Infamous hedge fund billionaire Steve Cohen found his reputation struck with scandal just five years ago- when a monster securities insider trading fraud took down his hedge fund firm SAC Capital Advisors in absolute scandal. In 2014, Cohen started his comeback, putting up his own money for trade at family office Point 72 Asset Management. Now that the hedge fund manager can manage money again for outside investors coming out of a two-year government ban in punishment, the stakes are high for Cohen to succeed. Is betting on Micron Technology, Inc. (NASDAQ:MU) and racing away from Alibaba Group Holding Ltd (NYSE:BABA) the key to Cohen turning over a new leaf to success?

Though bit by legal disgrace, Cohen still has a roughly whopping $13 billion to his name, as of February 2017- having found his way to become the 72nd wealthiest man across the globe, by Forbes’ reckoning. In the U.S., Cohen still stands as the 30th biggest moneymaker and of the hedge fund gurus, the comeback manager stands as the third best in realizing earnings. With a $1.8 billion settlement now behind him, Cohen is resting his comeback on Point 72’s powerhouse potential. Last year saw Point 72 hit an over 10% boost in growth after expenses- an improvement from a rocky 2016 that saw Cohen through his almost worst yearly performance on record.

Let’s take a closer look to see how Cohen’s bullish move in Micron and bearish dial-down in Alibaba sound off against the experts on the Street:

Micron Magnetizes a 2 and a Half Million Boost from the Billionaire

Micron has Cohen so bullish, he is out jumping up his stake in the chip giant to the tune of a monster 165% lift- or 2,514,007 shares. This takes Cohen’s holding in the semiconductor company up to 4,044,607 shares worth $166,314,000.

J.P. Morgan analyst Harlan Sur is looking through the same confident lens here, now on his sixth positive revision in a row for his global memory expectations.

In other words, the next two to three quarters are looking strong for memory pricing trends. With MU’s recent positive preannouncement in tow and boosts at play in contract pricing in DRAM memory, the analyst is out lifting his expectations for the chip giant.

“Historical revisions to our global model have generally been a good near/mid-term positive indicator for both financial and stock performance,” cheers the analyst, who maintains an Overweight rating on MU stock with a $60 price target, which aligns with where the stock is currently trading. (To watch Sur’s track record, click here)

Keep in mind, Sur notes, this is a Wall Street player that landed among the best performing semi stocks of 2017 on an 88% surge- and year-to-date has soared 7.5%. Considering the SOX index is already outclassing the broader indexes, it is no small feat to see MU beating out the SOX index. Meanwhile, Sur does not see this outperformance momentum stopping any time soon, considering he angles for supply of DRAM to continue both “tight” and “balanced” through this year.

While the analyst notes he expects average selling prices (ASPs) will come back down to a usual trend of sequential dips as the year gets further along, he also bets MU can bump its margins up this year on back of sustained NAND and DRAM cost reductions. Though capital expense forecasts from memory players in 2018 has risen substantially more for 2018, memory revenues simultaneously stand at record highs, points out Sur. As such, the ratio of capex to revenues continues to track under cumulative traditional norm.

“Moreover, the amount of capex required for technology transitions continues increasing, which means that in order to drive bit supply growth it costs manufacturers more capex dollars per wafer to drive bit growth higher and replace lost wafer capacity. Memory suppliers will continue to be disciplined in adding supply, in our view, focusing on profitability (especially in DRAM), and we believe majority of the capex spend is for technology migration with only modest increases in wafer capacity. On the demand side, we believe investors continue underestimating the positive impact of broad-based demand drivers beyond PCs/smartphones in areas such in data center, networking, AI/deep learning, etc. Overall, we believe Micron will drive further profitability improvements on solid manufacturing execution and by focusing on higher value-added, system-level solutions such as enterprise SSDs,” asserts Sur.

The analyst’s worldwide research team’s new Global Memory Model signals sustained gains in both DRAM as well as in NAND pricing through the first half of this year. DRAM now is anticipated to hit 19% higher; ASPs closing out the first half of the year are expected to reach 32% more to J.P. Morgan’s Global Memory Model’s prior expectations. NAND also looks strong: revenues for the first half of the year are now angled to reach 13% with ASPs closing out the first half of 2018 revised on a 19% upturn. In a nut shell, the next coming quarters look good for Micron’s stock performance from this bulls’ perspective.

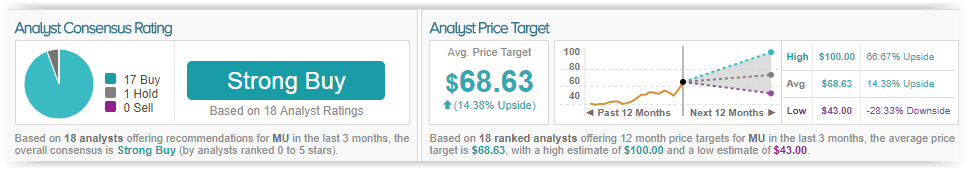

TipRanks showcases that this semiconductor player has become a strong favorite as far as Street-wide sentiment cheers. Out of 17 analysts polled in the last 3 months, 16 are bullish on MU shares with only 1 surveying from the sidelines. With a solid return potential of 13%, the stock’s consensus target price stands at $66.53.

Alibaba Gets a Severe Chop

In an opposite move in tech, Alibaba is a giant that has spooked Cohen in running halfway out of the stock. In a bearish quarterly play, Cohen sold off 535,353 shares in the company- a sharp reduction of over half leaving 507,175 shares left worth $87,452,000.

Yet, Cohen’s fears do not seem backed by most of the Street.

Jefferies analyst Karen Chan assesses usual seasonal moves in Chinese e-commerce and gets all the more confident and “comfort” in her gross merchandise volume (GMV) growth expectations for BABA this year of c.30%- with room for prospective upside.

One of the most upbeat analysts on the Street who roots for this Chinese e-commerce king, the analyst maintains a Buy rating on BABA stock with a $325 price target, which implies a nearly 64% upside from current levels. (To watch Chan’s track record, click here)

Chan makes a confident case, pleased to see such robust performance in online retail sales: “We believe the strong online retail sales in spite of weak seasonality could be attributed to: 1) a longer-than-usual shopping window prior to Chinese New Year holiday; 2) increased rural consumption spending over CNY from post-80s with smart home electronics and imported fresh goods showing fast growth; 3) step-up in online-offline promotional efforts, e.g. red packets, Taobao-RTmart (SunArt) promotion; 4) enhanced logistics service for fresh goods, e.g. Hema.”

Top analyst Colin Sebastian at Baird also goes against Cohen’s negative slash in BABA, approaching the stock with enthusiasm for what has been a solid beginning 2018 for Chinese retail sales.

Echoing Chan’s bullish stance, Sebastian also sees potential waiting in the wings for upside on the company’s top-line growth. Both analysts are taking notice of China’s National Bureau of Statistics calculating that online sales have hit 1.23T RMB in the first two months of 2018- a notable 37.3% year-over-year surge. From this time in 2017 of 31.9% growth along with 32.2% growth in all of 2017, this marks quite a jump for the giant. Online sales growth has also vaulted taking under account that in the fourth quarter growth was just 35.8%; and this is following a standout holiday shopping season.

E-commerce expansion has also proved strong, with total retail sales experiencing a 9.7% year-over-year hike, a lift from this time last year’s 9.5% year-over-year growth. Rural areas are the stars of the show here, having brought to the table 10.7% year-over-year growth. With Alibaba bolstering its New Retail initiative through a one-two punch of online and offline retail investments, Sebastian underscores consumer trends bolstering BABA’s “retail thesis.”

As meaningful growth prospects lie past core China retail, Sebastian concludes full bullish steam ahead on the company: “In addition to its New Retail strategy, the company is investing heavily in a number of other nonretail initiatives, including its rapidly expanding cloud offerings (we estimate +98% Y/ Y growth in F4Q). Alibaba recently announced the development of the world’s second-fastest publicly available quantum computing service, providing a cloud-based solution to allow its customers to test algorithms and evaluate the performance of their own hardware. Despite its leading market share in the Chinese cloud computing market, BABA continues to prioritize share gains as it seeks to provide a broader array of cloud services to an expanding customer base.”

In reaction, the analyst rates an Outperform rating on BABA stock with a price target of $220, which implies a close to 11% upside from current levels.

Colin Sebastian has a very good TipRanks score with a 79% success rate and an impressive ranking of #12 out of 4,786 analysts. Sebastian yields 27.6% in his annual returns. Investors betting on Sebastian’s recommendations on average would realize 48.1% in profits on BABA stock.

China’s e-commerce king has landed among the best ranked stocks on TipRanks. All 16 analysts polled in the last 3 months unanimously rate a Buy on BABA stock. The 12-month average price target of $230.94 notably suggests 16% in return potential from where the stock is currently trading.