The volatility in the market remains elevated as the pace of economic recovery remains uncertain. Amid the uncertainty, TipRanks brings you the latest analyst action on some of your favorite stocks to help you navigate the volatility with ease. Let’s look into the top bullish and bearish calls of the day and see what top analysts recommend.

Upgrades

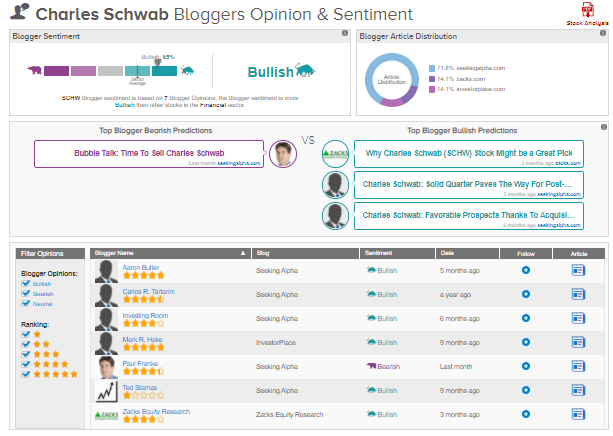

Wolfe Research analyst Steven Chubak upgraded Charles Schwab (SCHW) to Buy from Hold and maintained a price target of $87 based on his rate expectations and updated valuation framework.

Furthermore, TipRanks data shows that financial blogger opinions are 85% Bullish, compared to a sector average of 71%.

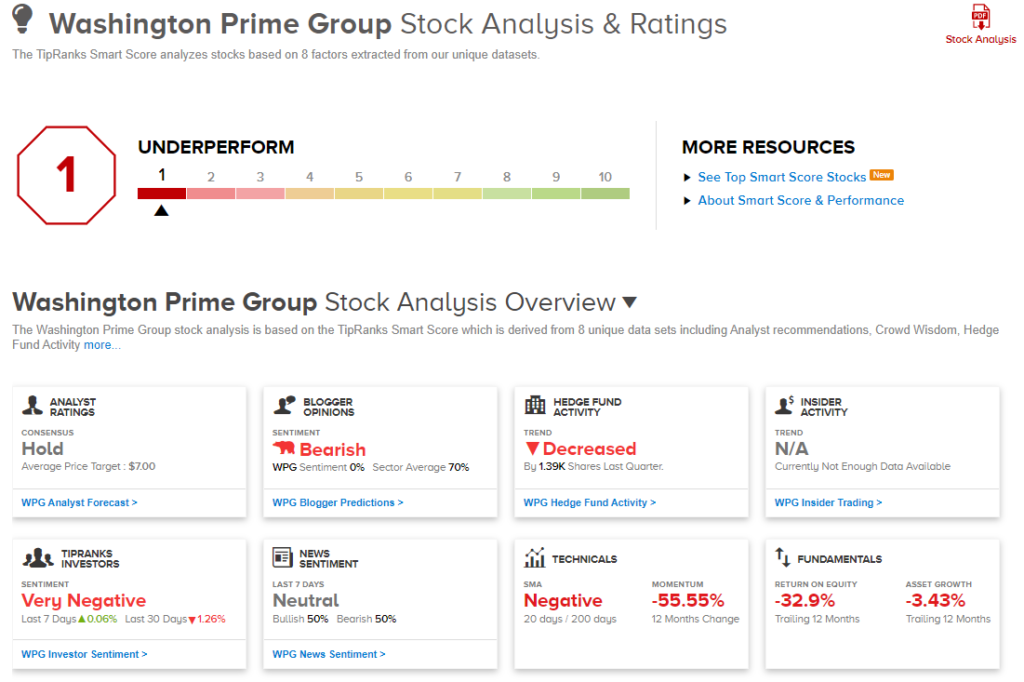

Truist Financial analyst Ki Bin Kim upgraded Washington Prime Group (WPG) to Hold from Sell. Kim prefers to be sidelined on the shares following the “rapid decline” in the stock price over the last two years, which has resulted in a low equity market cap and uncertainty over the company’s debt restructuring proceedings.

Despite the recent upgrade, according to TipRanks’ Smart Score system, WPG gets a 1 out of 10 which indicates that the stock is likely to underperform market expectations.

Roth Capital analyst Craig Irwin upgraded Acuity Brands (AYI) to Hold from Sell and lifted the price target to $165 from $150, following the “strong” fiscal 2Q results. Irwin argues that though the company is experiencing a decline in revenue, improvement in the construction environment is likely to be a tailwind.

TipRanks’ Hedge Fund Trading Activity tool shows that confidence in Acuity Brands is currently Neutral, as 8 hedge funds decreased their cumulative holdings of the stock by 239,900 shares in the last quarter.

Monness analyst Ryan Flanagan upgraded SailPoint Technologies (SAIL) to Buy from Hold and reiterated a price target of $64. Currently, Flanagan views an attractive entry point on the stock, given a significant fall in price from February highs. The analyst has become “incrementally more positive” on the Security Identity approach and considers SailPoint well-equipped in this “rising priority segment.”

Additionally, SailPoint scores an 8 of 10 from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

BMO Capital analyst John Kim upgraded Essex Property (ESS) to Buy from Hold and increased the price target to $310 from $275 “in conjunction with our Tracking Techies 1Q21 report.” According to Kim, “ESS has the highest exposure to Seattle and the Bay Area, the two markets with the largest job postings among 50 leading tech companies representing $11T in market cap.” The analyst foresees “ESS demonstrating greater pricing power beginning in 2H21 with occupancy stabilized, the economy reopening, and job growth accelerating in ESS’ markets.”

Additionally, TipRanks data shows that financial blogger opinions are 100% Bullish, compared to a sector average of 71%.

Downgrades

Raymond James analyst Danielle Brill downgraded Acadia Pharmaceuticals (ACAD) to Hold from Buy “given the added development risk, and projected timing of DRP launch,” which “is now 2024.”

According to TipRanks’ Smart Score system, Acadia gets a 1 out of 10 which indicates that the stock is likely to underperform market expectations.

Wolfe Research analyst Steven Chubak downgraded Citigroup (C) to Hold from Buy and maintained a price target of $76 based on his rate expectations and updated valuation framework.

TipRanks’ Stock Investors tool shows that investors currently have a Very Negative stance on Citigroup, with 4.5% of investors decreasing their exposure to C stock over the past 30 days.

KeyBanc analyst Leo Mariani downgraded Pioneer Natural (PXD) to Hold from Buy following the company’s acquisition of DoublePoint Energy for $6.4 billion, which he considers too expensive.

TipRanks’ Hedge Fund Trading Activity tool shows that confidence in Pioneer Natural is currently Neutral, as 10 hedge funds decreased their cumulative holdings of the stock by 161,800 shares in the last quarter.

Stifel Nicolaus analyst Nathan Jones downgraded AO Smith (AOS) to Hold from Buy and increased the price target to $67 from $65 based on the balanced risk/reward proposition for shareholders. Jones views steel inflation pressures and expected channel inventory destocking as offsetting factors against the company’s expectations of improved margins in China and “strong” growth in water quality products.

The Street’s consensus rating on the stock is a Hold. That’s based on 1 Buy and 4 Holds. Looking ahead, the average analyst price target stands at $66.75, putting the downside potential at 1.8% over the next 12 months.

Cowen & Co. analyst Helane Becker downgraded Fly Leasing (FLY) to Hold from Buy and maintained a price target of $17.05 citing the pending acquisition by Carlyle Aviation for $17.05 per share. In a note to investors, Becker said that the pending acquisition of Fly Leasing indicates limited upside in shares from the current level.

TipRanks’ Hedge Fund Trading Activity tool shows that confidence in Fly Leasing is currently Neutral, as 2 hedge funds decreased their cumulative holdings of the stock by 4,700 shares in the last quarter.

Besides the above, you can also have a look at the following:

Strong Q1 Delivery Numbers Could Make Tesla a $1,000 Stock, Says Analyst

2 Compelling Dividend Stocks Yielding at Least 8%; Oppenheimer Says ‘Buy’

Is XpresSpa Stock a Buy Right Now? This Is What You Need to Know

Dividend-Yield Calculator