Zoom Video Communications (ZM) has announced that it will open two new research and development centers – one in the greater Phoenix, Arizona area and one in Pittsburgh, Pennsylvania.

Zoom will immediately begin recruiting software engineers in these geographies. Employees will work from home until the offices are built and COVID-19-related isolation has abated, expected for fall 2020, Zoom said.

While the company has not finalized the office locations, Zoom is looking for space near Arizona State University and Carnegie Mellon University, both of which have strong engineering programs.

These two centers will add to Zoom’s existing R&D and support Zoom’s engineering leadership, which is based at its California headquarters.

“We plan to hire up to 500 software engineers between these two cities in the next few years, drawing largely on recent graduates of the many local universities,” said Eric S. Yuan, CEO of Zoom.

Shares in Zoom have rallied an eye-watering 143% year-to-date, due to the incredible demand boom the company’s video conferencing platform has experienced during the coronavirus pandemic.

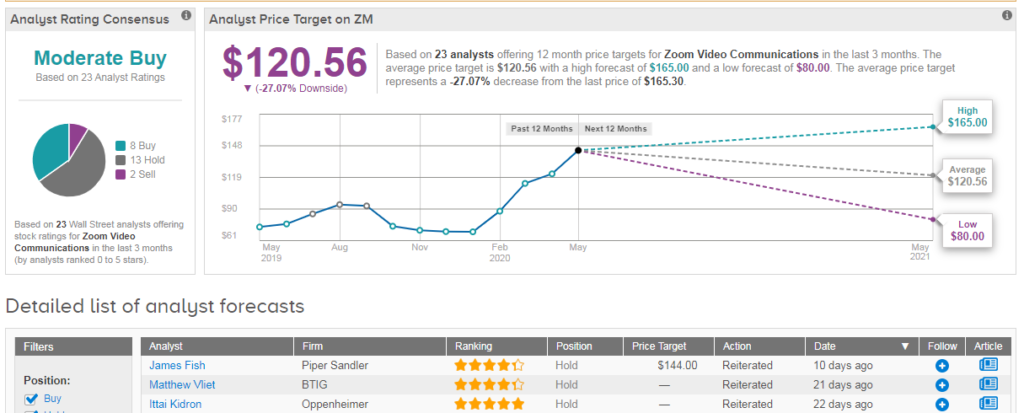

However, the surge in share price has left the majority of analysts sidelined on the stock. Oppenheimer’s Ittai Kidron explains: “We remain Perform-rated, seeing a balanced risk/reward trade-off (high valuation/unresolved issues vs. strong user growth and traction).”

Encouragingly, he believes Zoom is appropriately addressing top-of-mind concerns for larger enterprises, especially security-conscious customers, as well as consumers, who are using Zoom for new use cases.

“Evidence of [security] progress could buy the company time and allow it to regain user trust and potentially stave off legislative action” he said after the company rolled out Zoom 5.0 with a more secure encryption standard.

Overall the stock shows a cautiously optimistic Moderate Buy consensus. This breaks down into 8 buy ratings, 13 hold ratings and 2 sell ratings in the last three months. Notably the average analyst price target of $121 now indicates downside potential of over 27%. (See Zoom stock analysis on TipRanks).

Related News:

Twitter Won’t Reopen Offices Before Sept., Allows Permanent Work From Home

Uber Announces $750M Notes Offering, As GrubHub Takeover Reports Swirl

3M Sues Vendors Over False N95 Respirators