Shares of Toronto-Dominion Bank (TD) fell nearly 1% in early trading Thursday even after Canada’s largest bank posted better-than-expected earnings in its second quarter. Quarterly profit more than doubled from a year ago as the bank released some reserves for credit losses and earned higher revenue from fees.

Profit came in at C$3.7 billion (C$1.99 per diluted share) for Q2 2021, up from a profit of C$1.5 billion (C$0.80 per share) in Q2 2020. On an adjusted basis, TD earned C$2.04 per diluted share in its latest quarter, up from C$0.85 per diluted share in the prior-year quarter. The consensus was for adjusted earnings of C$1.76 per share.

Revenue totaled C$10.2 billion, down 2.9% from C$10.5 billion a year ago. Analysts expected revenue of C$10.27 billion.

Profit increased in all TD’s major divisions, especially in its U.S. retail business, where net income climbed 292% year-on-year to C$1.3 billion.

Meanwhile, Canadian retail operations saw net income soar 86% year-on-year to C$2.2 billion.

The bank’s banking unit managed to post an 83% increase in net income to C$383 million, mainly due to a release of C$63 million in provisions for credit losses. (See Toronto-Dominion Bank stock analysis on TipRanks)

TD Bank Group President and CEO Bharat Masranai said, “TD reported strong results in the second quarter, reflecting the underlying strength of our diversified businesses, improving economic conditions, and our prudent approach to managing risk. We continued to invest in our people, capabilities, and technology to position our business for growth as economies re-open and consumer and business activity recovers.”

Following the results, Canaccord Genuity analyst Scott Chan maintained a Hold rating on the stock and a C$89.50 price target, for 1.6% upside potential.

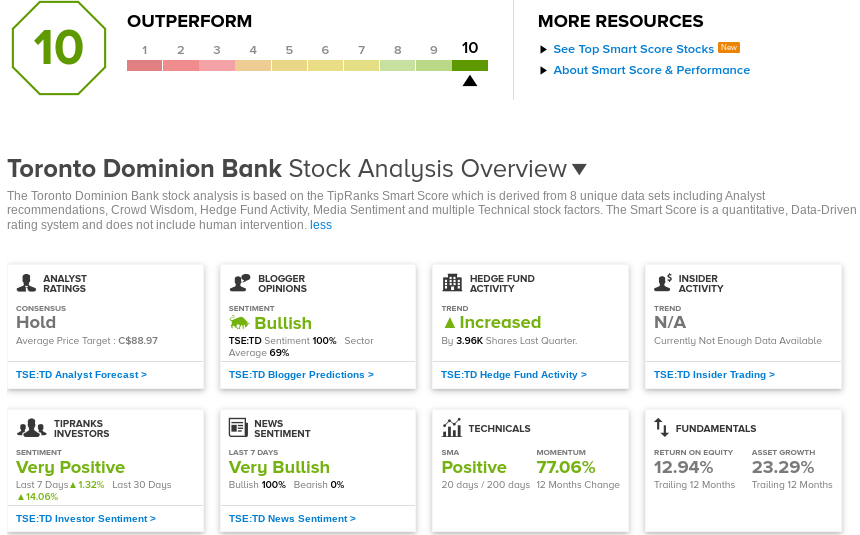

Overall, TD scores a Hold rating among Wall Street analysts based on 3 Buys, 4 Holds, and 2 Sells. The average analyst price target of C$88.97 implies 1% upside potential from current levels.

TipRanks’ Smart Score

TD scores a “Perfect 10” on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform the overall market.

Related News:

Royal Bank Q2 Profit Beats Expectations on Capital Markets Strength; Shares Up 1%

BMO Q2 Profit Nearly Doubles on Lower Provisions, Beat Estimates

TD Bank Earnings Preview: Here’s What to Expect