Teck Resources (TECK.B) shares plunged more than 3% Wednesday despite the company reporting better-than-expected earnings and revenue in its first quarter.

The Canadian miner revenue came in at C$2.55 billion in the quarter ended March 31, an increase of 7% from $C2.38 billion in the first quarter of 2020.

Meanwhile, 1Q 2021 profit was C$305 million (C$0.57 per share), compared to a loss of C$312 million (C$0.57 per share) in 1Q 2020. Higher copper prices drove the rise in profit. On an adjusted basis, Teck Resources earned C$0.61 per share in the first quarter, up 259% from C$0.17 per share a year ago.

Analysts on average expected EPS of C$0.4945 based on revenue of C$2.08 billion.

Teck Resources’ President and CEO Don Lindsay said, “Strong first quarter operational performance, in line with plan, and higher commodity prices contributed to a very solid start to 2021. We achieved major milestones for our priority projects, including surpassing the halfway point at our flagship QB2 copper growth project and moving into the commissioning phase of our Neptune steelmaking coal terminal upgrade. We remain absolutely focused on implementing the necessary protocols to mitigate transmission of COVID-19 and protect the health and safety of our people and local communities.”

The average realized price for copper rose 54% to $3.92 per pound in the first quarter, while sales were 67,000 tonnes from 73,000 tonnes a year earlier. (See Teck Resources stock analysis on TipRanks.)

Yesterday, BMO Capital analyst Jackie Przybylowski maintained a Hold rating on the stock with a $25.78 (C$32.00) price target with 17% upside potential.

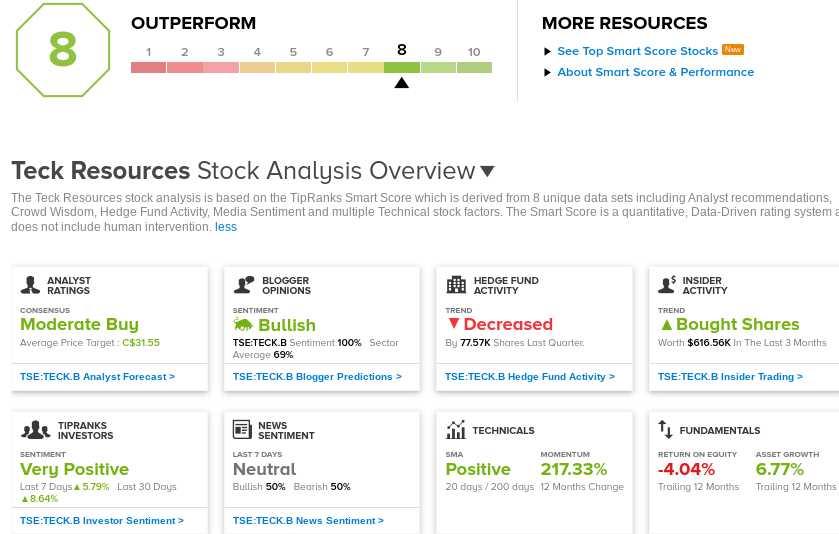

Overall, the consensus on the Street is that TECK.B is a Moderate Buy based on 9 Buys and 6 Holds. The average analyst price target of C$31.55 implies an upside potential of approximately 16% from current levels. Shares have risen by more than 170% in the last year.

TECK.B scores an 8 out of 10 on the TipRanks Smart Score rating system, indicating that the stock has strong potential to outperform the overall market.

Related News:

CGI’s Profit Rises To C$341.2M In 2Q

TFI International Posts Better-Than-Expected Results In 1Q

FirstService 1Q Results Beat Expectations; Shares Rise 2%