With volatility likely to continue in the market, TipRanks brings you the latest analyst action on some of your favorite stocks to help you navigate through the ups and downs. Let’s take a closer look at the top bullish and bearish calls of the day and see what the market pundits are recommending.

Upgrades

Goldman Sachs analyst Melissa Kuang upgraded Oversea-Chinese Banking Corp. (OVCHF) to Buy from Hold and increased the price target to S$14.30 from S$11.90 based on attractive valuation at current levels.

The consensus rating among analysts is a Moderate Buy based on 2 Buys and 1 Hold. The average analyst price target stands at $9.50 and implies upside potential of 6.6% to current levels.

Raymond James analyst Brian MacArthur upgraded Hudbay Minerals (HBM) to Buy from Hold and increased the price target to C$13.00 from C$12.50. In a note to investors, MacArthur said that based on pricing in the first quarter and current physical markets, he has raised expectations for base metal price in the near term. Furthermore, the analyst remains positive over the medium-term with the expectation of potential stimulus packages to escalate demand.

Additionally, Hudbay Minerals scores a 9 of 10 from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Scotiabank analyst Michael Doumet upgraded Toromont Industries (TMTNF) to Buy from Hold and increased the price target to C$115 from C$100. In a note to investors, Doumet said that Toromont “once again proved why its premium is warranted” in 2020. Furthermore, the analyst expects the company to record 40% growth in EPS through 2022 and continue to gain thereafter. Therefore, according to Doumet, buying the stock close to all-time highs is “the right move”.

The Wall Street community is cautiously optimistic about the stock with a Moderate Buy consensus rating. That’s based on 4 Buys versus 3 Holds. The average analyst price target of $79.88 implies that shares are almost fully valued at current levels.

Craig-Hallum analyst Alex Fuhrman upgraded BBQ Holdings (BBQ) to Buy from Hold and increased the price target to $15 from $5 following the release of better-than-expected quarterly results. According to Fuhrman, the company’s consecutive profitable quarters and acquisition of Granite City during the pandemic acted as positives. Furthermore, the analyst expects BBQ to perform even better with improved business models and record adjusted EBITDA over $10 million on easing of the pandemic in 2022 or early.

Additionally, TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on BBQ, with 23.4% of investors increasing their exposure to BBQ stock over the past 30 days.

Raymond James analyst Farooq Hamed upgraded First Quantum Minerals (FQVLF) to Buy from Hold and increased the price target to C$37 from C$35 reflecting near-term higher commodity price projections based on the first quarter’s pricing and tight physical markets. Additionally, the analyst foresees a rise in demand driven by potential stimulus packages over the medium term.

TipRanks data shows that financial blogger opinions are 100% Bullish, compared to a sector average of 66%.

Downgrades

J.P. Morgan analyst Kian Abouhossein downgraded Credit Suisse (CS) to Hold from Buy and decreased the price target to CHF 11 from CHF 12. The analyst cites the lack of clarity on the bank’s stance of bearing a $4.7 billion charge for its involvement with Archegos Capital Management and the fund’s recent fallout for the downgrade. Furthermore, Abouhossein believes that the bank’s move to slash the dividend and suspend share repurchases will put Credit Suisse at a disadvantage and expects CS shares to trade at “a material discount” to its peers in the near-term.

TipRanks’ Hedge Fund Trading Activity tool shows that confidence in Credit Suisse is currently Neutral, as 4 hedge funds decreased their cumulative holdings of the stock by 29,100 shares in the last quarter.

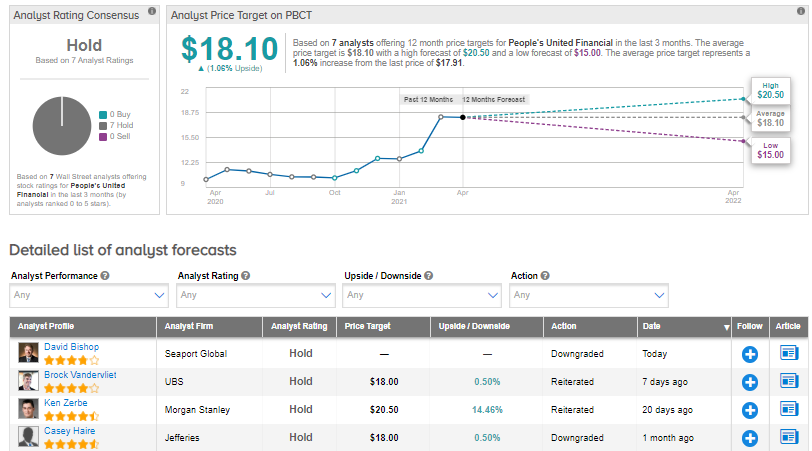

Seaport Global analyst David Bishop downgraded People’s United Financial (PBCT) to Hold from Buy reflecting the pending acquisition by M&T Bank.

Overall, the stock has a Hold consensus rating based on 7 unanimous Holds. The average analyst price target of $18.10 implies 1% upside potential from current levels.

Craig-Hallum analyst Jason Kreyer downgraded Leaf Group (LEAF) to Hold from Buy but increased the price target to $8.50 from $7.50 following Leaf Group’s intention to be acquired in an all-cash deal for $8.50 per share by Graham Holdings. Kreyer expects the acquisition to close soon and considers it to be the best strategic offer for shareholders.

TipRanks’ Stock Investors tool shows that investors currently have a Very Negative stance on LEAF, with 19.6% of investors decreasing their exposure to LEAF stock over the past 30 days.

Jefferies analyst Chris Howerton downgraded Acadia Pharmaceuticals (ACAD) to Hold from Buy and decreased the price target to $21 from $40 following the complete response letter (CRL) issued by the FDA rejecting the application for its antipsychotic drug, Pimavanserin.

According to TipRanks’ Smart Score system, ACAD gets a 1 out of 10 which indicates that the stock is likely to underperform market expectations.

KBW analyst Bose George downgraded PennyMac Financial (PFSI) to Hold from Buy and decreased the price target to $73 from $77 based on expectations of mortgage banking profitability to normalize in the near term. In a note to investors, George said that though 1Q was a “very strong” quarter, gain-on-sale margins are “normalizing quickly and could actually fall below historical troughs given the current competitive landscape.”

TipRanks’ Hedge Fund Trading Activity tool shows that confidence in PennyMac Financial is currently Neutral, as 7 hedge funds decreased their cumulative holdings of the stock by 130,800 shares in the last quarter.

Besides the above, you can also have a look at the following:

2 “Strong Buy” Stocks From RBC’s Top Analysts

Playboy Stock Is a Winner, But How Much Higher Can It Go?

Goldman Sachs Says These 3 Stocks Are Ready to Rip Higher

Dividend-Yield Calculator