Ameren Corporation (AEE) is an American electric power and natural gas provider serving 3.3 million customers. It operates through rate-regulated utility subsidiaries, Ameren Missouri and Ameren Illinois. In its 2021 list, J.D. Power ranked Ameren Illinois highest in customer satisfaction in the Midwest among large electric utilities.

Ameren recently raised $500 million through the offering of senior notes maturing in 2027. It plans to use the proceeds to reduce its short-term debt and meet other general corporate needs.

For Q3 2021, Ameren’s earnings report shows revenue increased to $1.81 billion from $1.63 billion in the same quarter last year and surpassed the consensus estimate of $1.76 billion. It posted EPS of $1.65 versus $1.47 in the same quarter last year and beat the consensus estimate of $1.61.

For full-year 2021, Ameren raised its EPS outlook to a range of $3.75 to $3.95. It previously anticipated EPS in the band of $3.65 to $3.85.

The company plans to distribute a quarterly cash dividend of $0.55 per share on December 31. Ameren stock currently offers a dividend yield of 2.53%.

With this in mind, we used TipRanks to take a look at the newly added risk factor for Ameren.

Risk Factors

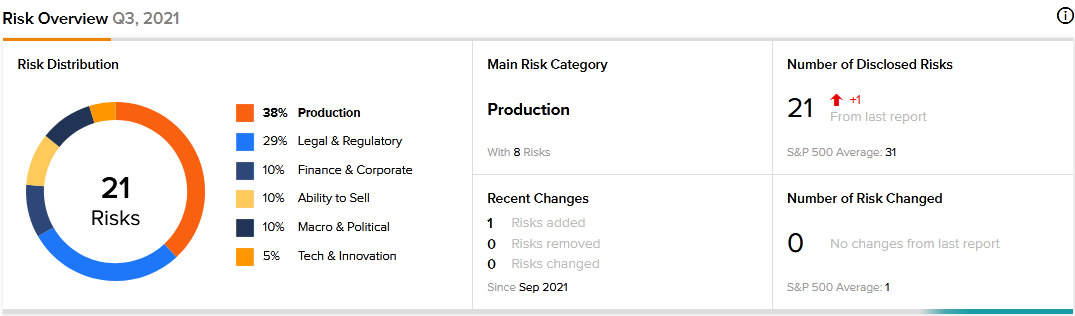

According to the new TipRanks Risk Factors tool, Ameren’s main risk category is Production, representing 38% of the total 21 risks identified for the stock. Legal and Regulatory and Finance and Corporate are the next two major risk categories at 29% and 10% of the total risks, respectively. Ameren recently updated its profile with one new Legal and Regulatory risk factor.

The company cautions that President Joe Biden’s COVID-19 vaccine mandate may have a material adverse impact on its operations and financial condition. It mentions that it may experience labor shortages as a result of its compliance with the requirement to get its employees vaccinated against COVID-19. Ameren warns that labor shortages may disrupt normal business operations and result in increased costs, which may weigh on its operating results and liquidity.

The Production risk factor’s sector average is 25%, compared to Ameren’s 38%. Ameren’s stock has gained about 13% since the beginning of 2021.

Analysts’ Take

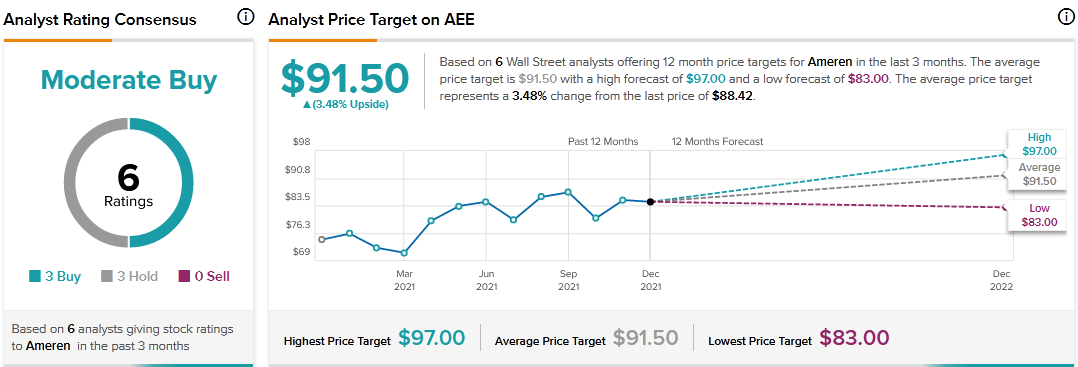

Morgan Stanley analyst Stephen Byrd recently reiterated a Hold rating on Ameren stock but raised the price target to $91 from $86. Byrd’s new price target suggests 2.92% upside potential.

Consensus among analysts is a Moderate Buy based on 3 Buys and 3 Holds. The average Ameren price target of $91.50 implies 3.48% upside potential to current levels.

Related News:

Curaleaf to Buy Bloom Dispensaries for $211M

Canadian Pacific Extends Multi-Year Contract with Canadian Tire

Arrival Commences Ground Trials of Electric Bus; Shares Rise