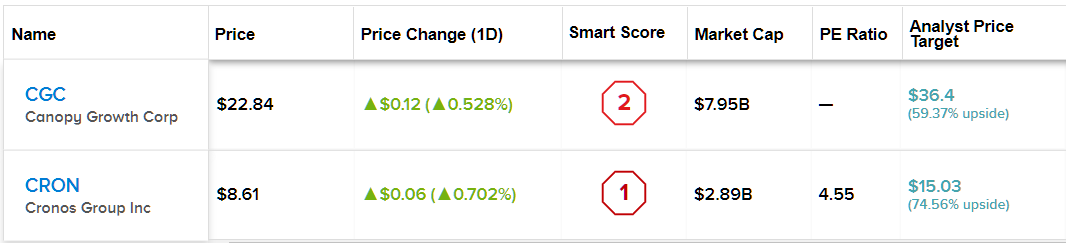

The consensus on Wall Street is that Canopy and Cronos are worth $36.40 and $15.03, respectively. (See Canopy and Cronos stocks analysis on TipRanks)

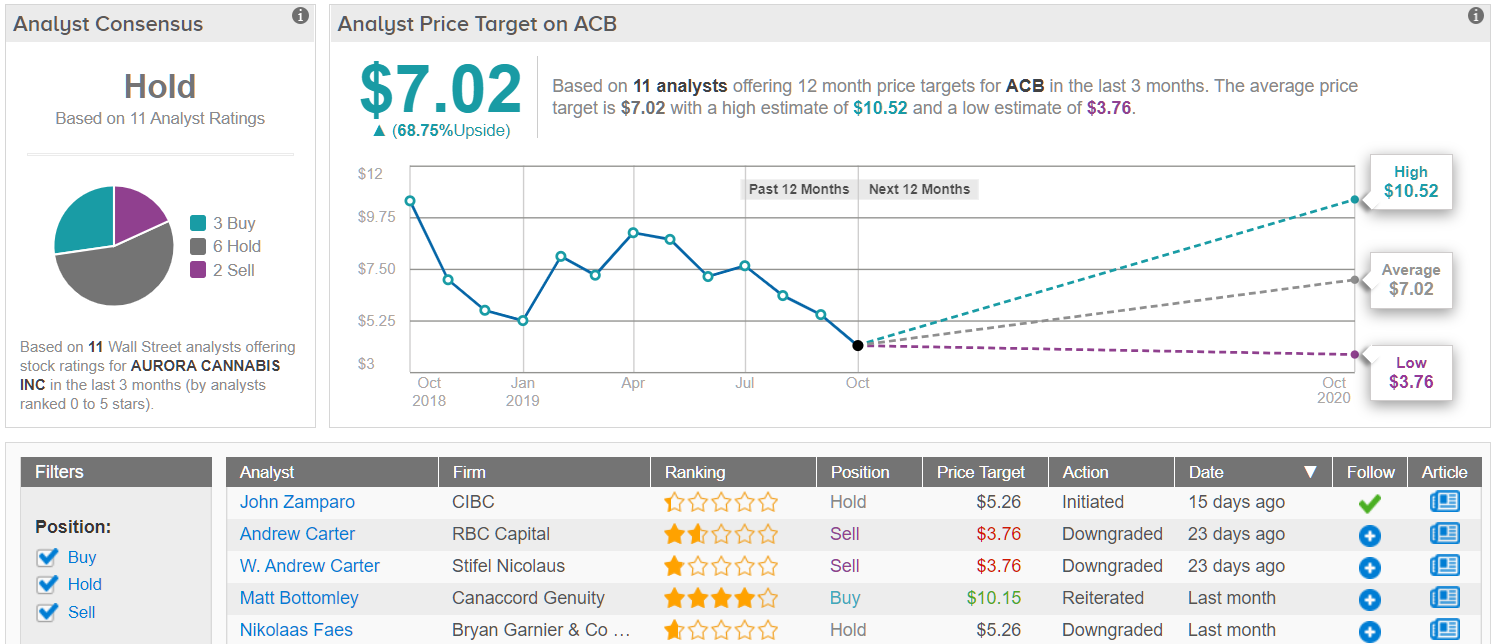

Meanwhile, analysts, on average, believe Aurora stock is capable of delivering nearly 70% profit if it reaches its $7.02 consensus price target. (See Aurora stock analysis)

Conclusion

To this day there are many that believe Canopy and Cronos continue to hold an advantage over their peers because of the cash on hand they have as a result of the investment from Constellation Brands and Altria. I’m not one of them, and have stated that publicly for some time, far before the firing of Bruce Linton.

As it has been demonstrably proven, having a lot of cash on the balance sheet doesn’t mean it’ll be used in a way that generates short-term or long-term growth. At best, all it does is allow companies to burn cash without having to raise additional capital. How is that a strategy that inspires confidence?

On the other hand, in the case of Aurora, it has positioned itself for long-term growth as well as any company in the cannabis sector. It has done so without giving up control to companies that don’t fully understand the industry.

I see Aurora as having a distinct advantage over their two competitors here, assuming it doesn’t succumb to temptation and exchange control for an investment of cash.

Aurora continues to lower costs, boost production capacity, and has a clear path to profitability, even though it will take a little longer than previously believed. The same can’t be said for Cronos or Canopy.

It’s confirmed by performance that the billions invested in Cronos and Canopy hasn’t generated the desired results. That thesis could change if everything goes right with Acreage Holdings for Canopy, but even so, I would rather see the management team in place at Aurora leading the charge, than the ongoing uncertainty surrounding what type of management is going to be put in place at Canopy, and whether or not Cronos will remove its existing management.