Ulta Beauty, Inc. (ULTA) reported stronger-than-expected Q1 results, topping analysts’ expectations driven by strong momentum in sales trends, market share gains, and overall consumer sentiment. Shares of the largest U.S. beauty retailer have gained 41.2% over the past year.

The company reported EPS of $4.10, beating analysts’ estimates of $1.93 per share. The company reported a loss of $1.39 per share in the same quarter last year.

Net sales of $1.9 billion exceeded the consensus estimate of $1.64 billion growing 65.2% on a year-over-year basis attributable to better consumer confidence, government stimulus, and the easing of COVID-19 restrictions.

Comp sales jumped 65.9% versus a decline of 35.3% in the prior-year quarter. This reflects a 52.5% increase in transactions and an 8.8% increase in average ticket sales. Comp sales grew 7% in the prior-year quarter. (See Ulta Beauty stock analysis on TipRanks).

Following the robust Q1 results, management raised the financial guidance for FY2021. Sales are now expected to range between $7.7 billion and $7.8 billion versus the prior guidance range of $7.2 – $7.3 billion.

Comparable sales are forecast to increase by 23% – 25% versus prior guidance of an increase of between 15% and 17%. EPS is expected to be in the range of $11.50 to $11.95, up from the prior forecast range of $8.85 – $9.30.

Ulta Beauty’s President Dave Kimbell commented, “As increasing consumer confidence, the relaxation of restrictions, and a desire for newness drive increased engagement with the beauty category, our differentiated model, combined with our ongoing efforts to create meaningful guest connections, position us well to lead through the category recovery.”

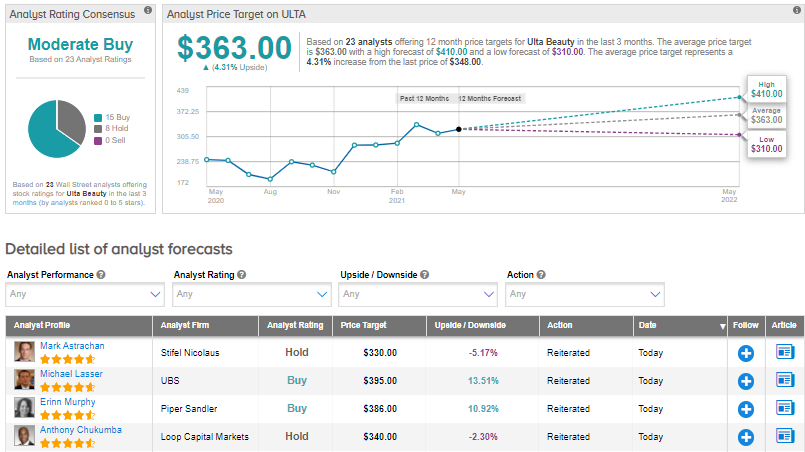

Following the earnings announcement, Piper Sandler analyst Erinn Murphy reiterated a Buy rating and increased the price target on the stock from $361 to $386 (10.9% upside potential.)

Murphy was impressed by the upbeat Q1 results including strong sales and margins which reached the highest levels ever recorded in the company’s history.

Overall, the stock has a Moderate Buy consensus rating based on 15 Buys and 8 Holds. The average analyst price target of $363 implies 4.3% upside potential from current levels.

Related News:

Nutanix Posts Smaller-Than-Feared Quarterly Loss, Revenue Beats Estimates

Medtronic Posts a Blowout Quarter as Revenue Outperforms, Bumps up Dividend

Sanofi and GSK Commence Phase 3 Study of COVID-19 Vaccine Candidate