Healthcare giant UnitedHealth (UNH) has reported its second quarter earning results with Q2 Non-GAAP EPS of $7.12 beating Street estimates by $1.88. Similarly GAAP EPS of $6.91 easily topped consensus expectations by $1.73.

However revenue of $62.14B fell short of estimates by $1.4B, despite rising 2.5% year-over-year, as growth in serving public-sector and senior programs was partially offset by commercial enrollment declines.

According to UNH earnings were substantially higher than anticipated due primarily to the unprecedented, temporary deferral of care in the company’s risk-based businesses. UNH expects these results will be offset in the quarters ahead by the assistance measures already taken, the resumption of deferred care and future COVID-19 cost and economic impacts.

Encouragingly, Optum second quarter revenues and operating earnings of $32.7 billion and $2.2 billion surged from $28 billion and $2.1 billion a year ago, led by earnings growth at OptumHealth. Indeed, OptumHealth served approximately 97 million people in the second quarter, compared to 95 million a year ago, while revenue per consumer served grew 25% year-over-year driven by continued growth in value-based care arrangements.

Meanwhile UnitedHealthcare public-sector and senior program revenue, including Medicare and Medicaid, grew by 7% year-over-year in the quarter and by nearly 600,000 additional people served year to date, while commercial revenue was impacted by economic-driven member attrition.

As the pandemic advanced, access to and demand for care was most constrained from mid-March through April, began to recover in May and approached more typical levels by the end of the second quarter, UNH said. Indeed, due to the Covid-19 related deferral of care, the Q2 medical care ratio declined to 70.2% from 83.1% last year.

Cash flows from operations were $10 billion or 1.5 times net income in the second quarter and $12.9 billion or 1.3 times net income year to date. At the same time, the operating cost ratio of 16.1% in the second quarter of 2020 increased from 13.9% in the same period last year, primarily due to the health insurance tax, COVID-19 response efforts and business mix.

Looking ahead, the company stuck to its 2020 earnings per share outlook of net earnings of $15.45 to $15.75 per share and adjusted net earnings of $16.25 to $16.55 per share.

During the second quarter, UNH returned $1.2 billion to shareholders via dividends, while the debt to total capital ratio was 40.9% at quarter end. “Return on equity of 33.7% for the first half of 2020 reflects continued strong core operating performance and the temporary impact of care deferrals experienced during the second quarter 2020” the company stated.

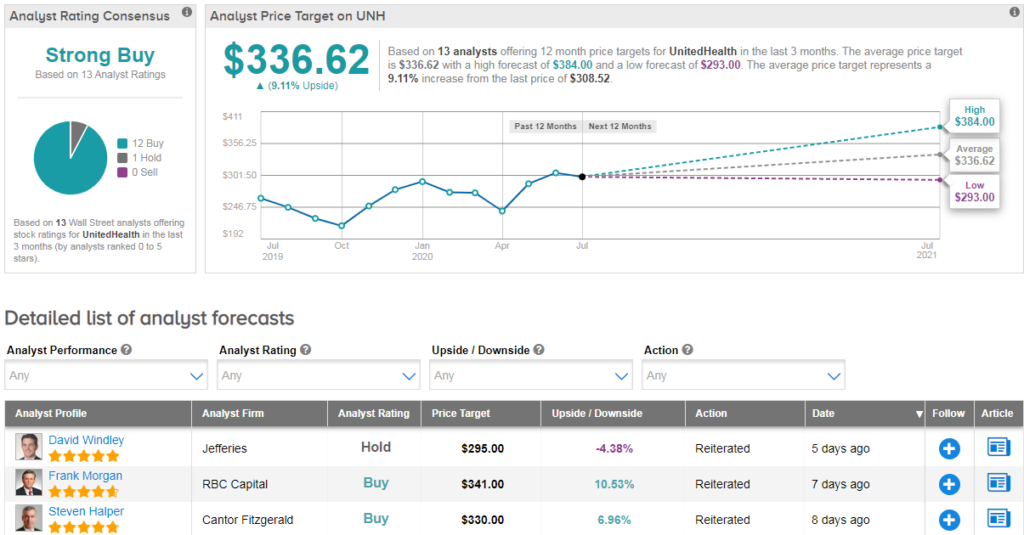

Shares in UNH have climbed 5% year-to-date, and the stock has a bullish Strong Buy Street consensus. That’s with an average analyst price target of $337 (9% upside potential). Shares are currently flat in Wednesday’s pre-market trading. (See UnitedHealth stock analysis on TipRanks).

Related News:

Boston Scientific Mulls Billion-Dollar Snake Venom Sale- Report

Abbott Labs, Edwards Lifesciences Settle Heart Device Patent Disputes

Akebia Initiates Vadadustat Study In Covid-19 Patients