The uncertainty regarding the pace of economic recovery has added to the volatility in the stock market. Amid volatility, TipRanks brings you the latest analyst action on some of your favorite stocks to help you navigate through the ups and downs. Let’s look into the top bullish and bearish calls of the day and see what the Wall Street experts are recommending.

Upgrades

Barclays analyst David E. Strauss upgraded Textron (TXT) to Buy from Hold and increased the price target to $68 from $52. The analyst views strength in several business jet indicators, which include young pre-owned inventory being “near all-time low levels,” recovery in aircraft utilization, and a firm survey of industry professionals. Therefore, Strauss lifted his 2022-2024 earnings estimates to reflect a higher estimate for Cessna deliveries. Furthermore, he expects the stock’s current discount to industrial peers to decrease over the coming year.

Overall, the Street has a cautiously optimistic outlook on the stock with a Moderate Buy consensus rating based on 2 Buys and 6 Holds. The average analyst price target of $52 implies downside potential of 7.3% to current levels.

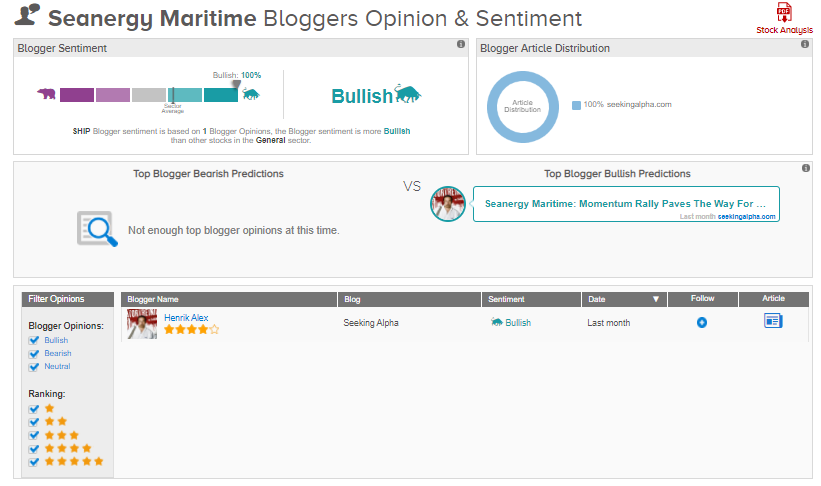

Noble Capital analyst Poe Fratt upgraded Seanergy Maritime (SHIP) to Buy from Hold. In a note to investors, Fratt said that he remains cautious on the stock due to Cape market volatility, but believes that the recent pullback in the share price creates an “attractive trading oriented opportunity.” The analyst maintained a price target of $1.50.

Furthermore, TipRanks data shows that financial blogger opinions are 100% Bullish, compared to a sector average of 64%.

CIBC analyst Robert Bek upgraded Telus (TU) to Buy from Hold and maintained a price target of C$28. In a note to investors, Bek said that the company’s C$1.3B equity raise is likely to speed up investments in infrastructure, which will be “a strong move” for Telus to expand its reach, improve efficiencies, and gain from “material potential changes in the competitive dynamic in the West.”

On TipRanks’ Smart Score ranking, Telus scores a 9 of 10, indicating that the stock has strong potential to outperform market expectations.

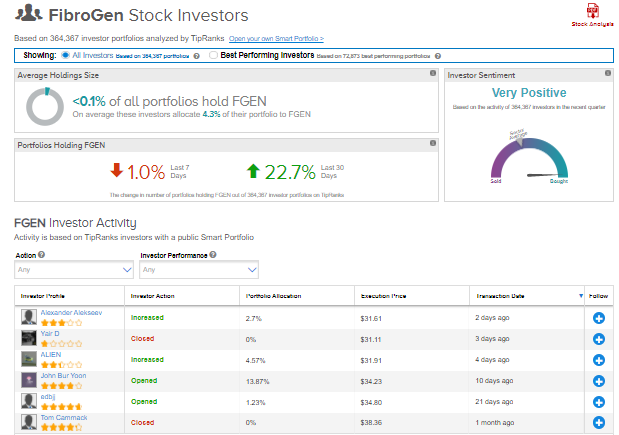

Merrill Lynch analyst Jason Gerberry upgraded FibroGen (FGEN) to Buy from Hold and reiterated a price target of $47. With roxadustat approval seen as “still most likely,” Gerberry views a favorable risk/reward profile. Furthermore, the analyst expects about 20% upside to the current share price despite the absence of NDD sales in the US or EU.

Furthermore, TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on FibroGen, with 22.7% of investors increasing their exposure to FGEN stock over the past 30 days.

Canaccord Genuity analyst Michael Walkley upgraded BlackBerry (BB) to Hold from Sell but decreased the price target to $9 from $10. In a note to investors, Walkley said that the company reported lower than expected 4Q results due to licensing headwinds as the company is in ongoing discussions for the sale of part of its mobile device patent portfolio. The analyst believes that finalization of the deal to sell the licensing business could help “unlock value and provide a capital infusion to drive accelerated software and services growth.” Furthermore, Walkley expects software and services fundamentals to improve during fiscal 2022.

TipRanks data shows that financial blogger opinions are 78% Bullish, compared to a sector average of 69%.

Downgrades

Sidoti analyst Anja Soderstrom downgraded Plexus (PLXS) to Hold from Buy. The analyst cited valuation for the downgrade with the view that the shares currently price in the company’s fiscal 2022 earnings potential. Soderstrom maintained a price target of $94 on the stock.

TipRanks’ Hedge Fund Trading Activity tool shows that confidence in Plexus is currently Neutral as 5 hedge funds increased their cumulative holdings of the stock by 13,400 shares in the last quarter.

Williams Financial analyst Sean Milligan downgraded Romeo Power (RMO) to Hold from Buy after the company’s disappointing first earnings call as a public company. Milligan said, “Very few shows that start this bad, end well.” He further added Romeo’s first call was “terrible from a supply chain and messaging perspective.” Milligan believes that the company is “situated poorly” between cell manufacturers and larger original equipment manufacturer players. The analyst reiterated a price target of $6.70.

Overall, the stock has a Hold consensus rating based on 1 Buy, 1 Hold, and 1 Sell. The average analyst price target of $10.57 implies 26.9% upside potential from current levels.

Stephens analyst Jack Atkins downgraded US Xpress Enterprises (USX) to Hold from Buy and increased the price target to $13 from $10, to reflect a balanced risk/reward profile of the company, following the 74% rally in shares since the beginning of 2021. Atkins believes that US Xpress seems likely to beat its goal of 900 seated Variant trucks by the end of 1Q, but he foresees “another potential miss” versus expectations. Furthermore, the analyst does not foresee “any clear profitability impact from the new Variant fleet.” According to Atkins, a “clear sign” of the company’s technology investments in both the asset and non-asset businesses to help in navigating through this cycle in a better way is lacking.

TipRanks’ Stock Investors tool shows that investors currently have a Very Negative stance on US Xpress, with 4.1% of investors decreasing their exposure to USX stock over the past 30 days.

Goldman Sachs analyst Shinichiro Nakamura downgraded Japan Post Bank (JPSTF) to Sell from Hold and increased the price target to ¥1,040 from ¥840. In a note to investors, Nakamura said that the company has limited upside potential from current levels and a lack of additional catalysts.

The Wall Street community is bearish on the stock with a Moderate Sell consensus rating based on 1 Hold and 1 Sell. The average analyst price target of $9.61 implies that shares are almost fully valued at current levels.

Stephens analyst Jack Atkins downgraded Schneider National (SNDR) to Hold from Buy and lifted the price target to $27 from $25, as he currently views the company as having a balanced risk/reward profile following the 22% rally in the shares since the beginning of 2021. Over the next 12-18 months, Atkins believes that Schneider’s multi-modal platform positions the company well to gain from later cycle modes like Brokerage and Intermodal, but considers the stock to be fairly valued at current levels.

Despite the downgrade, TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on Schneider, with 5.7% of investors increasing their exposure to SNDR stock over the past 30 days.

Besides the above, you can also have a look at the following:

Keep on Buying These 3 EV Stocks, Says Analyst Following Conference

3 Monster Growth Stocks That Could Soar Higher

NIO: Recent Pullback Spells Opportunity

Dividend-Yield Calculator