TripAdvisor (TRIP) said on Monday that it is expecting second-quarter revenue year-on-year performance to be “materially worse” than in the previous quarter sending shares down almost 5%.

The stock declined 4.8% to $17.30 in morning U.S. trading. The online travel site said it estimates to post an adjusted EBITDA loss of about $85 million for the quarter ended June 30. Revenue in June is expected to be down about 80% compared with the same period last year due to the stringent travel restrictions tied to the coronavirus pandemic.

Looking ahead, TripAdvisor expects to see some sequential quarter-over-quarter revenue improvement starting in the third quarter.

Even though, the travel site’s monthly unique users are still down significantly year-over-year, the numbers have improved since April. In April and May monthly unique users were about 33% and 45% of last year’s comparable period, respectively, and May monthly unique users increased about 38% versus April. Based on June trends so far, the company expects year-over-year monthly unique user performance will improve versus May.

As of May 31, TripAdvisor had $693 million of cash and cash equivalents, which represents a decline of $105 million from March 31.

As a result of cost reduction measures implemented so far this year, the online site said it has “sufficient liquidity to withstand an extended period of revenue disruption” and remains confident in its ability to meet its debt covenants through 2021.

TripAdvisor expects to release financial results for the second quarter ended June 30 in early August.

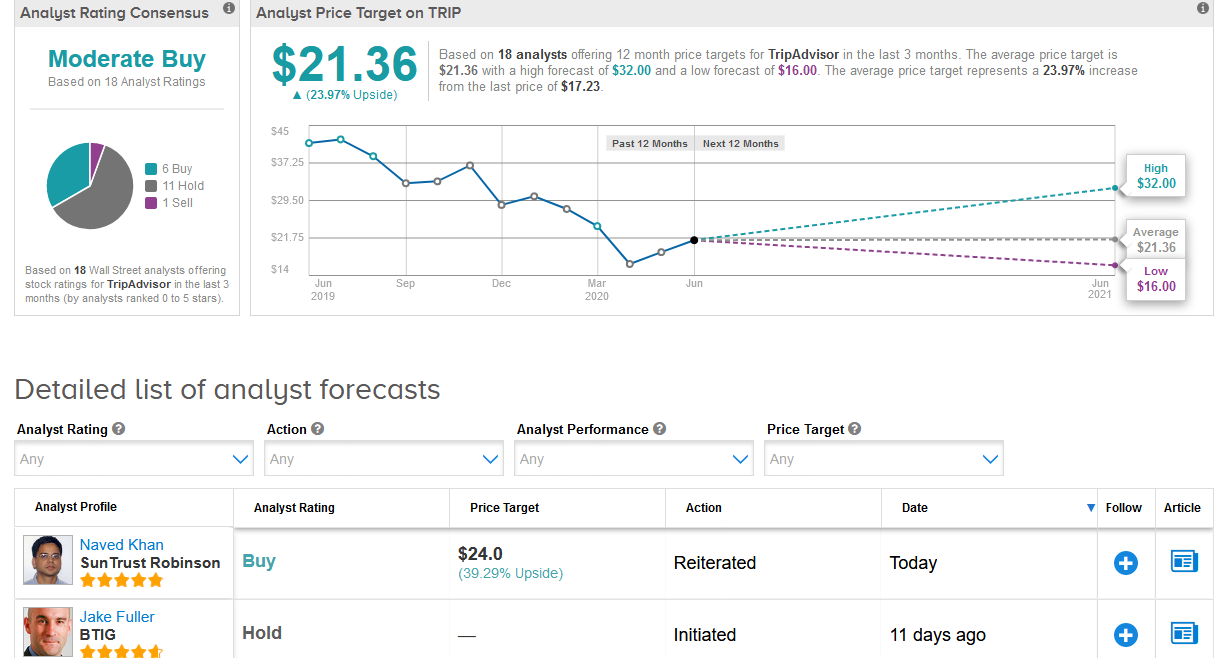

Shares in TripAdvisor have dropped some 37% so far this year. Based on the $21.36 average price target, analysts expect shares to advance by 24% over the coming 12 months. (See TRIP stock analysis on TipRanks).

Meanwhile, five-star analyst Jake Fuller at BTIG, who this month initiated the stock’s coverage with a Hold rating expects 2Q revenue to be down by 90-95%.

Following “aggressive cost cuts,” and a halt on marketing, the analyst believes TRIP will report an EBITDA loss of between $85-90 million for the quarter.

“It is hard to say what recovery might look like,” Fuller wrote in a note to investors. “We default to a U-shape given the economic fall-out, second wave fears and distancing restrictions impacting flights, accommodations and events.”

“We also note that a pivot towards experiences and dining holds promise, but we are not convinced in TRIP’s ability to execute,” the analyst added.

Overall, the stock’s Moderate Buy analyst consensus is based on 6 Buy ratings versus 11 Hold ratings and 1 Sell rating.

Related News:

Global Airlines Are Set To Lose $84.3 Billion In 2020, IATA Says

United Airlines Secures $5 Billion Loan To Shore Up $17 Billion Liquidity Chest

Airbus Gets No New Aircraft Orders In May Amid Aviation Crisis