The whole benefit of investing in the U.S. multi-state operators (MSOs) is playing out as planned with the approval of adult-use cannabis in Illinois. The large market opportunity immediately adds value to the Cresco Labs (CRLBF) business without the company having to acquire another business or look towards global expansion. The stock should not be trading at $10.50 with their growing total addressable market.

Already Focused On Illinois

The state of Illinois approved adult-use cannabis effective January 1, 2020. The state already had medical marijuana where Cresco Labs had 5 dispensaries addressing the need of the large population in Illinois that includes Chicago.

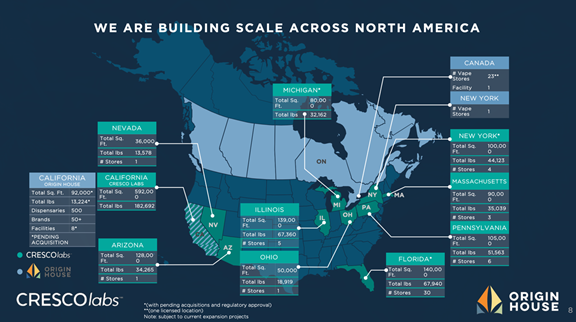

(Source: Cresco Labs presentation)

The company is in the middle of working on closing the Origin House (ORHOF) merger that provides wholesale access to 500 dispensaries in California. The opportunity in Illinois is estimated at a potential $2 to $4 billion market size leaving Cresco Labs in a great position whether or not the company gets approval to close that merger.As part of the Illinois approval, Cresco Labs can open 5 more dispensaries to reach a total of 10. The company plans to have these locations open before the adult-use market opens up on January 1 along with expanded cultivation facilities to reach the max allowed by the state.

Illinois is well positioned to match the future importance of states like California and Florida as Cresco Labs completes acquisitions already in the works.

Still Waiting

Cresco Labs is still waiting on several transformational mergers to close. The Origin House deal got the typical request from regulators for additional information. Even the VidaCann merger in Florida hasn’t closed, but the company has now opened additional dispensaries along with plans to reach 20 locations by the end of 2019.

The company has pending transactions that will allow Cresco Labs to enter New York, Massachusetts and Florida along with licenses to expand into Michigan. The deals gave the company access to 51 dispensaries and the approval in Illinois brings the total to 56.

In addition, the revenue forecasts at the time of the merger topped $1 billion by 2021 and the new expansion in a large market should provide a nice boost to those original estimates. Cresco Labs should be positioned for substantial growth over the next couple of years.

Once the mergers with Origin House and VidaCann close, the company will have substantial positions in the key cannabis markets of California, Florida and Illinois that all offer market opportunities that might exceed the current struggling Canadian market.

At the time of the merger, the company had listed the fully diluted valuation in the C$5.5 billion range. With about a 15% decline in the stock price since, the updated valuation is about C$4.8 billion. The converted value is about $3.7 billion providing a very reasonable value for all of the opportunities for MSOs building scale in the U.S.

Takeaway

The key investor takeaway is that Cresco Labs remains an emerging MSO giant. The cannabis company has substantial growth plans right under the surface of investor view due to the pending acquisitions.

Within a year, the company will go from reporting quarterly revenues in the $20 million range to topping $125 million. The stock will rise accordingly.

To read more on the nitty gritty of what’s going on in the rising cannabis industry, click here.

Disclosure: No position.