The volatility in the market remains elevated as the pace of economic recovery remains uncertain. Amid the uncertainty, TipRanks brings you the latest analyst action on some of your favorite stocks to help you navigate the volatility with ease. Let’s look into the top bullish and bearish calls of the day and see what top analysts are recommending.

Upgrades

1. Carnival

Argus Research analyst John Staszak upgraded Carnival (CCL) to Buy from Hold following the company’s guidance for 1Q earnings and advance bookings sequential growth of 90%, recorded earlier this week. According to Staszak, growth in the metric reflects the impact of rising demand for cruise vacations on the rolling out of coronavirus vaccines and the decreasing the impact of the pandemic. Furthermore, the analyst expects the sale of 19 less fuel-efficient ships to benefit Carnival in the latter part of 2021. Staszak maintained a price target of $33.

The Wall Street community is cautiously optimistic about the stock with a Moderate Buy consensus rating based on 6 Buys, 3 Holds, and 3 Sells. The average analyst price target of $28.57 implies 2.5% downside potential to current levels.

2. Harley-Davidson

Northcoast Research analyst Brandon Rolle upgraded Harley-Davidson (HOG) to Buy from Hold but maintained a price target of $49 based on his belief that the company is likely to beat earnings expectations for fiscal 2021, despite the likely impact of shipping challenges on first-quarter earnings. Rolle expects Harley-Davidson to record US retail sales growth in fiscal 2021 compared to fiscal 2019. Although the shipping issues disrupted growth in the second half of the first quarter, retail demand has remained “robust” through early April.

Harley-Davidson scores an 8 of 10 from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

3. Assertio Therapeutics

Gabelli analyst Kevin Kedra upgraded Assertio Therapeutics (ASRT) to Buy from Hold with a price target of $0.80. In a note to investors, Kedra said that the company’s current valuation looks “more compelling” following the sell-off in shares since 4Q earnings results were reported in March. Furthermore, Assertio’s restructuring efforts and focus on maximizing cash flow through its hub-focused business model seem like positive catalysts to the analyst.

TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on Assertio, with 4.5% of investors increasing their exposure to ASRT stock over the past 30 days.

4. Zimmer Biomet Holdings

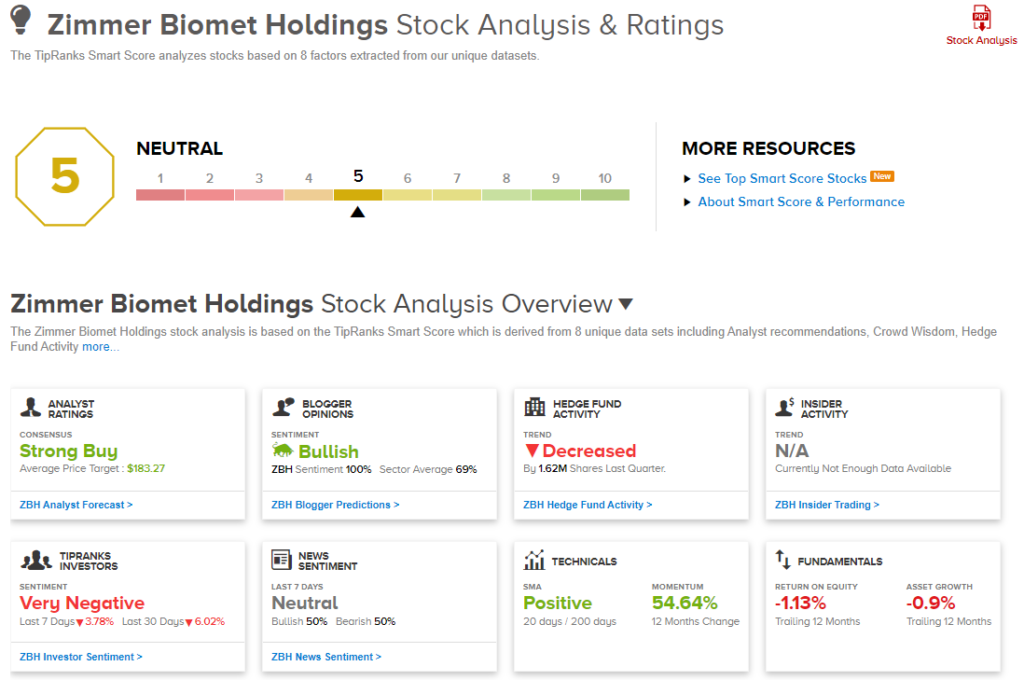

Northland Securities analyst Jason Wittes upgraded Zimmer Biomet Holdings (ZBH) to Hold from Sell and increased the price target to $200 from $165. Wittes said, “Big cap ships like ZBH take time to turn, so we have been cautious on when to upgrade, but our checks (on salesforce/products and docs) indicate that the path to mid-single digits (4-5%) thanks to ROSA adoption, a renewed commitment to innovation, and the selling off underperforming Dental and Spine and making way for M&A.”

According to TipRanks’ Smart Score system, Zimmer Biomet gets a 5 out of 10, which indicates that the stock is likely to perform in line with market averages.

5. Victory Capital Holdings

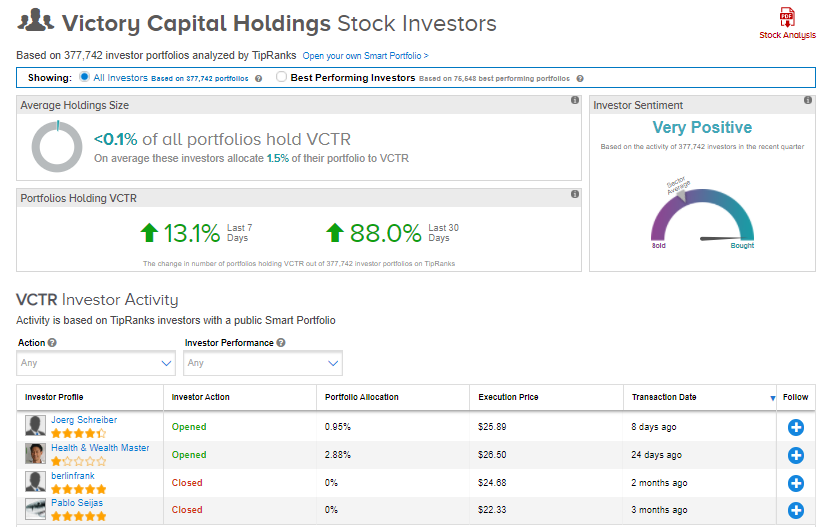

Merrill Lynch analyst Michael Carrier double-upgraded Victory Capital Holdings (VCTR) to Buy from Sell and increased the price target to $32 from $24. According to Carrier, the company’s recovering level of outflows, cost-control measures, efficient capital management, and attractive valuation are the reasons for the upgrade.

TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on Victory Capital, with 88% of investors increasing their exposure to VCTR stock over the past 30 days.

Downgrades

1. Azul SA

Goldman Sachs analyst Bruno Amorim downgraded Azul SA (AZUL) to Hold from Buy but increased the price target to $22.20 from $21.60 citing the current valuation. Amorim said that the shares seem fully priced following a “steep recovery” in demand for the coming period.

TipRanks’ Stock Investors tool shows that investors currently have a Very Negative stance on Azul, with 9.5% of investors decreasing their exposure to AZUL stock over the past 30 days.

2. Tufin Software Technologies Ltd

Oppenheimer analyst Ittai Kidron downgraded Tufin Software Technologies (TUFN) to Hold from Buy. Though Kidron expects Tufin “to meet near-term expectations,” he foresees “execution uncertainty coupled with an early transition to subscription and SaaS.”

Overall, the stock has a Hold consensus rating based on 4 Holds versus 1 Buy. The average analyst price target of $18 implies almost 77.9% upside potential from current levels.

3. Boise Cascade

D.A. Davidson analyst Kurt Yinger downgraded Boise Cascade (BCC) to Hold from Buy but increased the price target to $62 from $57. In a note to investors, Yinger said that the stock experienced a “strong run” since he upgraded the stock in February. Though rising commodity prices and expected increased supplemental dividends might reflect upside potential for estimates, the analyst doubts further multiple expansions from current levels with the price seemingly at an “unsustainable price level”.

According to TipRanks’ Smart Score system, Boise Cascade gets a 7 out of 10, which indicates that the stock is likely to perform in line with market averages.

4. The Supreme Cannabis Company

Stifel Nicolaus analyst Andrew Partheniou downgraded The Supreme Cannabis Company (SPRWF) to Sell from Buy and decreased the price target to C$0.40 from C$0.55 after the company agreed to be acquired by Canopy Growth in a transaction valued at $435 million on a fully-diluted basis. According to Partheniou, the deal is compelling and should be approved by investors.

TipRanks’ Stock Investors tool shows that investors currently have a Very Negative stance on The Supreme Cannabis Company, with 4.9% of investors decreasing their exposure to SPRWF stock over the past 30 days.

5. Solaris Oilfield Infrastructure Inc

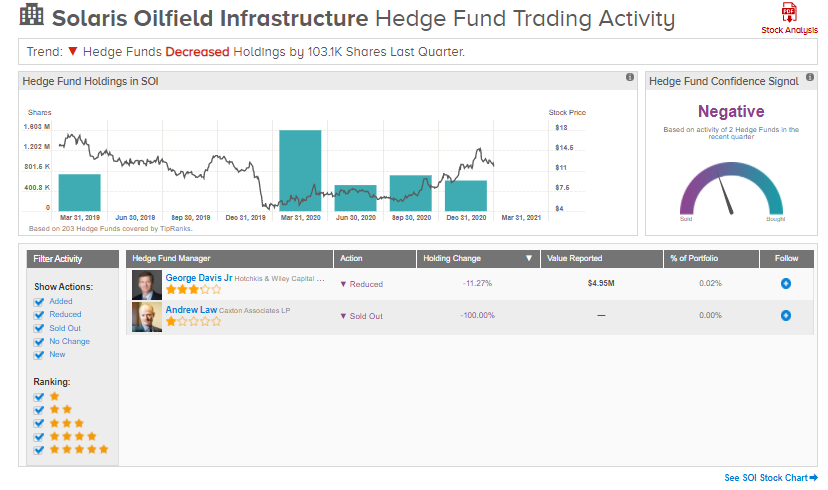

Cowen & Co. analyst Marc Bianchi downgraded Solaris Oilfield (SOI) to Hold from Buy and decreased the price target to $12 from $14 based on the assumption that terminal decline rates in discounted cash flow models depend on specific offerings and end market exposures.

TipRanks’ Hedge Fund Trading Activity tool shows that confidence in Solaris Oilfield is currently Negative, as 2 hedge funds decreased their cumulative holdings of the stock by 103,100 shares in the last quarter.

Besides the above, you can also have a look at the following:

XPeng to Produce Its Own Chips; Analyst Weighs In

Is Carnival Stock a Buy Right Now? This Is What You Need to Know

Bionano: Prenatal Testing Offers Another Opportunity for Saphyr, Says Analyst

Dividend-Yield Calculator