The cannabis sector has seen a huge rally over the last week and Aurora Cannabis (ACB) is no exception. Some general excitement over a competitor’s quarterly earnings report and some positive regulatory headlines from the U.S. have investors throwing caution to the wind again. The company still has too many unresolved risks to rush into the stock here just because a competitor beat quarterly estimates due to a large bulk wholesale deal.

Money Losing Operations

The firing of CCO Cam Battley and the placing of a facility on the market for sale at a price of C$17 million doesn’t alter the bleak financial prospects of Aurora Cannabis. In the last quarter alone, the Canadian cannabis company reported an EBITDA loss of C$39.7 million.

A capex cut might help stem the cash flow burn, but Aurora Cannabis has made limited steps announced to the public on the operational side. The company needs higher revenues and reduced costs in order to reach EBITDA profitable, a measure that doesn’t even factor in potentially mounting interest expenses into the cash burn equation.

The big story coming up with the FQ2 results in mid-February is whether the company restructures operations to reduce the operating expense base of C$81.1 million. Aurora Cannabis already has solid gross margins near 60% so the key to success is matching the expense side of the equation with gross profits reduced by disappointing sales.

Wholesale Sales

The Organigram (OGI) earnings beat has the whole market up, but the company beat sales estimates based on a surprise bulk wholesale sale of C$9.2 million. Aurora Cannabis had a similar quarterly boost back in the June quarter where an additional C$18.0 million in bulk wholesale sales boosted those numbers sending the stock up to $6.50 back in September. The stock didn’t hold up at the end of 2019, partly because the September quarter sales saw wholesale revenues decline 50% to only C$10.3 million.

The addition of competition in the wholesale space should hurt the ability of the company to repeat the revenue boost from bulk sales at 60% gross margins. Without the bulk sales, OrganiGram didn’t see any jump in revenues sequentially for the last quarter following the weak August quarter hit by lack of provinces ordering and product returns.

Aurora Cannabis avoided the product returns hit, but the company saw sales dip last quarter. Investors shouldn’t expect any revenue boost this quarter outside of the wholesale sales. Analysts forecast December quarterly revenues of C$80 million which won’t inspire the market to chase this rally back above $2.

With at least 1.2 billion shares outstanding, the stock has a market value of ~$2.5 billion and quarterly revenues of $60 million aren’t going to inspire investors to hold the sock assuming the adjusted EBITDA levels don’t show any major improvement.

Consensus Verdict

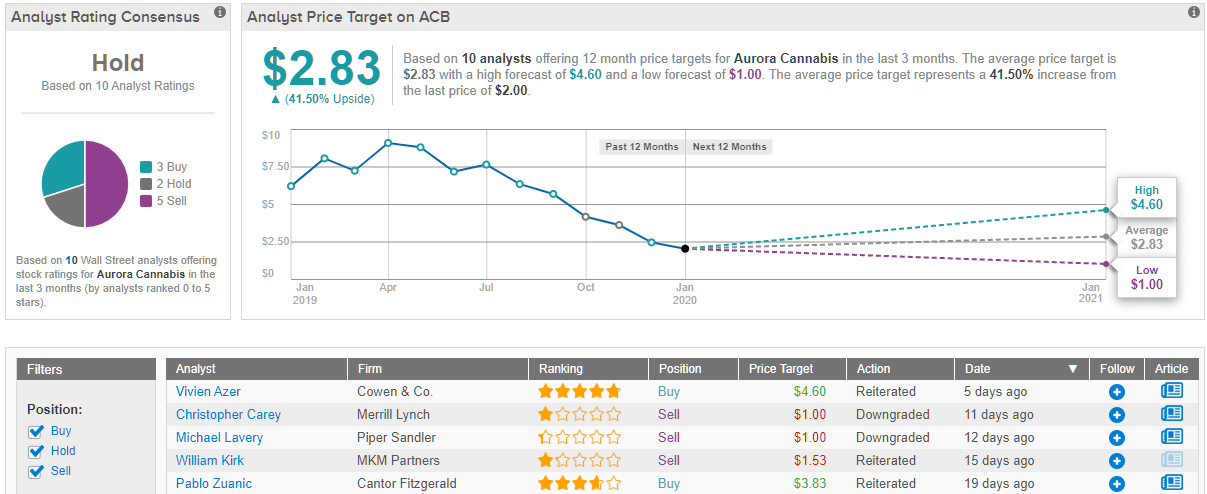

All in all, the Street’s current view on Aurora Cannabis is a mixed bag, indicating uncertainty as to its prospects. The stock has a Hold analyst consensus rating with only 3 recent “buy” ratings. This is versus 2 “hold” and 5 “sell” ratings. However, the $2.83 price target suggests an upside potential of nearly 40% from the current share price. (See Aurora Cannabis stock analysis on TipRanks)

Takeaway

The key investor takeaway is that Aurora Cannabis has a lot of positive catalysts to play out in 2020, but the company needs to reorganize the firm to reduce operating expenses following delayed catalysts in 2020. The stock has seen a recent boost due to some over excitement about the rebound in sales at Organigram, but investors should be cautioned that the revenue beat was due to low quality sales.

To find good ideas for cannabis stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.