With volatility in the market likely to continue, TipRanks brings you the latest analyst action on some of your favorite stocks to help you navigate through the ups and downs. Let’s take a closer look at the top bullish and bearish calls of the day and see what market pundits are recommending.

Upgrades

1. Beach Energy Limited

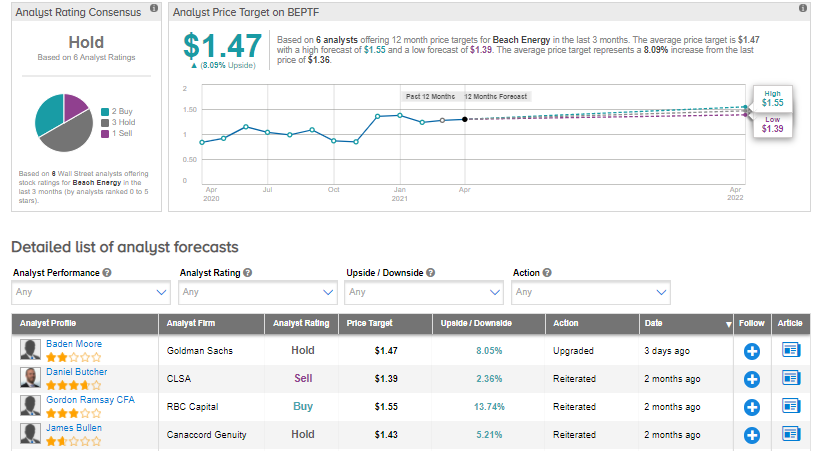

Goldman Sachs analyst Baden Moore upgraded Beach Energy (BEPTF) to Hold from Sell and increased the price target to A$1.90 from A$1.70 following the Otway Gas arbitration’s better-than-expected result.

The stock has a Hold consensus rating based on 2 Buys, 3 Holds, and 1 Sell. The average analyst price target of $1.47 implies 8% upside potential from current levels.

2. Simon Property Group

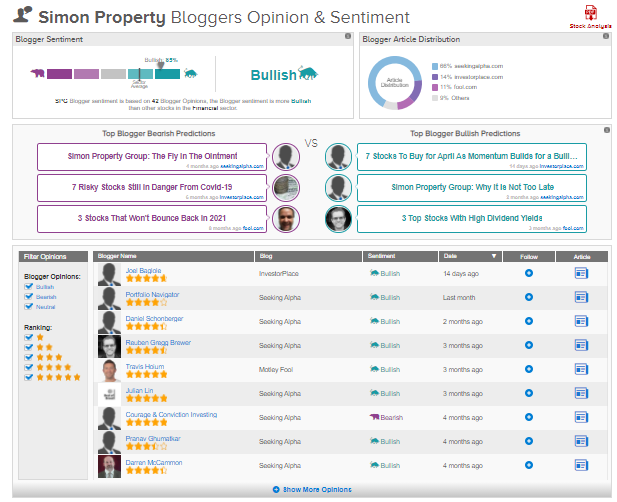

Jefferies analyst Jonathan Petersen upgraded Simon Property (SPG) to Buy from Hold and increased the price target to $130 from $112. Petersen believes “Trading at a 2x-2.5x turn discount to its 5y avg on consensus P/FFO (13.9x vs 2021:11.9x 2022: 11.3x), SPG’s valuation can grow. Occupancy & renewal spreads remain pressured NT, but retailer investments, pent-up consumer demand, and lower bad debt are positive catalysts, in addition to external growth opportunities. Achievable 2021 guidance, low 2022 consensus expectations (+4.8% Y/Y FFO/ps) augur potentially higher earnings revisions and multiple expansion.”

TipRanks data shows that financial blogger opinions are 85% Bullish compared to a sector average of 69%.

3. Nexa Resources SA

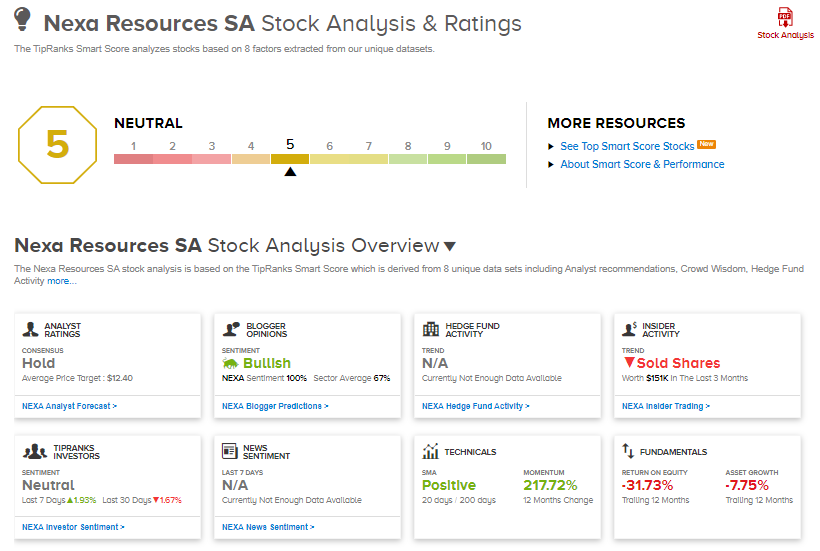

Credit Suisse analyst Caio Ribeiro upgraded Nexa Resources (NEXA) to Hold from Sell and increased the price target to $11 from $8.50 based on updated estimates and the company’s outlook for production, cash costs, and capex following the 4Q results.

According to TipRanks’ Smart Score system, Nexa gets a 5 out of 10, which indicates that the stock is likely to perform in line with market averages.

4. Sensata

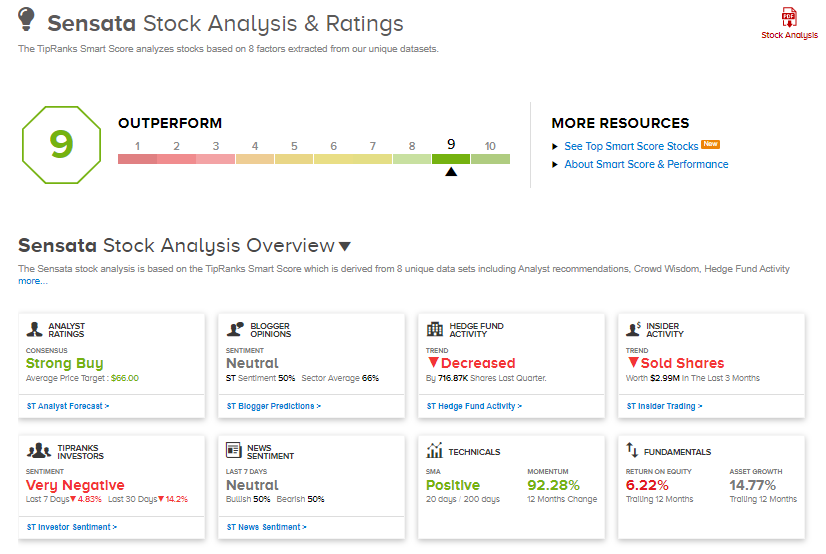

Evercore ISI analyst Amit Daryanani upgraded Sensata (ST) to Buy from Hold and increased the price target to $67 from $60. In a note to investors, Daryanani said that the company seems to have huge opportunities for growth as it focuses on moving customers towards “an electrified future” for auto and heavy vehicle and off road markets. Furthermore, according to the analyst, the recent underperformance of the stock and limited multiple expansions indicate upside potential.

Sensata scores a 9 of 10 from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

5. Affirm Holdings

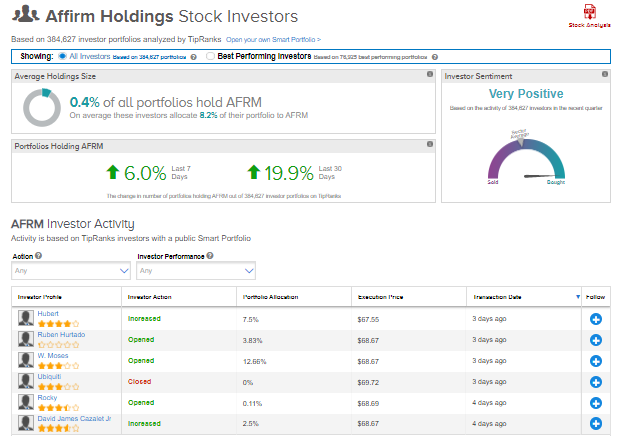

Seaport Global analyst Chris Brendler upgraded Affirm Holdings (AFRM) to Buy from Hold and maintained a price target of $80. According to Brendler, the pullback in stock over the last 10 weeks makes the company’s valuation “much closer” to its Australian competitor Afterpay, and the analyst believes that Buy Now Pay Later, or “BNPL” is “going to be huge” in the US. Therefore, based on “a string of encouraging data points,” the analyst anticipates the company to significantly outperform expectations in the near term.

TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on Affirm Holdings, with 19.9% of investors increasing their exposure to AFRM stock over the past 30 days.

Downgrades

1. Sonoco Products

Seaport Global analyst Salvator Tiano downgraded Sonoco Products (SON) to Hold from Buy based on the belief that the stock’s risk/reward will be “more balanced” in the coming period. Furthermore, following the 9% price appreciation so far this year, Tiano believes that the shares have “just too limited” upside potential.

TipRanks’ Hedge Fund Trading Activity tool shows that confidence in Sonoco Products is currently Very Negative, as 6 hedge funds decreased their cumulative holdings of the stock by 183,800 shares in the last quarter.

2. PPD

William Blair analyst John Kreger downgraded PPD (PPD) to Hold from Buy following Thermo Fisher’s announcement to acquire PPD in a cash deal worth $17.4 billion. According to Kreger, the deal has a high chance of closure as he believes that there will be no competitive bidders.

The rest of the Street is cautiously optimistic about the stock with a Moderate Buy consensus rating. That’s based on 3 Buys versus 7 Holds. The average analyst price target of $44.21 implies 4.5% downside potential to current levels.

3. Millicom International Cellular SA

Morgan Stanley analyst Cesar Medina downgraded Millicom International (TIGO) to Sell from Hold but increased the price target to SEK 340 from SEK 330 citing the company’s competition risk and less attractive risk-reward compared to its peers in Medina’s Latin America TMT coverage.

Despite the downgrade, according to TipRanks’ Smart Score system, Millicom gets a 4 out of 10 which indicates that the stock is likely to perform in line with market averages.

4. Discover Financial Services

BMO Capital analyst James Fotheringham downgraded Discover Financial Services (DFS) to Hold from Buy and maintained a price target of $105 citing the company’s “exclusively” valuation. In a note to investors Fotheringham said that the stock has doubled over the past year, and currently, is trading at or above historical averages.

TipRanks’ Stock Investors tool shows that investors currently have a Very Negative stance on Discover Financial, with 12.9% of investors decreasing their exposure to DFS stock over the past 30 days.

5. Kainos Group PLC

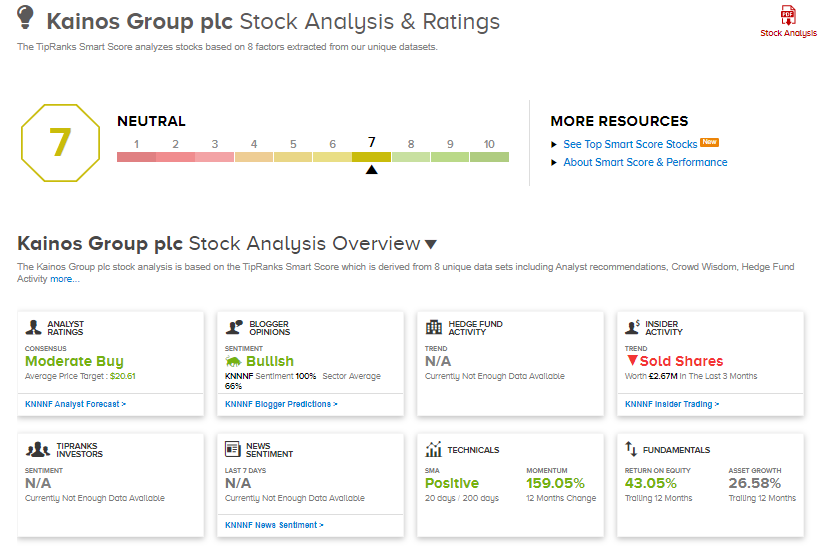

Canaccord Genuity analyst Kai Korschelt downgraded Kainos Group (KNNNF) to Hold from Buy but increased the price target to 1,685 GBP from 1,630 GBP. According to Korschelt, following the recent price appreciation, the stock has “limited room for a re-rating”. Furthermore, the analyst foresees the company’s earnings growth “taking a pause” over the next 12 months.

According to TipRanks’ Smart Score system, Kainos gets a 7 out of 10, which indicates that the stock is likely to perform in line with market averages.

Besides the above, you can also have a look at the following:

2 “Strong Buy” Momentum Stocks That Could Reach New Highs

Coinbase IPO: A Turning Point For Crypto

GameStop: Overvalued and Vulnerable to the Digital Threat

Dividend-Yield Calculator