With so much news in the last week impacting the U.S. cannabis sector, the reasons for massive declines on a stock like Harvest Health & Recreation (HRVSF) aren’t easy to ascertain. The vaping issue is the most likely reason for daily selloffs, but the company also lost a few executives and investors could be selling the news of the SAFE Banking Act. Either way, the fears appear overblown as the company likely remains on target for sales to approach $1 billion in 2020.

Vape Fears

The latest news has the CDC reporting that patients sickened by vapes used THC vape devices. The good news for the industry is that the majority of the cases are reporting the use of illegal devices with a current focus on Dank Vapes, a counterfeit TCH cartridge brand purchased online.

The bad news for the industry is that many markets are pulling vape products until the federal health agencies are able to corner the actual products causing the health issues. The impact to the U.S. cannabis companies is that some 20-30% of sales come from vapes with California starting September with over 30% of sales generated by vapes.

Long term, this horrible health situation should drive consumers to the legal markets and towards well identified brands. Consumers should start questioning illicit products that aren’t correctly regulated and tested.

Until that point, Reuters is reporting that consumers are spending 30% less on vape products and shifting usage to other products like flower and oil that reportedly have lower profit margins. The impact is short-term financial hits to a sector already under pressure.

Opportunity

In the stock market, fear always breeds opportunity for alert investors. This health scare is unique in that the companies like Harvest Health getting hit aren’t actually implicated in the health scare causing the market weakness.

A potential investor in this stock has to also deal with a Board of Director and President of the company departing in a short period of time. Ironically though, Harvest Health recently confirmed plans for significant revenue growth in 2020 based on the expected closing of mergers with Falcon, Verano Holdings and CannaParmacy. The deals include the expectations to add operational executives and key leadership personnel from these acquired companies possibly causing the departure of these executives.

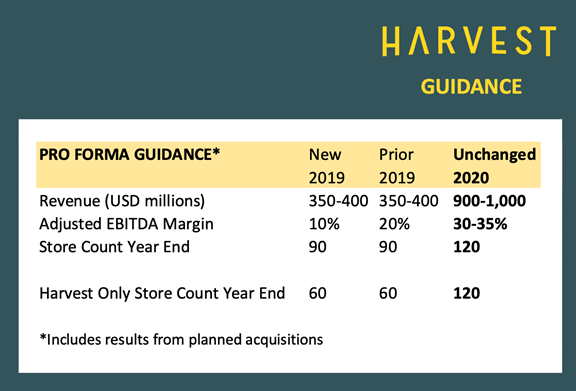

Regardless, the company appeared to maintain guidance over a month after the vaping issue started and long after the industry started feeling the impact of declining vaping sales. The official guidance along with the Q2 earnings presentation was for 2020 revenues to top $900 million and approach $1 billion with EBITDA margins topping 30%.

Source: Harvest Health

The key here is the share count will approach 500 million following the above deals closing placing the market valuation at only $1.5 billion with the stock price dipping to $3. The market has priced in all of the fears surrounding vapes and executive departures while not factoring in the positives of closing deals and the potential approval of the SAFE Banking Act.

Takeaway

The key investor takeaway is that Harvest Health & Recreation has dipped to yearly lows as the vaping health concerns and other issues hit the stock. This gives investors a buying opportunity to own a leading U.S. cannabis company on the weakness, mostly unrelated to the company.