Chinese electric vehicle manufacturer XPeng Inc. (XPEV) announced a series of innovative products at its annual 1024 Tech Day. The products include the latest and most sophisticated version of its in-house developed advanced driver assistance system XPILOT 3.5 and XPILOT 4.0, the design of a new generation road-capable flying car.

Additionally, the company disclosed major supercharging technology breakthroughs and robotic innovations that constitute the main components of the company’s smart mobility ecosystem. Shares of the company closed 1.3% lower on Friday.

Sharing his thoughts, the CEO of XPeng, He Xiaopeng, said, “Our exploration of more efficient, safer, carbon-neutral mobility solutions goes far beyond just smart EVs, and is the cornerstone of our long-term competitive advantages.”

“We strive to implement cutting-edge mobility technologies in mass-production models for the benefit of our customers,” Xiaopeng added. (See XPeng stock charts on TipRanks)

Markedly, XPeng’s XPILOT has been recognized as a leader in smart driver assist technology. To date, the usage data reflects strong acceptance by customers and recognition of XPILOT’s multi-scenario driver assistance at a high level. Consequently, the company has planned the rolling out of XPILOT 3.5 in the first half of 2022, which will support China’s complex driving scenarios on major roads in the city.

Furthermore, XPILOT 4.0 is expected to be available in the first half of 2023. The model is designed to deliver full-scenario driver assistance, which can be helpful for customers who drive point-to-point.

At Tech Day, a new generation flying car design was also unveiled. The new design is expected to be rolled out in 2024 (the new road-capable model), showcasing a lightweight design and a foldable rotor mechanism for seamless fly-drive conversion, the company said.

Notably, China’s first 800V high-voltage mass-production SiC platform will be introduced by XPeng, with new-generation “X-Power” superchargers. These chargers will be able to charge for a range of up to 200 km in just 5 minutes.

Recently, Bank of America Securities analyst Ming-Hsun Lee maintained a Buy rating on the stock and raised the price target to $63 (46% upside potential) from $61.

Lee’s action followed his updated revenue estimates for 2021, 2022 and 2023, in which he increased 7%, 8% and 10%, respectively, based on higher volume sales assumptions.

According to the analyst, XPeng reported September vehicle deliveries of 104,000 units, and the company’s Q3 shipments of 25,666 units (up 199% year-over-year) exceeds his Q3 estimate by 15% and remains 14%-19% above guidance.

XPeng shares have exploded almost 120% over the past year, while the stock still scores a Strong Buy consensus rating based on 5 unanimous Buys. That’s alongside an average XPeng price target of $56.40, which implies 30.74% upside potential to current levels.

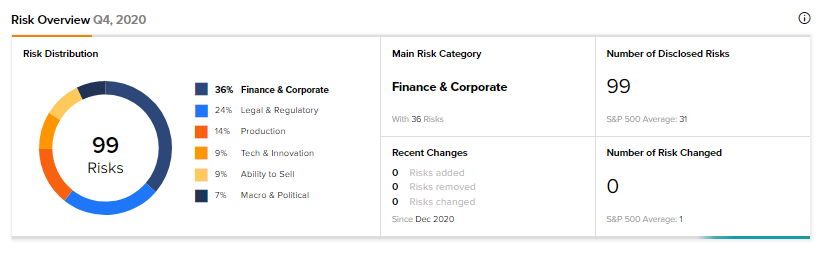

Investors should always be aware of the risks involved in any stock. According to the new TipRanks’ Risk Factors tool, XPeng is at risk mainly due to three factors: Finance and Corporate, Legal and Regulatory, and Production, which contribute 36%, 24% and 14%, respectively, to the total 99 risks identified for the stock. Under the Finance and Corporate risk category, the stock has 36 risks, details of which can be found on the TipRanks website.

Related News:

HP Provides Fiscal 2022 Guidance & Raises Dividend; Shares Rise 5%

Vicor’s Quarterly Results Disappoint; Shares Drop 4% After-Hours

Moderna’s COVID-19 Vaccine Booster Dose Recommended by ACIP