One major catalyst for the U.S. cannabis market is cannabinoid or CBD sales. The passage of the 2018 Agriculture Improvement Act (farm bill) legalized hemp production setting the market up for a strong sales ramp.

Hemp contains less than 0.3% of tetrahydrocannabinol (THC), whereas marijuana contains up to 30% of the psychoactive compound. CBD is increasingly presumed to contain properties for wellness and pain management increasing the attractiveness of hemp-infused CBD products, but the U.S. FDA has other thoughts.

The FDA has questioned the lack of safety research on CBD products and placed into question the approval of edibles. In addition, CBD products aren’t allowed to advertise any medical benefits from the products such as pain relief.

For this reason, the large proclamations for huge CBD sales have taken a hit. National retailers haven’t stocked edible products due to the potential ire of the FDA causing a pure CBD company in the U.S. like Charlotte’s Web Holdings (CWBHF) to recently miss sales targets. The industry is trending more towards 2022 sales of $4.4 billion versus some original high expectations up around $21.9 billion.

The U.S. CBD market is even more complicated due to the flood of Canadian companies pushing south. The U.S. CBD space is the only area where most companies from Canada and the U.S. are expected to compete for now leading to the development of thousands of brands crowding into the space.

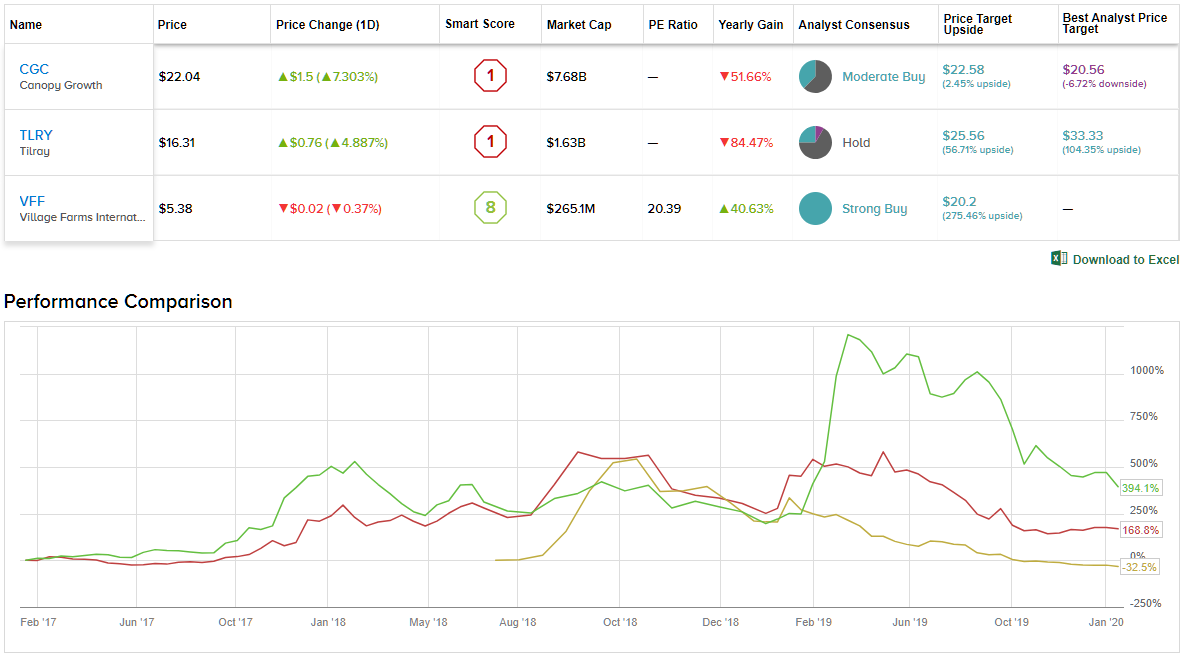

We’ve delved into these three U.S. cannabis MSOs with a strong market position in Illinois that will benefit from the opening up of the adult-use market. Using TipRanks’ Stock Comparison tool, we lined up the three alongside each other to give us an idea of what the Street thinks is in store for the trio in the year ahead.

Canopy Growth (CGC)

About a month ago, Canopy Growth officially launched their hemp-derived CBD product for the U.S. The First & Free brand marks the entrance of the Canadian cannabis company into an already crowded CBC space.

At launch, the company is offering various assortments of oil drops, softgels and creams. Notably, Canopy Growth is avoiding marketing dietary supplements that are currently under the scrutiny of the FDA and the higher selling products by current U.S. brands.

Canopy Growth has long promoted the desire to enter the U.S. via CBD products. The business provides the company with a second avenue to expand in the largest cannabis market after securing the right to purchase Acreage Holdings when cannabis is federally legal.

The company has established an operating complex in New York for the extraction and production of hemp-derived products including CBD. Canopy Growth is spending several hundred million on its industrial hemp park in the state and contracted with American farmers for thousands of acres of hemp cultivation.

While CBD sales are important to the plan for Canopy Growth to enter the U.S. market, the current $7 billion market cap of the stock suggests the crowded space won’t provide the sales to move the needle fro the stock.

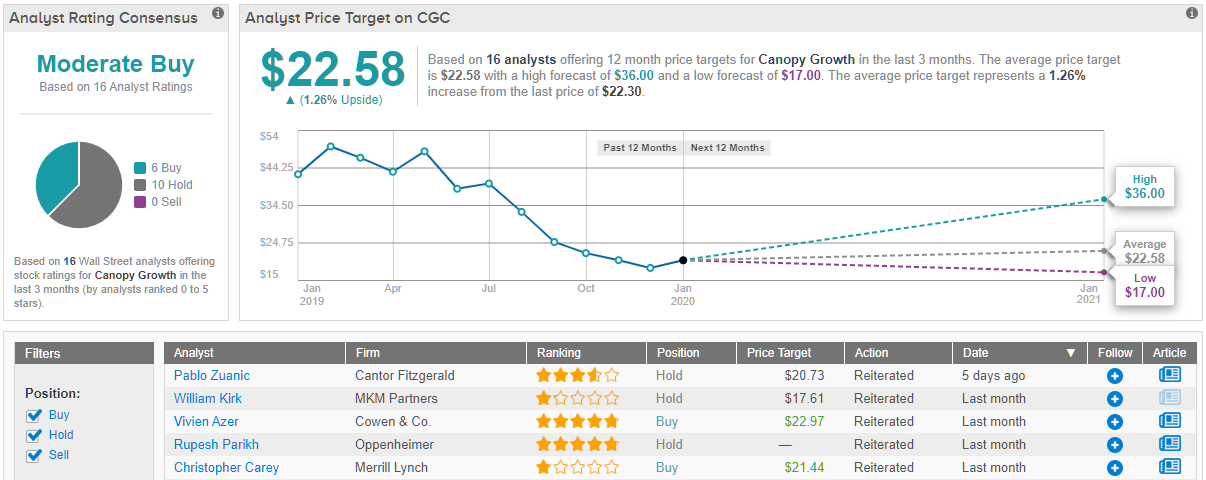

All in all, Wall Street is not as bearish on Canopy, but is not convinced on this stock, either. CGC holds a Moderate Buy from the analyst consensus, based on 6 “buy” ratings – but also 10 “holds.” Shares sell for $21.92, and the $22.58 average price target suggests a modest upside of just 1%. (See Canopy stock analysis at TipRanks)

Tilray (TLRY)

Tilray positioned the company to launch CBD products in the U.S. last year via the acquisitions of Manitoba Harvest and Smith & Sinclair. By Q3 alone, the company had products in nearly a thousand retail locations, though sales were minor.

The Canadian cannabis company is highly focused on Cannabis 2.O products whether in Canada or the U.S. Their High Park division has innovative products in CBD formats of beverages, edibles and vapes with products under existing brands such as Marley Natural, Goodship and others.

The Smith & Sinclair company offers craft edible candy, fragrances and unique consumable products with the intent to launch the Pollen brand for the CBD space. The Manitoba Harvest division already has $15 million quarterly revenue based with connections at thousands of retailers in the U.S. already selling hemp products. The natural move is into the hemp-infused CBD space.

In essence, the company has a diverse portfolio of CBD brands to explore sales opportunities in the U.S. As with the other Canadian players, Tilray hopes to eventually utilize established connections in the CBD space to allow for quick expansion in the U.S. once THC products are federally legal.

Tilray is the better bet in the sector for a company looking for a purer CBD or Cannabis 2.0 products company. The stock only has a market value of $1.5 billion now and Tilray is less focused on cannabis cultivation.

The biggest issue remains the valuation with 2020 revenue expectations of $317 million placing the stock at close to 5x revenues. The stock upside could come from strong sales of higher margin CBD products.

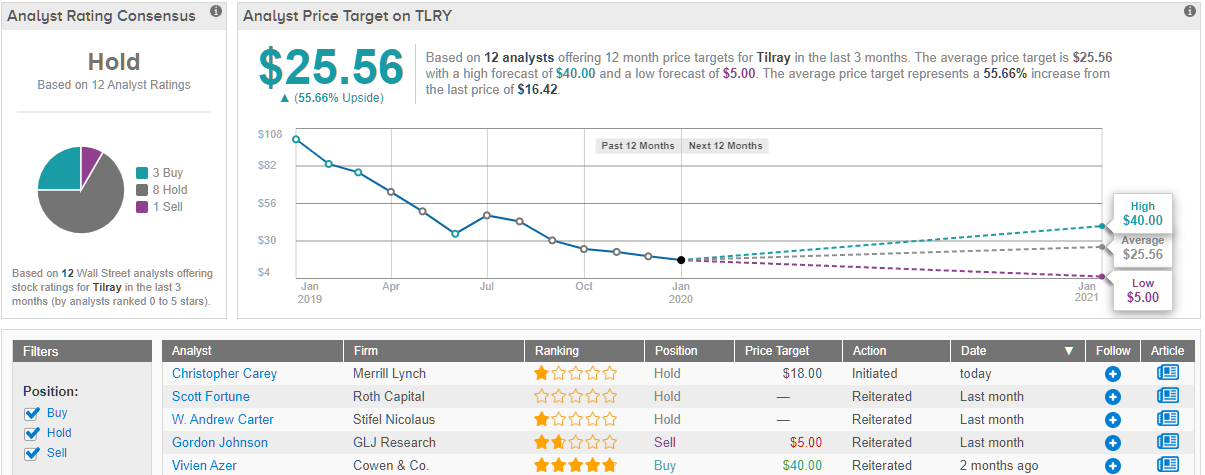

According to TipRanks, the consensus on Wall Street is that Tilray stock is a “hold” for investors. But TipRanks might as well have said “buy” — because analysts, on average, think the stock, currently at $16.44, could zoom ahead to $25.56 within a year, delivering 56% profits to new investors. (See Tilray stock analysis at TipRanks)

Village Farms International (VFF)

Village Farms International is a unique company in the space with a twist due to their existing business in Texas. The company has entered in the CBD market via simply converting greenhouses into hemp cultivation facilities while additionally adding joint ventures for growing hemp outdoors in multiple states to convert into CBD biomass.

The company planted 870 acres of hemp in 2019 with the original 625 acres averaging 1,600 pounds of hemp per harvested acre. Village Farms was positioned to commence sales of hemp biomass in Q4.

The upside potential comes this year as Village Farms looks to expand into white-labelled and branded CBD products in 2020. The biggest concern with the stock is the drama with joint-venture partner Emerald Health Therapeutics (EMHTF).

The companies have a major dispute over the Pure Sunfarms JV ownership. The JV cultivates and sells cannabis in Canada. Without resolution of this dispute, the stock could trend lower. Village Farms has a meager stock valuation of $300 million so any of the moves into branded product sales in either U.S. CBD sales or Canadian cannabis sales would provide a major lift to the stock.

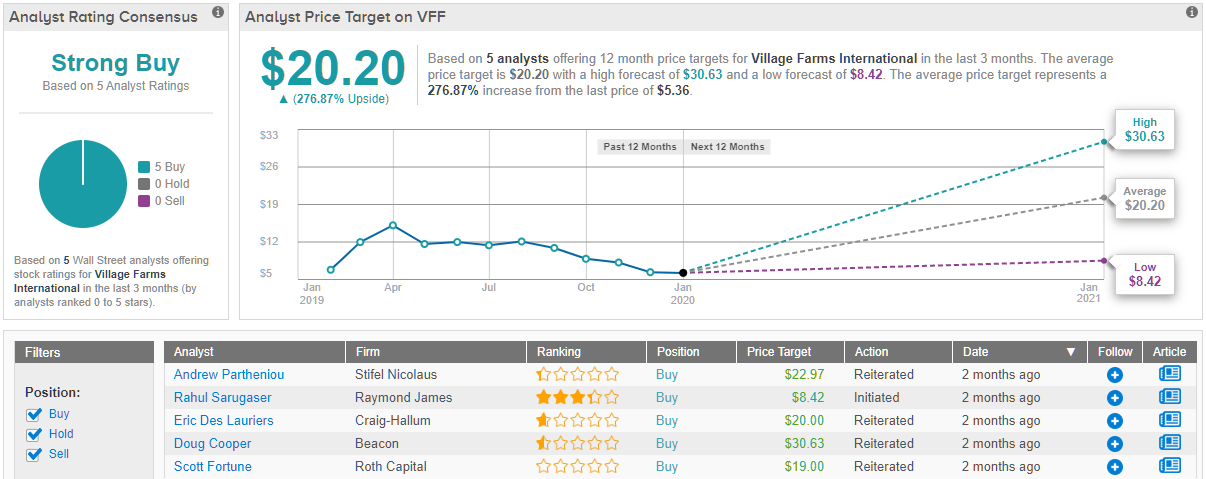

TipRanks’ data shows a bullish camp backing this greenhouse firm. The ‘Strong Buy’ stock has amassed 5 ‘buy’ ratings in the last three months, with no “sell” or “hold” ratings. The 12-month average price target stands tall at $20.20, marking nearly 280% in return potential for the stock. (See Village Farms stock analysis at TipRanks)