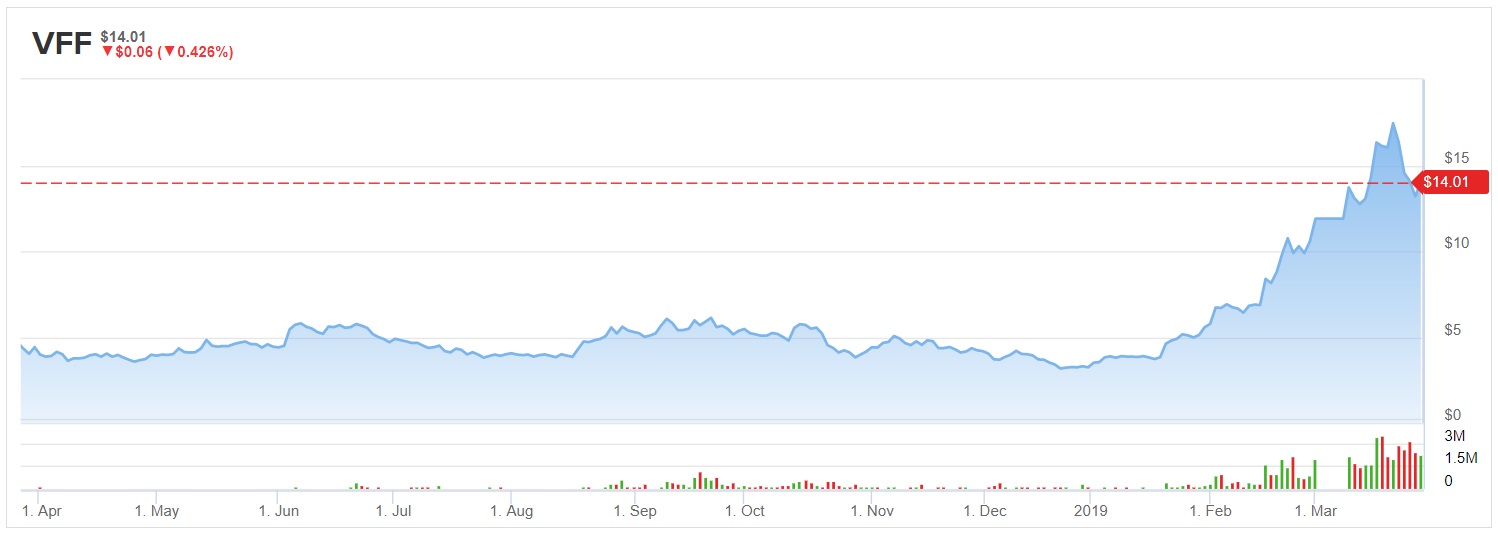

Village Farms International (VFF) provides the playbook for making money in the cannabis sector. After the big rally from under $5 to recently a high over $18, the stock no longer provides a good bet.

Shift To Cannabis

The first step for a big gain in the cannabis sector is actually entering the market. Village Farms made this move back in June 2017 with the forming of a joint venture with Emerald Health Therapeutics.

The previous vegetable farmer in the U.S. formed Pure Sunfarms to grow cannabis at an indoor greenhouse in British Columbia. Village Farms owns 50% of the venture with Emerald Health.

Pure Sunfarms commenced sales in late September 2018. The company generated $5.5 million in quarterly sales for Q4 and $1.7 million in EBITDA with Village Farms sharing in 50% of the financials.

The venture expects to ramp cannabis production up to 75,000 kilograms by mid-2019. Pure Sunfarms recently received approval from Health Canada to expand production to their entire growing area of 1.03 million square feet.

The stock originally traded in the $1.50 range before transitioning from a tomato and pepper grower to the cannabis industry. The company is now pursuing the hemp industry in the U.S. with an eye toward converting some Texas greenhouses to the hemp-derived CBD industry.

Uplist To Major U.S. Exchange

The secondary step for major sector gains is uplisting a stock onto one of the major U.S. exchanges. Over time, this method won’t provide the same returns seen by Village Farms, but the process should still work for some American plays as the market is void of such investment options now. Once saturation is reached, uplisting won’t likely provide any stock gains as the primary method for quality companies reaching the market would ultimately be an IPO.

Village Farms announced filing their application to list its common shares on the Nasdaq on January 21. The stock was trading below $4.00 prior to the announcement.

The company commended trading under “VFF” on February 21. The stock ended the day trading at $9.85 providing for a 550% gain in the period of announcing an entry into the cannabis sector and uplisting the stock to a major exchange. The company didn’t even announce a quarterly report with cannabis production under their belt during this whole process.

On March 13, Village Farms announced Q4 results that included revenues of $38.8 million only generating meager growth. The stock has plunged since reaching the $18 highs after the uplisting as the company doesn’t have the same growth trajectory of the other cannabis companies already having a farming business included in the results.

Village Farms is now worth ~$700 million with meager revenues from cannabis and only a minimal plan to share 50% in a small cannabis venture.

Takeaway

The key investor takeaway is that Village Farms has already seen the big pop from the company transitioning to cannabis and uplisting the stock to a major U.S. exchange. The best move for investors is to now find the next cannabis stock following this playbook.

To read more on the nitty gritty of what’s going on in the rising cannabis industry, click here.

Disclosure: The author has no position in VFF.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.