With volatility likely to continue in the market, TipRanks brings you the latest analyst action on some of your favorite stocks to help you navigate through the ups and downs. Let’s take a closer look at the top bullish and bearish calls of the day and see what market pundits are recommending.

Upgrades

1. FedEx Corporation

KeyBanc analyst Todd Fowler upgraded FedEx Corp. (FDX) to Buy from Hold and maintained a price target of $350. Fowler cited strong B2C parcel volumes in 1Q, indicated by the proprietary Online Parcel Index, as the reason for the upgrade. Furthermore, the analyst believes that the persistence of positivity surrounding resilient airfreight dynamics, improving global economic activity, and rational pricing dynamics are likely to “more than offset” any significant impact of a return to in-person shopping and service spending.

FedEx scores a “Perfect 10” from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

2. Luminex Corporation

J.P. Morgan analyst Tycho Peterson upgraded Luminex Corp. (LMNX) to Hold from Sell and increased the price target to $37 from $22 following DiaSorin’s announcement to acquire Luminex for $37 per share in an all-cash deal worth $1.8 billion.

TipRanks’ Hedge Fund Trading Activity tool shows that confidence in Luminex is currently Neutral, as 4 hedge funds decreased their cumulative holdings of the stock by 1,400 shares in the last quarter.

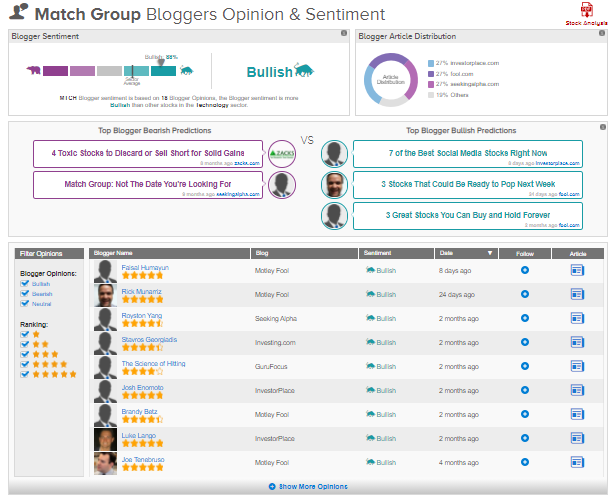

3. Match Group

BTIG analyst Jake Fuller upgraded Match Group (MTCH) to Buy from Hold considering the stock’s year-to-date pullback as the “immediate catalyst”. Furthermore, Fuller foresees upside potential to Match Group’s expectations for 2022-2025 based on re-opening tailwinds, new products, Hyperconnect acquisition, and upcoming brand/live streaming opportunities. The analyst maintained a price target of $175.

TipRanks data shows that financial blogger opinions are 88% Bullish on Match Group, compared to a sector average of 67%.

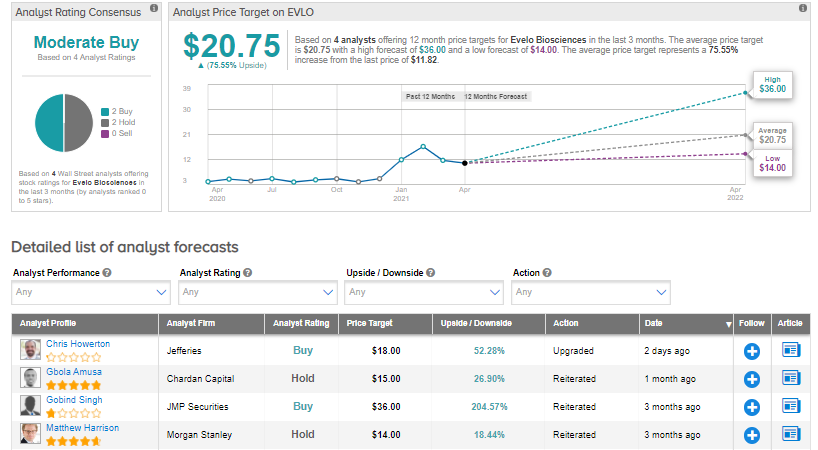

4. Evelo Biosciences Inc

Jefferies analyst Chris Howerton upgraded Evelo Biosciences (EVLO) to Buy from Hold and increased the price target to $18 from $11. Howerton cited expectations of strong execution on key programs and elevated microbiome space momentum as reasons for the upgrade. The analyst views “mounting evidence” of Evelo’s single strain microbe approach to “significantly impact” various inflammatory diseases. Furthermore, the analyst prefers the company’s risk/reward profile based on anticipated multiple major data releases over the next 6 to 12 months.

The Wall Street community is cautiously optimistic about the stock with a Moderate Buy consensus rating based on 2 Buys and 2 Holds. The average analyst price target of $20.75 implies 75.6% upside potential to current levels.

5. Cameco Corp

Cantor Fitzgerald analyst Mike Kozak upgraded Cameco (CCJ) to Buy from Hold and increased the price target to $18.50 from $15.75 following the company’s plan to restart its Cigar Lake mine. In a note to investors, Kozak said that though the company has not provided any production guidance for 2021 associated with the ramp-up of Cigar Lake, he anticipates Cameco to take a “slow and steady” approach.

TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on Cameco, with 13.5% of investors increasing their exposure to CCJ stock over the past 30 days.

Downgrades

1. Northwestern Corp.

Credit Suisse analyst Michael Weinstein W. downgraded Northwestern (NWE) to Hold from Buy but increased the price target to $66 from $60 based on the current valuation, which reflects recent outperformance of the stock.

According to TipRanks’ Smart Score system, Northwestern gets a 7 out of 10, which indicates that the stock is likely to perform in line with market averages.

2. Boingo Wireless Inc.

William Blair analyst Jim Breen downgraded Boingo Wireless (WIFI) to Hold from Buy as the go-shop period associated with the company’s deal to be acquired by Digital Colony expired. Breen said that Boingo specified in its filing last week the lack of further indications of interest during the go-shop period, which expired on April 2. Notably, the acquisition is likely to close in the second quarter, per the analyst.

TipRanks’ Stock Investors tool shows that investors currently have a Very Negative stance on Boingo Wireless, with 9.6% of investors decreasing their exposure to WIFI stock over the past 30 days.

3. Vistra Energy

Merrill Lynch analyst Julien Dumoulin Smith downgraded Vistra Energy (VST) to Hold from Buy based on the concerns related to Storm Uri’s impact on the company. Furthermore, according to Smith, the current upside potential in the shares is not adequate to support a positive stance.

TipRanks’ Hedge Fund Trading Activity tool shows that confidence in Vistra Energy is currently Negative, as 10 hedge funds decreased their cumulative holdings of the stock by 1.1 million shares in the last quarter.

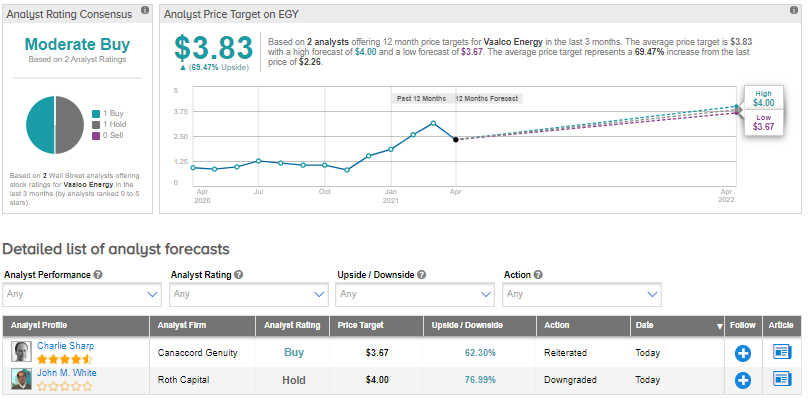

4. Vaalco Energy Inc

Roth Capital analyst John M. White downgraded Vaalco Energy (EGY) to Hold from Buy but maintained a price target of $4 following the company’s announcement of new CEO, George Maxwell, effective April 12. In a note to investors, White said that the change in management is a “total surprise as the departing CEO had a strong record in recent years.” Awaiting the company’s detailed plan on the management change and any update on prior business plans, the analyst has downgraded the shares “Out of caution”.

The Wall Street community is cautiously optimistic about the stock with a Moderate Buy consensus rating based on 1 Buy and 1 Hold. The average analyst price target of $3.83 implies 69.5% upside potential to current levels.

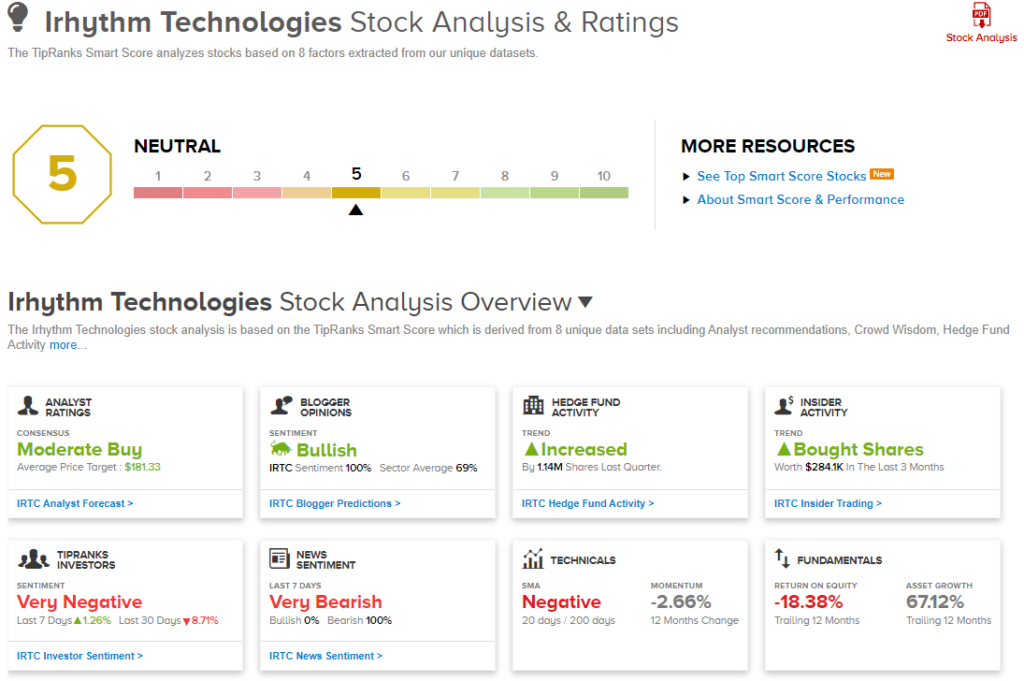

5. iRhythm Technologies

J.P. Morgan analyst Robbie Marcus downgraded iRhythm Technologies (IRTC) to Hold from Buy and decreased the price target to $95 from $215. Marcus’ action followed the publication of reimbursement rates by Medicare administrative contractor, Novitas Solutions, which indicates that rates are higher compared to January but “substantially lower” than the previous rate of $311, and are unprofitable to iRhythm. Though the analyst expects the current “short-sighted decision” by Novitas to be reversed, this is not anticipated in the near term, and therefore, he foresees a “challenging path” for the company.

According to TipRanks’ Smart Score system, iRhythm gets a 5 out of 10, which indicates that the stock is likely to perform in line with market averages.

Besides the above, you can also have a look at the following:

Alibaba: Long-Term Bullish Prospects Remain Intact, Says Top Analyst

The Dip in These 3 Stocks Is a ‘Buying Opportunity,’ Say Analysts

Nvidia Analyst Day Preview: What You Need to Know, According to RBC

Dividend-Yield Calculator