The U.S. District Court for the District of New Jersey has ruled in favor of Teva Pharmaceutical Industries Ltd. (TEVA) in a patent infringement lawsuit regarding a generic version of Narcan nasal spray for the treatment of opioid overdose.

Claims from four patents related to Narcan were found to be invalid, according to the ruling by a New Jersey federal judge. The lawsuit, filed by Opiant Pharmaceuticals Inc. (OPNT) and Emergent BioSolutions Inc. (EBS) alleged that Teva’s generic version of Narcan nasal spray infringes the drug’s patent.

In reaction to the decision, Opiant said that its commercial partner Emergent BioSolutions, intends to appeal the decision at the Court of Appeals for the Federal Circuit.

Narcan, a life-saving medication that can stop or reverse the effects of opioid overdose, was developed by Opiant and licensed to Adapt Pharma, which was has been bought by Emergent BioSolutions. Since 1999, more than 400,000 Americans have died from opioid overdoses, according to statistics from the Centers for Disease Control and Prevention.

“While we are disappointed by the decision today, we are mindful of the important role Narcan nasal spray plays across the U.S. in helping our communities save lives from opioid overdose,” said Opiant President and CEO Roger Crystal. “With our pipeline and strong financial position, we remain committed to develop best-in-class medicines for addiction and overdose.”

Back in April 2019, Teva was given FDA approval for the first generic naloxone hydrochloride nasal spray, commonly known as Narcan.

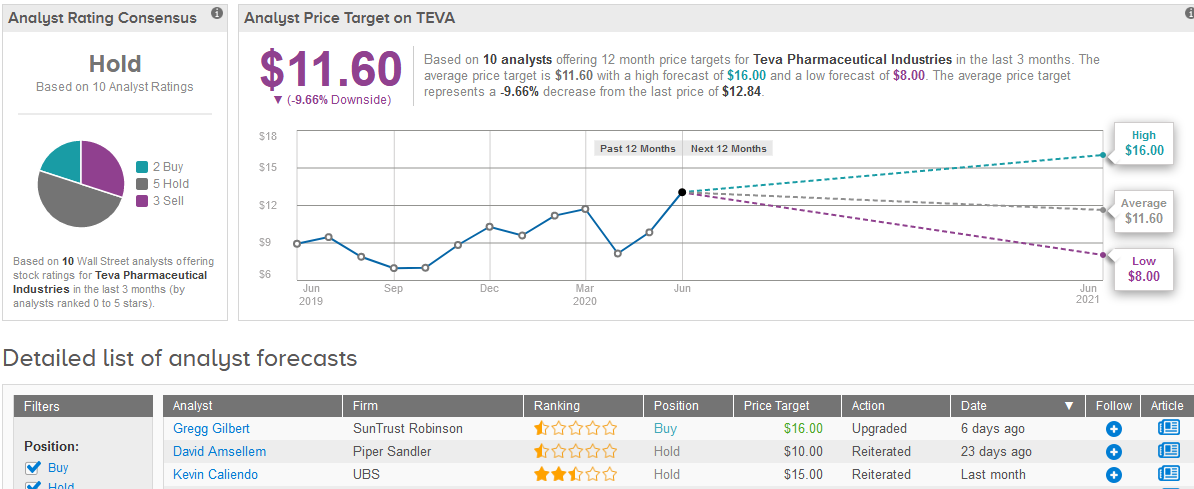

Teva shares rose 2.1% to $12.84 in after-market trading on Friday. The stock’s value has almost doubled since reaching a low in March and is now trading 34% higher than at the start of the year.

This month, SunTrust Robinson analyst Gregg Gilbert raised Teva to Buy from Hold with a price target of $16, up from $11.

Gilbert asserted that he had previously kept a neutral view on the stock amid investor skepticism regarding the generic drugmaker’s long-term targets and its ability to manage its opioid and collusion liabilities.

“The evidence regarding Teva’s ability to achieve its leverage and margin targets is growing, with some potential for clarification about the size and timing of liabilities becoming clearer in the coming months,” Gilbert wrote in a note to investors.

Overall though Wall Street analysts are mainly sidelined on the stock. The Hold consensus shows 5 Hold ratings and 3 Sell ratings versus 2 Buy ratings. In view of the recent rally, the $11.60 average price target implies 10% downside potential in the shares in the coming year. (See Teva stock analysis on TipRanks).

Related News:

Novavax Spikes 31% on $384 Million Cash Injection for Vaccine Production

Moderna’s (MRNA) Stock Will Surge 80% From Current Levels, Says Analyst

Think Novavax Has Surged Enough for Now? Think Again, Says 5-Star Analyst