Some of questioned the supply and demand question concerning cannabis companies because of the perceived lack of demand that will cause the market to be flooded with too much supply.

At this time, at least in Canada, the main problem has been the extremely slow licensing process for retailers which has allowed the black market to thrive and significantly price pot lower than their legal counterparts because of the inability of cannabis producers to scale to the point of lowering costs. That and excise taxes have been the main reasons for the competitive disadvantage of legal marijuana companies.

The issue isn’t oversupply at this time, but the lack of retail outlets to serve customers. There is plenty of demand, because of the lack of places to sell, there has been an artificial oversupply that isn’t related to market conditions but government under performance. With that in mind, the oversupply issue is real, not because of lack of demand, but because of lack of retail stores. That is incrementally being remedied, but will take time to work out.

As a result, investors are concerned about what companies are going to do with their abundant supply, and part of the answer for some of them is the rapidly growing German medical pot market, which will enjoy a strong growth trajectory over the next five years.

Prohibition Partners, a market intelligence company, recently released a report on the potential of the cannabis sector in Germany, the largest medical cannabis market in Europe.

In 2017, the first year medical cannabis in Germany was legalized, 1,200 kilograms of cannabis was imported. In 2018 that soared to 3,000 kilograms, and in the first half of 2019, it stood at approximately 2,500 kilograms.

As for the outlook of Prohibition Partners concerning the number of German cannabis patients in Germany, they see it probably growing to over 1 million patients by 2024.

In ths article we’ll look at why this will especially benefit Canopy Growth, Aurora Cannabis and Aphria.

Canopy Growth (CGC)

Many in the market were suprised when Germany snubbed Canopy Growth in its domestic licensing process. At the time Canopy was considered the leader in the industry and was expected to be a production player in Germany.

That didn’t work out, but the company entered the German market a different way, through the acquisition of Germany’s C3 Cannabinoid Compound Company. When the deal was announced, it was serving about 19,500 patients. It generated revenue of C$41.5 million for full-year 2018.

One of the major problems for Canopy Growth has been its going through a period of schizophrenia concerning its purpose, as it has stated in the past it was primarily a recreational pot company focused on the Canadian market, then focused on the U.S. market (via its Acreage Holdings call option), and now is looking for growth in the medical cannabis market of the EU. That’s why I’ve said it needs to get a CEO sooner rather than later in order to start clearly laying out the vision of the company.

For that reason, even though it appears Canopy should participate in the rapidly growing German cannabis market, it’s considered a secondary move when taking into consideration the U.S. and Canadian cannabis markets in the near term.

It has been puzzling to some as to why a company generating C$90.5 million in quarterly revenue is looking to a much smaller German market.

I think it’s going to pay off in the long term if the number of German cannabis patients does jump to over a million in a few years, but until that happens, the company could be missing better growth opportunities in North America over the next couple of years.

Shares of Canopy Growth have taken a hit in 2019, and analysts are split on whether to get more optimistic about the stock, while others argue that the rest of the year will be challenging as well. In the last three months, the cannabis maker has landed 8 ‘buy’ ratings vs. 8 ‘hold’ ratings. That said, the consensus average price target points to $34.76, or over 70% upside potential for the stock. This suggests that by consensus expectations, for now, the bulls win on Canopy. (See Canopy stock analysis on TipRanks)

Aurora Cannabis (ACB)

For Aurora Cannabis, the German market makes a lot of sense because from the beginning it has clearly stated it’s primarily a medical cannabis company, so it aligns with its purpose.

One of the challenges for Aurora has been the lack of GMP-compliant cannabis it can sell in the EU, which is being remedied by the recent completion of a couple of facilities in Canada that will start to ship product to Germany and other EU markets.

This is one of the areas where demand outpaced supply, and with the addition of more compliant EU cannabis, Aurora’s international sales should jump significantly in the quarters and years ahead.

I don’t think a lot of investors are taking into account the long-term potential of Germany in particular, and with its exports and licensed facility in Germany, it is poised to enjoy long-term growth in the EU medical cannabis marekt.

This will also reduce some of the oversupply in the market when it actually arrives

Again, when talking oversupply in this article, there’s a need to separate the temporary constraints in the Canadian market as a result of the slow licensing approval process, and the eventual oversupply that comes from an abundance of pot that exceeds demand. That moment, while not here yet, will eventually come.

Having a presence in 25 countries will help Aurora overcome the excess supply that will ultimately plague the cannabis sector, while maintaining strong margins that accompany the medical cannabis market.

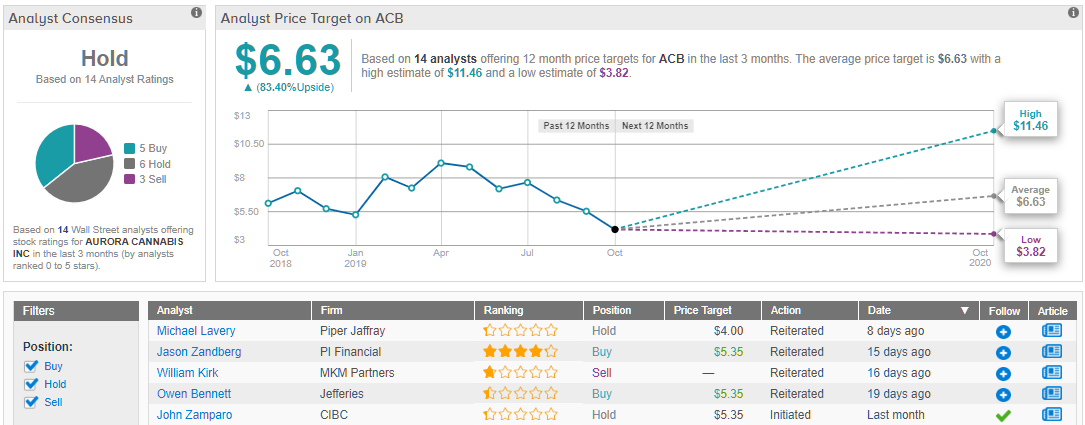

According to TipRanks, the consensus on Wall Street is that ACB stock is a “hold” for investors. But TipRanks might as well have said “buy” — because analysts, on average, think the stock, currently at $3.61, could zoom ahead to $6.63 within a year, delivering over 80% gains to new investors. (See Aurora stock analysis on TipRanks)

Aphria (APHA)

Even though Aphria isn’t going to produce near the amount of cannabis Aurora Cannabis and Canopy Growth will, it has, for now, enjoyed the benefit of generating a profit as it expands.

I’ve stated before that the smaller companies will benefit from the slow pace of licensing in Canada, over time that will change as the larger producers scale to meet demand, as more retail outlets help lower costs and take share away from illegal pot sellers.

Aphria is in the unique position of being the third-largest cannabis producer in the world, standing between the many smaller producers and the two production giants mentioned above.

If it can keep its costs down as it expands, it should significantly benefit from the growing German medical cannabis market, which will further widen its margins and presumably, improve its profitability over the long term.

How Aphria allocates its supply will determine its level of success in Germany because it won’t have the quantity of product Aurora and Canopy will have as global demand continues to increase.

This won’t be an issue for Aphria for some time, so I expect the company to continue to improve its sales, margins and earnings, as it sells more cannabis into the German market.

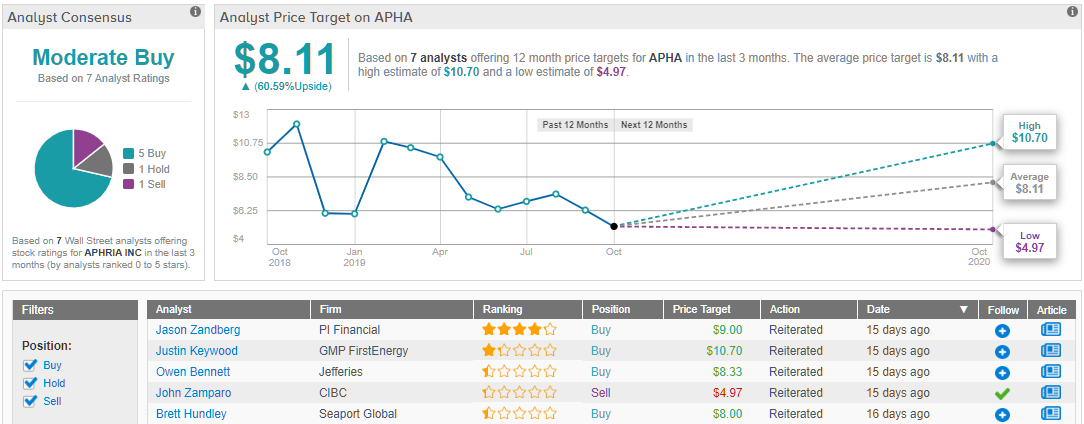

All in all, Wall Street is quite positive on this cannabis player: APHA has received 5 ‘buy,’ 1 ‘hold’ and 1 ‘sell’ ratings in the last three months. Running the numbers across the Street, the 12-month average price target lands at 8.11, representing about 60% upside from current levels. (See Aphria stock analysis on TipRanks)

Conclusion

There’s a lot of concern over the eventual global cannabis oversupply situation that is coming, but I don’t think we’re close to that happening yet for the reasons mentioned in this article.

This is evidenced by the growth trajectory of the German medical cannabis segment, and the strong probability it will also legalize recreational pot in the years ahead.

For Aurora Cannabis, Canopy Growth and Aphria, they have positioned themselves to ride this huge wave through at least 2024, before the growth starts to level off.

Of these three companies, because of the licenses awarded them, I like Aurora Cannabis and Aphria the best as to long-term potential, but still think the German market will be good for Canopy as well.

The problem for Canopy is if it is giving up too much in North America for what is considered less potential for it in the EU.

The bottom line is, as far as related to oversupply, these three companies will not endure the level of negative impact others will because of their international exposure. Aurora Cannabis, because of its market-leading international presence, will do the best over time.

To find good ideas for cannabis stocks trading at fair value or better, visit TipRanks’ Best Stocks to Buy tool, a newly launched feature that unites all of TipRanks’ equity insights.