Transat AT (TRZ) shares jumped by nearly 6% Thursday morning after the international tourism company announced it had reached a deal with the Government of Canada to borrow up to C$700 million in emergency loans. Transat will use part of the funds to reimburse clients whose travel plans had been canceled.

Of the C$700 million, C$390 million will be used to maintain Transat’s operations, while up to C$310 million will be used to compensate travelers scheduled to depart on or after February 1 but had a travel credit issued instead due to the health crisis. The company issued 13 million warrants to the government to purchase Transat shares at an exercise price of C$4.50 per share as part of the financing.

Transat’s President and CEO Jean-Marc Eustache said, “With this support, we now look forward to resuming operations as soon as safe travel is possible and travel restrictions can be lifted. We will then be able to implement our plan to make Transat a solid and profitable company once again, one that will continue to symbolize leisure travel for its many customers in Quebec and elsewhere. The funds obtained will also enable us to reimburse our customers whose travel had to be canceled due to the pandemic under conditions that are sustainable for the company, which we welcome.”

The airline agreed to restrictions on dividends, share buybacks, and executive compensation. The agreement also forces the company to maintain the same current level of employment. (See Transat AT stock analysis on TipRanks)

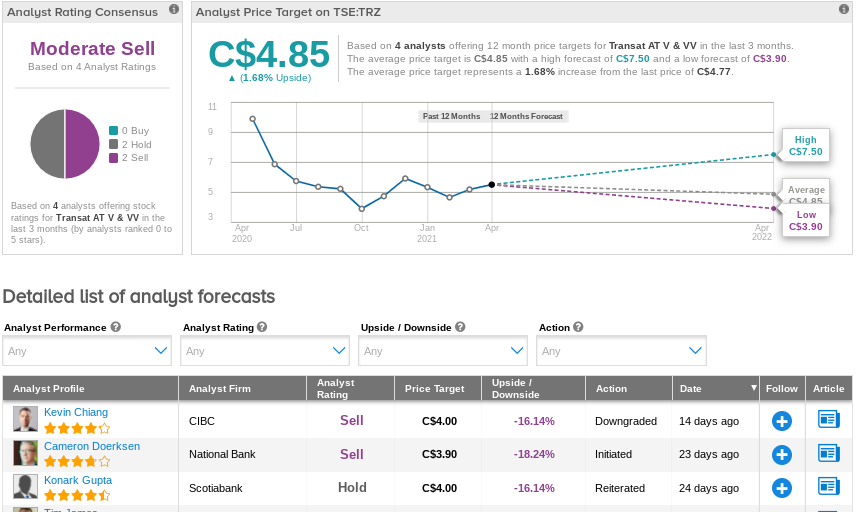

Two weeks ago, CIBC analyst Kevin Chiang downgraded the stock to a Sell rating with a C$4.00 price target (16% downside potential).

Chiang stated, “While its stock price has reset after the end of its arrangement agreement with Air Canada, it has held in better than we would have anticipated. While media reports point to a $5/share bid from [Canadian media executive] Pierre Karl Péladeau, we do not view this as sufficient upside given that the stock is trading 10 percent from this level. We also view this potential bid as the glass ceiling for the stock since other potential bidders have stated they are no longer looking at TRZ.”

Overall, the consensus is that TRZ is a Moderate Sell based on 2 Holds and 2 Sells. The average analyst price target of C$4.85 implies an upside potential of about 1.7% to current levels. Shares are down more than 50% over one year.

Related News:

Newmont Earnings And Revenue Miss Estimates In 1Q; Shares Plunge 3%

BCE’s 1Q Earnings And Revenue Beat Estimates

Waste Connections Posts Better-Than-Expected Results In 1Q